About The Fund

Is there a fund that can help you build wealth over the long term and help you save tax, simultaneously? Yes, there is!

The Quantum ELSS Tax Saver Fund (QETSF) invests in equities and also allows you to save tax u/s 80 C of the Income Tax Act. Please note that your investments in this fund (like all ELSS funds) are subject to a lock-in period of 3 years.

5 Reasons to invest in the Quantum ELSS Tax Saver Fund

1. Optimize tax saving under Section 80C.

2. Uses a bottoms-up stock selection process to minimize risk.

3. Has a low portfolio turnover.

4. Holds cash when stocks are overvalued - no derivatives and no hedging.

5. Follows a disciplined research and investment process.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification

- Post-Graduate Diploma in Management (Finance) from IMT & is a CFA Charter Holder. (Chartered Financial Analyst) (CFA Institute USA)

-

Funds Managed:

Qualification:

- Post-Graduate Diploma in Management (Finance) - IMT

-

Funds Managed:

Qualification:

- MBA in Finance, B.E., & is a CFA Charter Holder. (Chartered Financial Analyst) (CFA Institute USA)

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmarks

Quantum ELSS Tax Saver Fund

(An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit.)

Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI -

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Invests primarily in equity and equity related securities of companies in BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years.

-

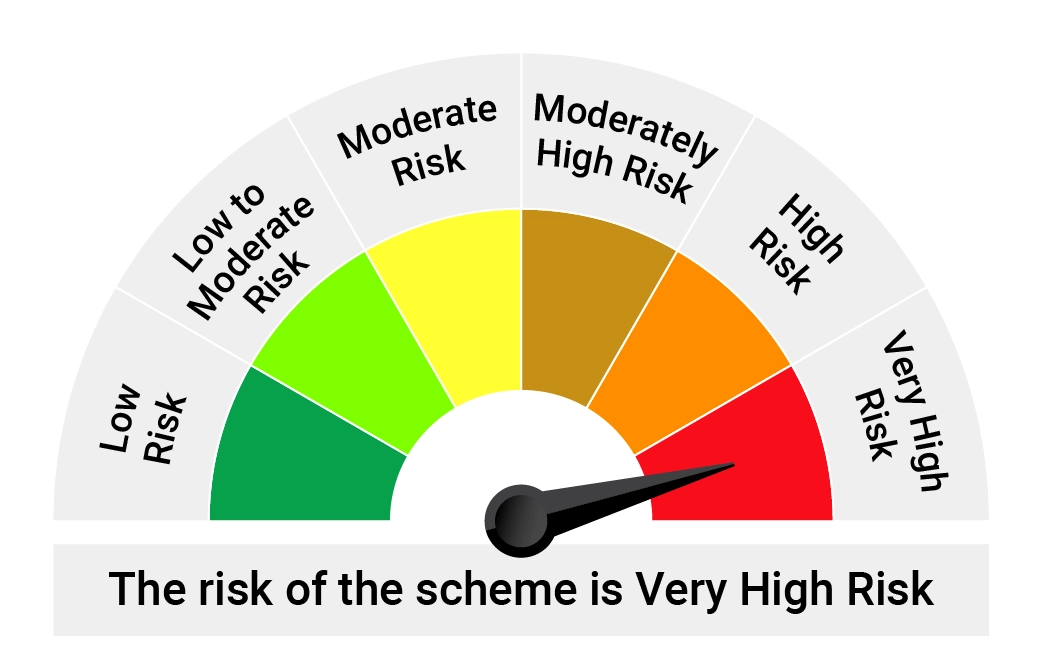

Risk-o-meter of Scheme

-

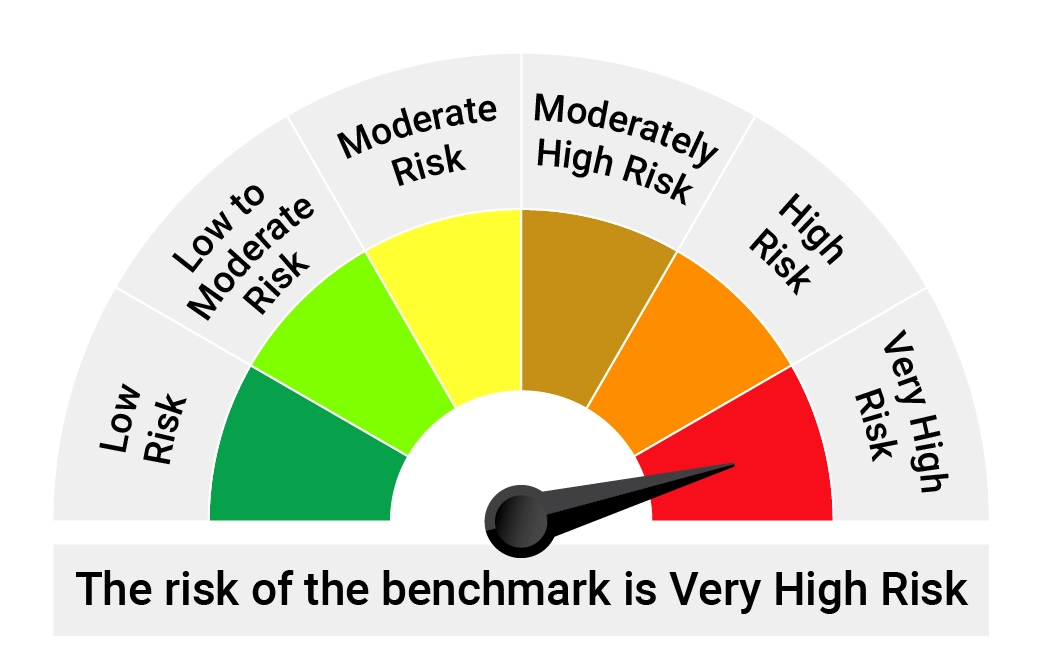

Risk-o-meter of Tier-1 Benchmark and Tier-2 Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Jun 30, 2025

The Risk Level of the Benchmark Index in the Risk O Meter is basis it's constituents as on Jun 30, 2025

Frequently Asked Questions

As the name suggests, an equity-linked savings scheme (ELSS) also known as a tax saving fund is an equity mutual fund scheme invests at least 80% of its total assets in equity and equity-related instruments. As per SEBI definition, ELSS - a tax saving mutual fund is an open-ended equity schemes that come with a statutory lock-in period and tax benefit u/s 80 C.

If you have a high-risk appetite and are young, have time to your advantage & are looking to address long-term financial goals, and do not mind investing in equity with patience and discipline, then investing in Equity Linked Savings Scheme (ELSS) is a worthwhile option for you.

The key objective of an ELSS mutual fund is providing tax-saving benefit along with capital appreciation, i.e., wealth creation, when you invest. Like any other equity mutual fund, an ELSS invests in equity and equity-related instruments and has the flexibility to invest across sectors and the market cap spectrum. So yes, they are risky. Hence, invest in them only if you have a high-risk appetite. Bear in mind that the returns will be subject to market fluctuations depending on the underlying portfolio characteristics of the fund.

As you know, ELSS Funds invest majorly in equity or equity shares. So, the returns may be potentially higher than other non-market linked tax-saving options under section 80C. When you top this benefit with the tax-saving benefits and the flexibility of a lower lock-in, you may consider an ELSS mutual fund as an effective tax saving investment option.

It is suggested that you should stay invested in ELSS funds for longer than 5 years. Since ELSS invests in equities, its equity exposure requires you to have a longer investment horizon, so that the impact of market movements is reduced.