Start the New Year with a New SIP for your Loved Ones

Posted On Tuesday, Nov 17, 2020

2020 has been a year for the history books, and thankfully, it’s coming to an end! This year, the world seems to have turned upside down and so have our usual festivities.

Diwali; the Festival of Lights, was a much needed celebration, a break for us all. In our celebratory mood, we all love to shower our family and friends with gifts.

But have you ever stopped to consider that buying materialistic things is not the only way to make your loved ones happy?

This festive season is also the right time to start an investment and gift them the happiness they deserve.

Be it your child’s education, their marriage or a family vacation - you can begin planning for it now and start investing.

Starting an SIP considering the goals of your loved ones is an excellent gift- one they will cherish their entire life.

The thing with SIPs is that they are affordable and flexible: It is suitable for any wallet size. You can start with an investment as low of Rs.500 per month.*

Together with that they offer a host of other excellent benefits!

Investing through SIPs will enable you to benefit from the power of compounding. As a responsible parent, caring for your family never stops. Why stop now when your SIP investments has the potential to grow your investment corpus to achieve one of these goals that brings a smile to your loved one.

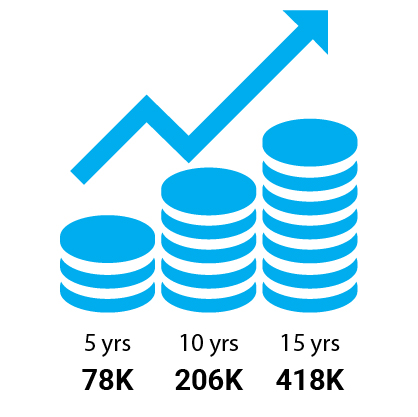

This illustrates the effect of compounding with just a monthly SIP of Rs. 1000 at an assumed rate of return of 10%.

*Note: Quantum Mutual Fund offers SIP as low as Rs. 100 per month.

This is for illustration purposes only. Investments through SIP is subject to market risks and does not assure a profit or returns or protection against a loss in downturn market.

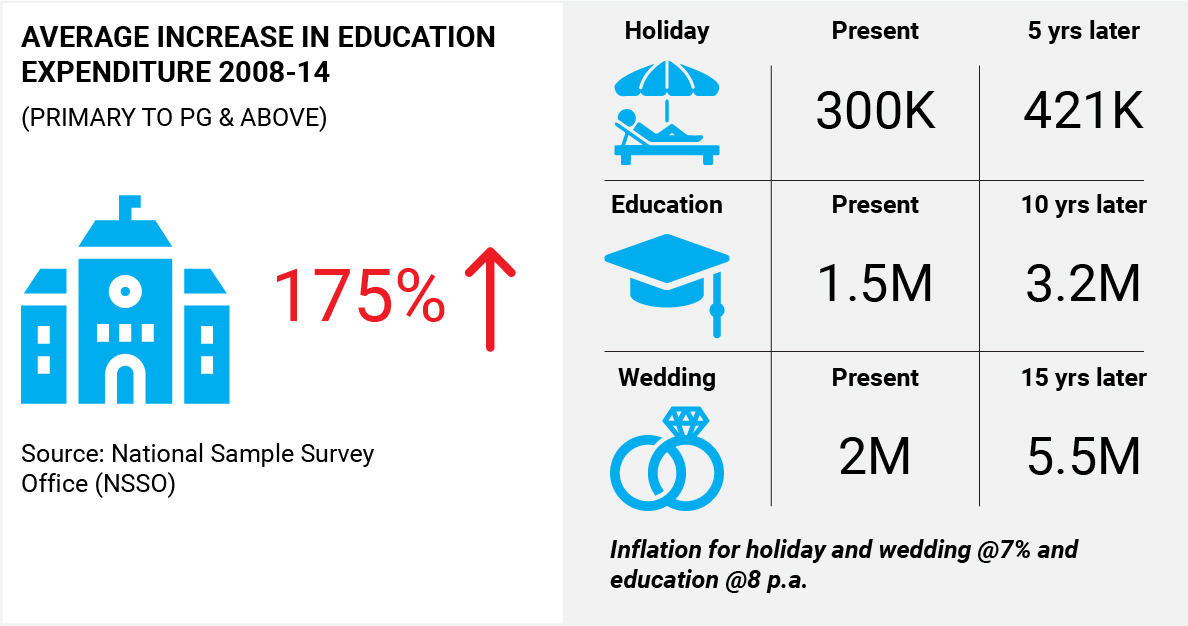

Planning your SIPs helps you be better prepared against future risks; for instance inflation.

ARE YOU FACTORING INFLATION TO YOUR GOALS

As we see in the infographic here, it is important to plan your SIPs and continue investing which has the potential to meet your child’s dreams for the future.

To calculate on your SIPs and how to allocate assets, check our mutual fund calculators:

Child’s education | Child’s marriage | Family Vacation

Make your investment cost-efficient with an SIP: SIPs lets you avail the benefit of rupee cost averaging. In the stock market, investors 'time the market' and buy low and sell high. With an SIP, you don’t need to time the market. When the stock prices are low, SIPs allocate an investor more units, and allots lesser units when the stock prices soar high, thereby averaging out his/her savings automatically.

The following table is for illustration purposes only. It shows how many units you can purchase at a given monthly net asset value (NAV) of the SIP you chose.

| Month | Investment (in INR) | NAV (in INR) | Units purchased |

| Jan 2020 | 5000 | 10 | 500 |

| Feb 2020 | 5000 | 9 | 555.56 |

| Mar 2020 | 5000 | 11 | 454.54 |

Become a disciplined investor with an SIP: A lesson that many experienced investors learn is if you don’t invest regularly in a disciplined manner, it is likely that you may fall short of your investment goals or end up disillusioned. Investing through an SIP ensures that you are investing regularly and in a hassle-free manner.

This year, with the pandemic playing havoc with our livelihoods and lives, it’s a great time to think differently and yet stay ahead of the pack.

Start SIP investments for your family.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More