Small Cap, Big Difference to your Portfolio - NFO Launched Today on Oct 16!

Posted On Monday, Oct 16, 2023

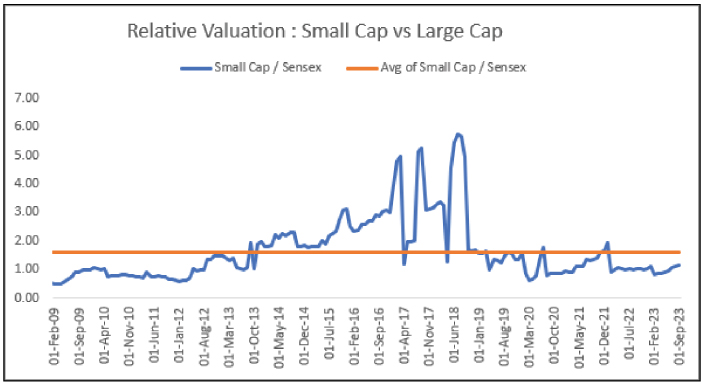

Equity market goes through cycles. If you were to see the relative valuation of small caps vs Sensex, it is trading close to long term averages. However, we believe some fundamentally sound stocks in the segment may still have room for further growth and potential to scale fresh peaks. There are pockets of value and several bottom-up stories that can translate into upside for the portfolio. It is with this conviction that after 11 funds each in 3 asset classes of equity, debt and gold, we are pleased to launch another cap to the feather to help augment your equity portfolio.

Data as of Sep 30, 2023. Past performance may or may not be sustained in the future

Adding another Feather to the cap - NFO Period Opens

With our track record of diligently building investment portfolios, we are pleased to announce the launch of our new fund offering (NFO) – Quantum Small Cap Fund on Oct 16th– a new feather to our cap.

Quantum Small Cap Fund is an Open-Ended Equity Scheme predominantly investing in Small Cap Stocks. The Scheme will invest minimum 65% and maximum 100% in Small Cap Stocks.

Ever since its inception, Quantum has stood true to its investor centric philosophy and meticulously launched funds over the years across the asset classes of Equity, Debt and Gold to serve as building blocks in the tried and tested 12:20:80 Asset Allocation Strategy.

Within the 80% equity bucket, allocating 10-15% to the Small Cap Fund can help diversify your equity investments beyond large-cap or mid-cap stocks offering potential for long term wealth creation due to the following reasons:

- Niche Industries - Operate in disruptive or emerging sectors where large companies have negligible presence.

- Agility – Adapt to changing market dynamics and seize opportunities that larger companies might overlook.

- Competitive Advantage – Own innovative product offerings that give them a competitive edge over larger companies.

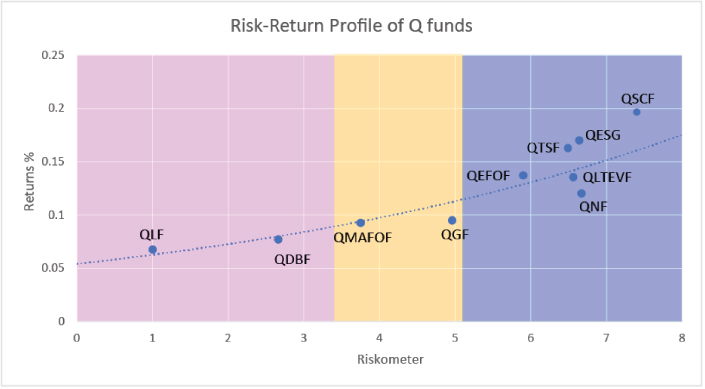

The fund finds a place on the higher end of the risk-return spectrum offering potential for good risk adjusted returns for the higher risk it takes.

The above chart is for illustration purpose only

How does Small Cap augment your equity portfolio

Backed with a proven track record since 2006, Quantum Mutual Fund is set to make a big difference to your portfolio through carefully selected & accurately diversified portfolio offering exposure to quality companies. Quantum recognizes the challenges that some of the Small Cap Funds with large AUM may face today – in order to accommodate rising inflows, some funds have become over-diversified leading to sub-optimal positions and thereby effect returns potential. Some of funds may be faced with issues of illiquidity due to the risk of outsized positions. Quantum Mutual Fund aims to address these challenges with its new NFO – Quantum Small Cap Fund. Read more>

Here are some key advantages of our fund:

- True to Label Fund - Disciplined about fund capacity to prevent large size becoming a hindrance to performance. the fund will invest in quality Small Cap names and be a true to label Small cap fund.

- Prioritizes Liquidity – Minimum Rs. 2CR Average Value per day in all stocks. We will only invest in stocks which have a minimum daily trading volume of 2 crores ensuring liquidity remains a fundamental aspect of our investment strategy.

- High-Conviction Portfolio – Of 25 to 60 Stocks for optimal diversification to avoid becoming a “Closet” Small Cap Index. We will hold a high conviction, adequately diversified portfolio of 25-60 stocks with minimum weight of 2% at cost in each stock and will also keep a check on overdiversification to avoid behaving like a Small Cap Index which can eventually impact returns.

- Agile Portfolio Construction – Track Record since 2006 of judiciously building portfolios. Since the launch, our funds have patiently used corrections to build portfolio and delivered risk adjusted performance across various market cycles.

- Ensuring Limited Ownership – General limit of 5% of market capitalisation holding in all stocks in scheme portfolio. Even though a stock’s weight in the Fund may not be large, the fund’s allocation to it could be a large part of that stock’s market capitalization (7-8%). This comes with the risk that incase the fund wants to exit this stock at some point either due to change in investment thesis or a large redemption, selling such a large quantity of the stock on the exchange could be difficult and could drive the price lower, resulting in the fund selling the stock at a lower price. To overcome this challenge, Quantum Small Cap fund will generally ensure that holding in a stock would be limited to 5% of their market capitalization.

- Sizeable Stock Exposure – Minimum weight of 2% at cost in each stock. Quantum Small Cap Fund will have an adequately diversified portfolio of high-conviction stocks. Each stock in the portfolio will have weightage of minimum 2% at cost to ensure return potential.

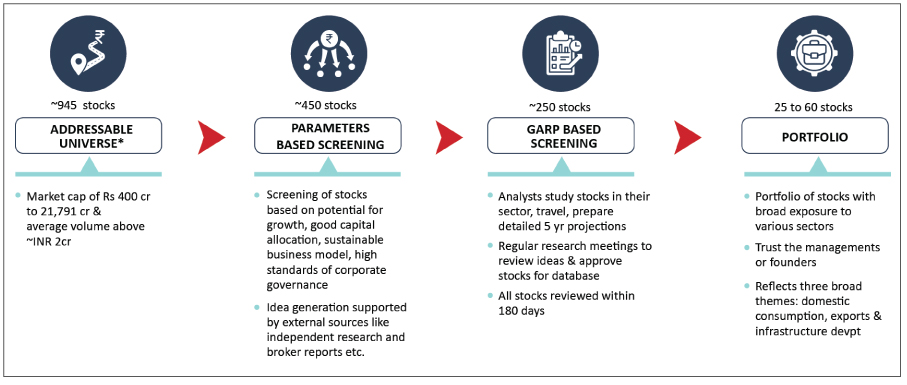

Our Investment Process

From the vast universe of small caps, there are around 945 Small Cap Stocks which meet the liquidity filter of minimum daily trading volume of 2 crores and a minimum market capitalization of Rs.400 crores as on September 30,2023. Quantum Small Cap Fund's holding Minimum 2% at cost with a maximum weight of 4% at cost in each stock, ensuring meaningful exposure without excessive concentration.

From this addressable universe, Quantum screens a robust high-conviction portfolio of 25-60 stocks that show potential for growth, adhere to corporate governance standards, and are reasonably valued.

Quantum Small Cap Stock Selection Process covers around 945 stocks from addressable universe of market cap of Rs.400 Crores to Rs. 21791 Crores with average volume of Rs. 2 Crores as on September 30,2023.

Robust Investment Process

Data as on September 30, 2023. Please refer Scheme Information Document of the Scheme for complete Investment Strategy

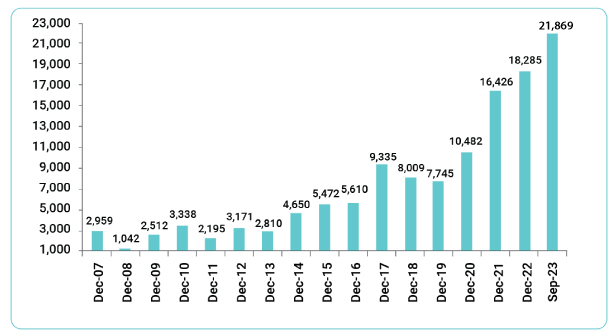

Small Caps - more fuel left to the rally?

Small caps are in high growth phase and has potential to continue to grow.

We have witnessed that Small Cap Indices have recorded a remarkable growth outperforming their larger counterparts. The 251st stock onwards which is the start of the universe has grown from Rs. 2,959 crores to Rs. 21,791 crores over the last 15 years which shows the potential that small caps present.

Data as on September 30, 2023.

Data as of Sept 29, 2023. Past performance may or may not be sustained in the future.

Grab opportunity to grow returns before too late

Small-sized companies have proven their mettle even in the face of adversities and have the potential to enhance your equity portfolio.

We believe there is still room for upside potential in the Small Cap space, you should not miss out on the opportunity to benefit from the liquidity, governance filter with valuation discipline Quantum Small Cap Fund has to offer. Make the most of the opportunity to grow wealth by adding Quantum Small Cap Fund as part of your diversified equity portfolio. Gain potential of high growth and reasonable valuations combined.

The NFO Period begins on Oct 16 and closes on Oct 27, 2023.

For more details, visit our fund page: Click here.

|

|

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Small Cap Fund An Open-Ended Equity Scheme Predominantly Investing in Small Cap Stocks | • Long term capital appreciation • Investment in Small Cap Stockx |  Investors understand that their principal will be at Very High Risk |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

#The product labeling assigned during the NFO is based on internal assessment of the scheme characteristics or model portfolio and the same may vary post NFO when the actual investments are made.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More