Planning your taxes? Consider an option that can Save Tax AND Grow Wealth

Posted On Tuesday, Feb 14, 2023

It’s February and we are pretty much in the tax planning season. If you are a high-risk taker, looking to get two birds with one stone, i.e. save tax and grow wealth in a way that potentially counters inflation, then the Equity Linked Savings Scheme (ELSS) - also known as a tax-saving mutual fund - may be a worthwhile option for you.

What is an ELSS?

• An equity-oriented mutual fund scheme that invests at least 80% of its total assets in equity and equity-related instruments (in accordance with the equity-linked savings scheme, 2005, as notified by the Ministry of Finance)

• Has a mandatory lock-in period of three years (meaning money cannot be withdrawn for three years)

• And helps you avail deduction of up to Rs 1.5 lakh under Section 80C of the Income Tax Act, 1961 in the financial year in which the investment is made.

But you may ask: Is it the right time to invest in ELSS amidst the volatility in the equity markets?

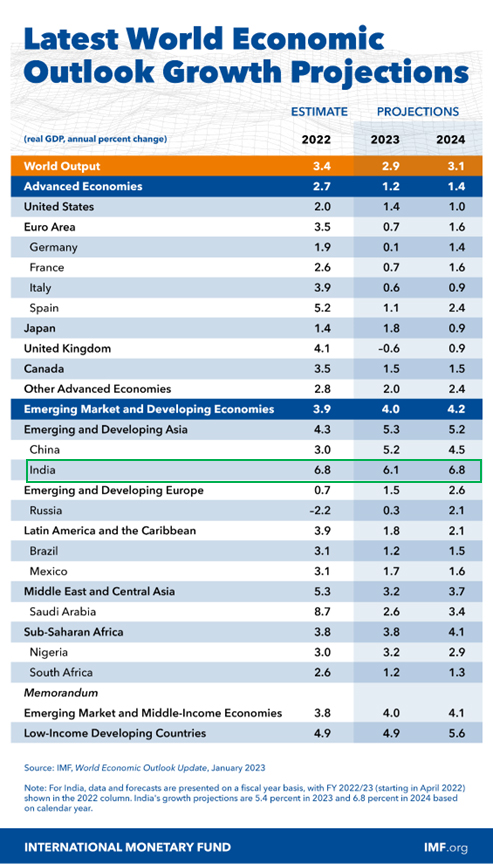

Well, yes there are a few challenges such as elevated inflation, central banks raising rates, geopolitical tensions, and global economic slowdown in 2023 as forewarned by the World Bank and the International Monetary Fund (IMF) are attributing the volatility. Having said that, India is a “bright spot” as observed by the IMF (and rightly so).

(Source: www.imf.org)

Backed by several reforms of the government and prudent monetary policy actions of the RBI, India today is one of the fastest-growing major economies in the world expected to grow at over 6.0%.

The recent union budget 2023-23 (and even the previous ones) laid emphasis that inclusive growth continues and the economy is more resilient. For instance, the increase in capital investment outlay by 33% to Rs 10 lakh crore -- which is 3.3% of GDP for FY24 and was much needed in economic uncertainty and global slowdown -- is commendable and sort of ensures that the cyclical recovery continues and revs up growth further. Decent budgetary allocations have also been made to various sectors.

Moreover, several companies across sectors are reporting an encouraging earnings trend thus keeping the mood upbeat in the Indian equity markets.

Against the broad backdrop of the above, Indian equities remain an appealing asset class to invest in with a long-term investment horizon (of 3 years and more).

Characteristics of an ELSS Mutual Fund

ELSS or tax saving funds usually are...

• Market cap and sector agnostic (investment may be in large-cap, mid-cap, and small-cap stocks, across sectors).

• The portfolio construction approach could be a mix of bottom-up and top-down.

• And the fund manager may follow a growth style, value style or combination of both.

Amid macroeconomic uncertainties, how a value-oriented mutual fund comes to the rescue

In the current market scenario, where valuations are not cheap and the margin of investing is low in growth stocks [commanding ridiculous Price-to-Equity (P/E) and Price-to-Book Value (P/B) multiples], you need to be careful while choosing ELSS for making tax-saving investments.

You would be better off with an ELSS that follows a value style. The fund manager should be mainly investing in undervalued stocks commanding lower P/E, P/B, offering higher dividend yield, and in well-established companies that have an advantage in terms of the moat, market share, lower debt, etc. Generally, such companies when the market is volatile in the interim or witnesses a downturn, remain afloat and are likely to be rewarding for investors in the long run.

In the year 2022 value style of investing worked well (against the backdrop of Russia’s invasion of Ukraine, supply chain disruptions that followed, inflation, central banks raising interest rates to tame inflation, and heightened stock market volatility). In 2023 as well, in light of the potential economic slowdown, we believe, value-style investing would work favourably.

How does ELSS fit in your overall diversified equity scheme portfolio?

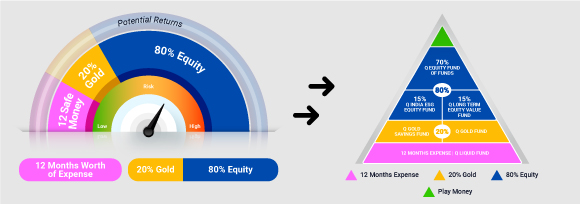

Different styles come in favour in the market depending on the economic environment. Value style tends to do well during times of a rising interest rates. Your Quantum Tax Saving Fund forms a part of your equity allocation and any additional fund that you consider needs to be diversified in terms of investment style or theme.

Less than a month left to save tax -start now!

You have a month and a half to save tax. This means it’s high time you start making your tax-saving investments, and not keep them for the last minute. If you delay investing in ELSS till the last minute you may end up investing in a not-so-worthy and/or unsuitable ELSS scheme. So, take control and consider investing in a value-styled ELSS today! Consider investing in Quantum Tax Saving Fund. Make sure you have the stomach for a high-risk and longer (3 years+) investment horizon.

Do not miss the opportunity to grow your wealth and earn tax benefits in the process! Use our handy Asset Allocation Calculator to make Quantum Tax Saving Fund part of your diversified equity portfolio.

You may invest a lump sum or take the Systematic Investment Plan (SIP) route. The lock-in period allows you to maintain a disciplined approach and stay invested for the long term, which potentially helps grow your hard-earned money with equities.

Happy Investing!

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit Tier I Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Planning your taxes? Consider an option that can Save Tax AND Grow Wealth

Posted On Tuesday, Feb 14, 2023

It’s February and we are pretty much in the tax planning season. If you are a high-risk taker, looking to get two birds with one stone

Read More