Mirror, Mirror... Which is the Best Asset Class of them All?

Posted On Monday, Sep 14, 2020

Don't put all your eggs in one basket.

That's the basic philosophy of diversification.

If you've been following our newsletters, you will know that different asset classes react differently to economic and market events.

While the world grapples with uncertainty amidst the current Covid-19 situation, investors are dealing with their own dilemma.

Which asset class is best suited for the current conditions?

Those who try to time the markets may get disappointed.

There is no way to predict the markets and in which way things will head.

If you made predictions for various asset classes, the one thing that stands out is one can't predict with certainty which way the markets will head.

The other of course is that there is no consistent outperformer, or underperformer.

There have been years when equity markets had a dream run. Bonds have seen times when they were touted as the most dependable of assets. At times it's Gold that has shined the brightest.

When equities are witnessing a correction, the presence of other asset classes in your portfolio would help you garner net positive returns.

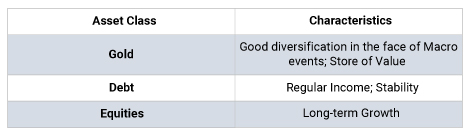

Each asset has its own characteristic benefit

This is why a well-diversified portfolio with all these assets should be at the core of your investment philosophy.

Multi-Asset Funds - A comprehensive approach to diversification

A practical way to diversify your portfolio and rebalance regularly as per market movements is by investing in a multi asset fund.

A multi-asset fund can be beneficial as they provide the convenience of diversification across different asset classes of Equity, Debt and Gold within a single product.

Let's look at Quantum's Multi Asset Fund of Funds (QMAF) as an example.

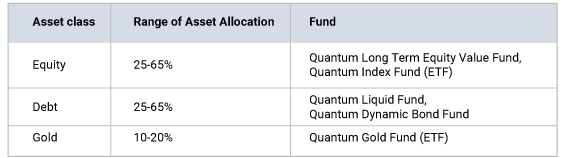

This fund invests across asset classes: Equity, Debt and Gold. Diversification across asset classes and within asset classes will be done through schemes of Quantum Mutual Fund. The chart below shows the Asset Allocation breakup of QMAF.

Along with QMAF, here's a quick roundup of some of the key benefits of investing in a Multi-Asset Fund

? You are invested in three major asset classes simultaneously.

? By Investing in three asset classes you ensure that your downside risk is protected.

? The Fund Manager makes disciplined investments across asset classes for you.

? They rebalance the allocation of assets within the fund as per markets

? No need to pay taxes each time your portfolio gets rebalanced.

All the work is done for you. Diversification, and optimal and disciplined asset allocation.

By an experienced fund management team.

Depending on a single asset in the current times may not be practical, it could dent your wealth goals.

Incorporate diversification into your portfolio today to invest in any market situation.

Editor's Note: Want to know more about asset allocation with Quantum multi-asset fund of funds? Write to us at [email protected] Or give us a missed call at +91-22-68293807 and we will call you back.

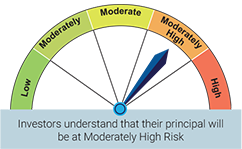

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Mirror, Mirror... Which is the Best Asset Class of them All?

Posted On Monday, Sep 14, 2020

Don't put all your eggs in one basket. That's the basic philosophy of diversification.

Read More