heading

About The Fund

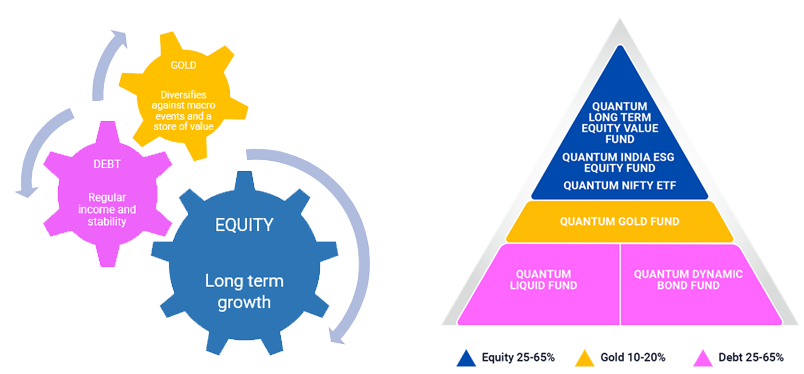

The Quantum Multi Asset Active FOF diversifies across equity, debt, and gold, reducing dependence on a single asset class. Based on a proprietary model that takes into account various economic factors and valuations, the Fund manager strategically positions the portfolio to generate risk-adjusted returns. So, as an investor, you get a professional Fund Manager to take care of your asset allocation needs and have the ease of checking only one NAV to know how your investments are faring. Limit your downside risk by investing in this truly balanced Fund.

4 Reasons to Invest in the Quantum Multi Asset Active FOF

1. Dynamic, research backed asset allocation.

2. Aims to generate superior risk adjusted returns.

3. Diversification across Equity, Debt & Gold schemes of Quantum Mutual Fund.

4. Periodic rebalancing to buy low and sell high.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- CAIA (Chartered Alternative Investment Analyst), and Masters in Management Studies in Finance

-

Funds Managed:

Qualification:

- B.Com Degree, CA Inter, Pursuing CFA

-

Qualification:

- B.Com Degree, CA (Institute of Chartered Accountants of India)

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Multi Asset Active FOF

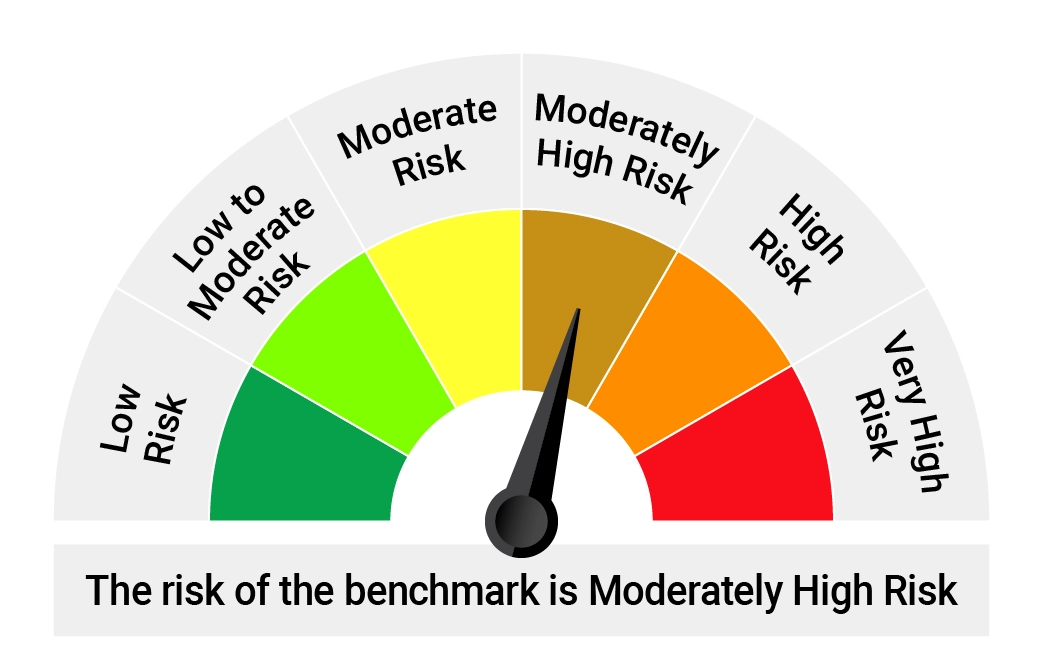

(An Open-Ended Fund of Funds scheme investing in Equity-oriented schemes, Debt oriented schemes and Gold based schemes)Tier I Benchmark : CRISIL Dynamic Bond A-III Index (20%) + CRISIL Liquid Debt A-I Index (25%) + Nifty 50 TRI (40%) + Domestic price of Gold (15%)

-

This product is suitable for investors who are seeking*

• Long term capital appreciation and current income

• Investments in portfolio of schemes of Equity oriented Schemes, Debt oriented Schemes and Gold based Schemes of Quantum Mutual Fund -

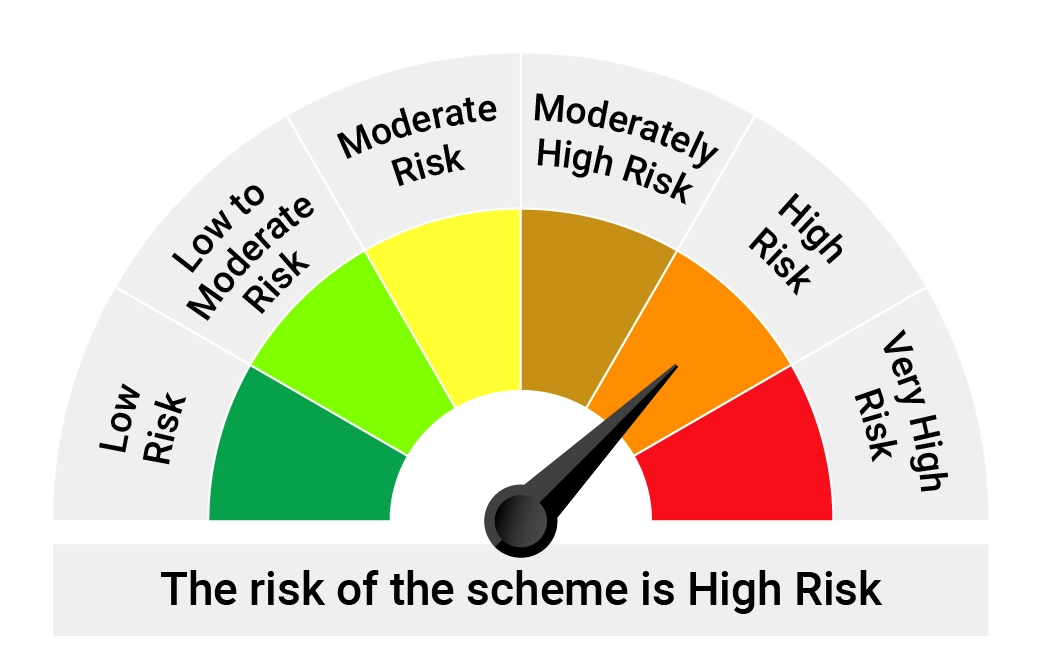

Risk-o-meter of Scheme

-

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

*Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes in which this Scheme makes investment.