Market Fundamentals in Favour of Value

Posted On Friday, Jun 16, 2023

Value investing has made a strong comeback over the last two years versus growth stocks globally, and in India it is even more pronounced. As interest rates stabilise, the market continues to be ripe for Value Funds

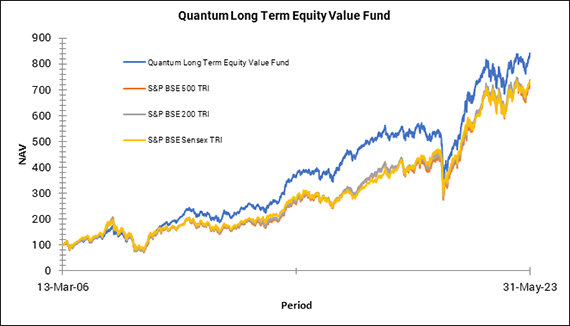

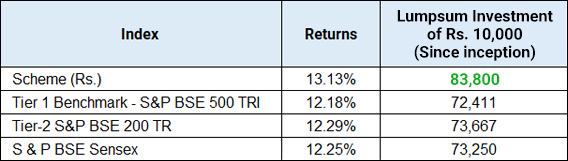

Investors of our flagship fund, the Quantum Long Term Equity Value Fund, have been rewarded with a strong performance. The fund has outperformed the benchmark S&P BSE 500 TRI 12.18% and S&P BSE 200 TRI 12.29% since inception basis with a return of 13.13% CAGR and has potential to continue offering risk adjusted returns in the long run^

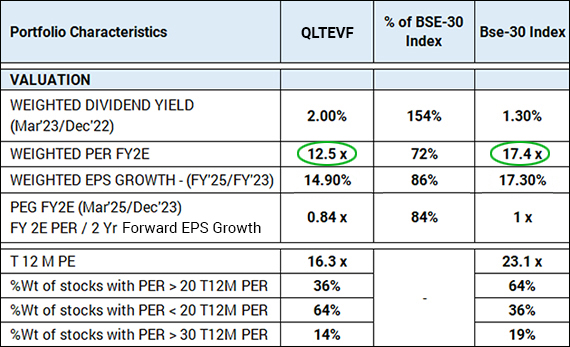

Quantum Long Term Equity Value Fund portfolio

PER: Price to Earning Ratio, EPS: Earnings per Share, PEG: Price to Earnings/EPS Growth, T12M: Trailing 12months

The above table depicts value characteristics of QLETVF Portfolio and not the indicative returns.

As we see in the table above, the Quantum Long Term Equity Value fund showcases typical characteristics of a value fund such as higher dividend yield, lower valuation (Price to earnings) lower PEG (Price to earnings growth) ratio and comparable earnings growth compared to the benchmark.

The weighted PE FY2E/FY25E is approx. 30% lower as compared to BSE 30 Index.

#QuantumLeapofValue

- Over 17 Years track record

- Bottom-up stock selection to Minimise Risk

- Well Researched and Diversified Portfolio

- Low Portfolio Turnover Ratio

- Robust Investment Process

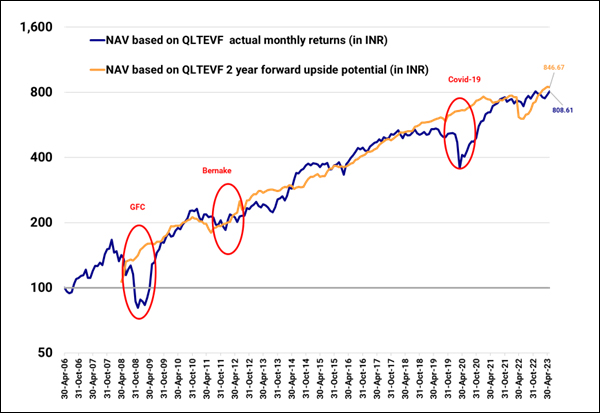

Barring black swan events, the forecasted upside potential of Quantum Long Term Equity Value Fund over the years has closely tracked the actual fund performance over the long-term indicative of a robust investment process that has worked over the long term.

The above graph shows the estimate of rebased NAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2. Source: Quantum AMC, Bloomberg Finance L.P., As of May 31, 2023

A lumpsum investment of Rs. 10,000 since inception in this fund (Mar 13, 2006) would have grown to Rs. 83,800 as of May 31, 2023 with a return of 13.13% CAGR.

Growth of Rs 10,000 if invested in Quantum Long Term Equity Value Fund since its inception

Data as of May 31, 2023. Past performance may or may not be sustained in the future.

Value Investing – A Time-tested Strategy for Equity Investing

Value investing is a proven equity investing strategy propagated by legendary investors like Warren Buffett and Benjamin Graham that focuses on investing in undervalued stocks that are priced lower than their intrinsic value.

Despite the current circumstances marked by normalised interest rates and easing inflation we believe the resurgence of value investing is likely to continue for the following reasons:

- Rising cost of capital: Though interest rates have normalised, they are high relative to the past decade thereby creating an opportunity for value investing. High interest rates increase the cost of capital and could negatively impact the profitability of “growth” stocks. As Value funds are focussed on buying assets that are already priced below their intrinsic value, they provide a margin of safety and hence has a buffer to absorb the relatively low pressure on multiples.

- Global uncertainties: Value investing can help lower downside risks when there is global economic uncertainty. It provides exposure to undervalued stocks that has lower probability of losses even if the base case assumptions while buying the stock doesn’t play out.

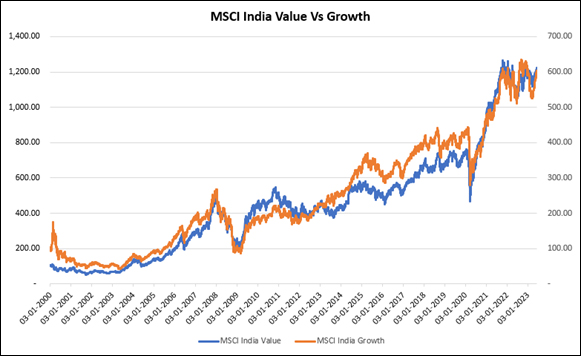

- Markets are cyclical: One thing that you should not do when building your equity portfolio is try to second-guess where equity markets will go next. Building a diversified equity portfolio is important to reduce market stress and capture opportunities across market cycles. Every style goes through its cycle, as reflected in the below chart where MSCI India Value Index has outperformed in some years and underperformed in other years.

Data as of January 03, 2023. Past performance may or may not be sustained in the future.

In the short term, the equity market might not reflect the fundamentals but may solely move on sentiments and liquidity. If you want your investments to reach its true potential, its pertinent to exhibit patience and maintain a long-term investment horizon with a reasonably valued fund as part of your diversified equity portfolio. Sticking to value investing can prove a rewarding experience in the long run especially during the times when the market continues to remain uncertain.

A value fund forms a crucial component (15%) of your diversified equity portfolio as part of Quantum’s 12| 20:80 Asset Allocation Strategy. We suggest you explore our Asset Allocation Calculator online to understand how best to build your equity portfolio to position your Value Fund investment.

Use Asset Allocation Calculator

In conclusion, there is still room for further gains in value investing. Don't let this opportunity slip away! Now is a good time to add to your existing value investments and reap benefits in the long-run. Invest in Quantum Long Term Equity Value fund now for a portfolio comprising of solid fundamentals, stronger growth potential and with reasonable valuations.

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Direct Plan - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark # Returns (%) | Tier 2 - Benchmark ## Returns (%) | Additional Benchmark ### Returns (%) | Scheme (₹) | Tier 2 - Benchmark ## Returns (₹) | Additional Benchmark ### Returns (₹) | Additional Benchmark ### Returns (₹) |

| Since Inception (13th Mar 2006 | 13.13% | 12.18% | 12.29% | 12.25% | 83,800 | 72,411 | 73,667 | 73,250 |

| May 31, 2013 to May 31, 2023 (10 years) | 12.89% | 14.39% | 14.22% | 13.68% | 33,641 | 38,404 | 37,837 | 36,078 |

| May 31, 2016 to May 31, 2023 (7 years) | 10.68% | 14.27% | 14.22% | 14.38% | 20,350 | 25,449 | 25,365 | 25,615 |

| May 31, 2018 to May 31, 2023 (5 years) | 9.87% | 12.58% | 12.81% | 13.48% | 16,011 | 18,091 | 18,276 | 18,827 |

| May 29, 2020 to May 31, 2023 (3 years) | 25.97% | 27.95% | 27.02% | 26.02% | 20,014 | 20,975 | 20,523 | 20,037 |

| May 31, 2022 to May 31, 2023 (1 year) | 12.06% | 12.85% | 12.57% | 14.05% | 11,206 | 11,285 | 11,257 | 11,405 |

Data as of May 31, 2023

#S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Past performance may or may not be sustained in the future.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). #with effect from December 01, 2021 benchmark has been changed from S&P BSE 500 TRI.

The Scheme is co-managed by George Thomas and Christy Mathai, & Click here for performance details of other funds managed by them. Click here.

| Name of the Scheme & Tier I Benchmark | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I and Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy.) Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Market Fundamentals in Favour of Value

Posted On Friday, Jun 16, 2023

Value investing is a proven equity investing strategy propagated by legendary investors like Warren Buffett and Benjamin Graham that focuses on investing in undervalued stocks that are priced lower than their intrinsic value.

Read More