Make Sustainability Part of Your Investing Goal This 2021

Posted On Wednesday, Jan 13, 2021

2020 was a year of unpredictability – many lives and jobs were lost during the Covid-19 pandemic and the national lockdowns that followed. Along with taking care of our physical and mental health, 2020 taught us about the importance of taking care of our financial health.

Resurgence of a second wave of Covid cases and rising inflation are key risks that could stall an economic recovery. Elevated valuations also mean returns expectation need to be moderated and downside risks are now higher.

While the markets are currently at an all-time high, market timing usually does more harm than good, consider another option: make sustainability as part of your investing goal this 2021.

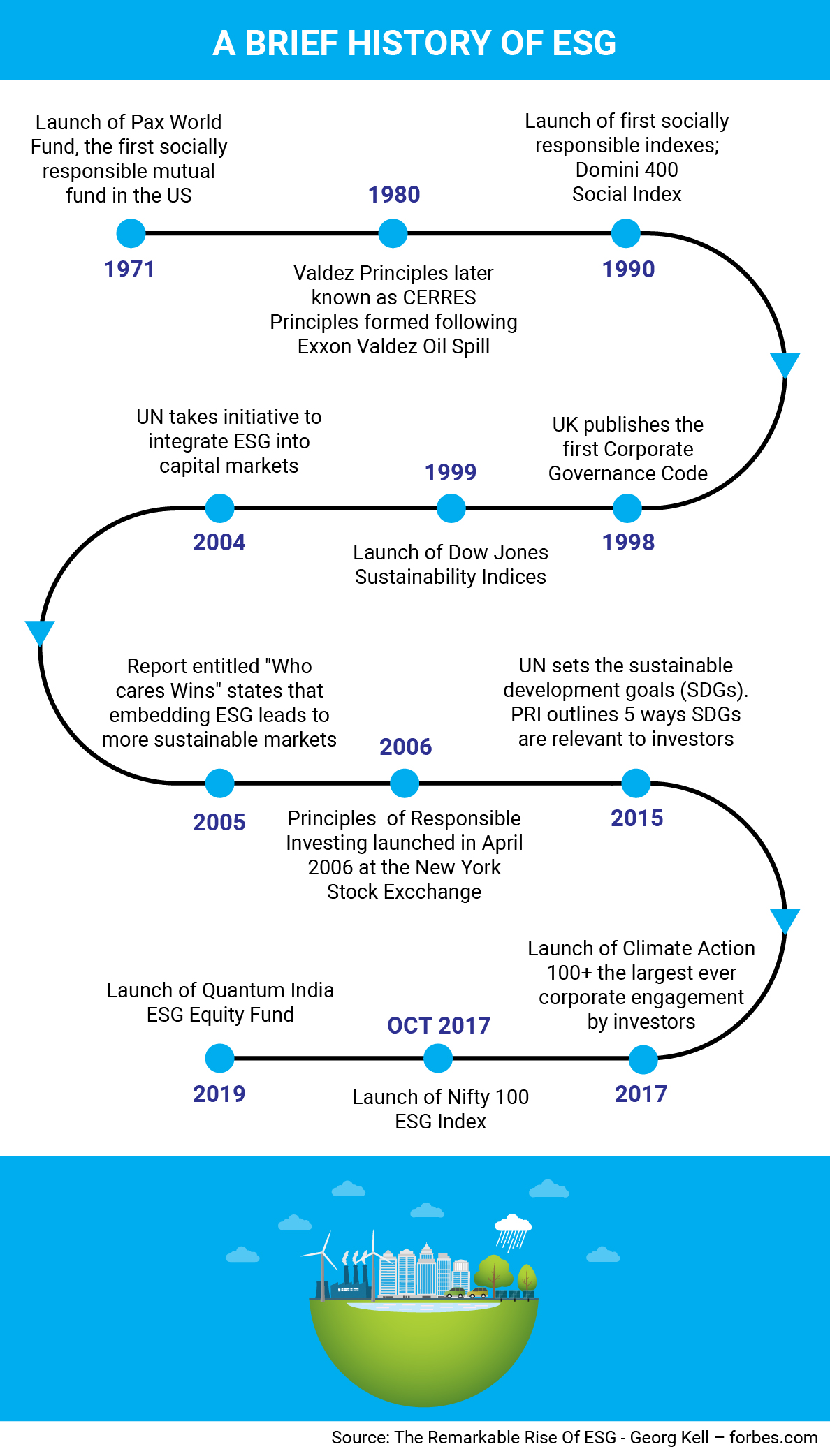

How has ESG investing evolved?

From the lessons we learnt last year, investors are fast evolving to make ESG factors (Environment, Social and Governance) a part of their portfolio. It is important to not only factor in diversification in equities but also invest in sustainable companies that can meet and exceed the ESG benchmarks.

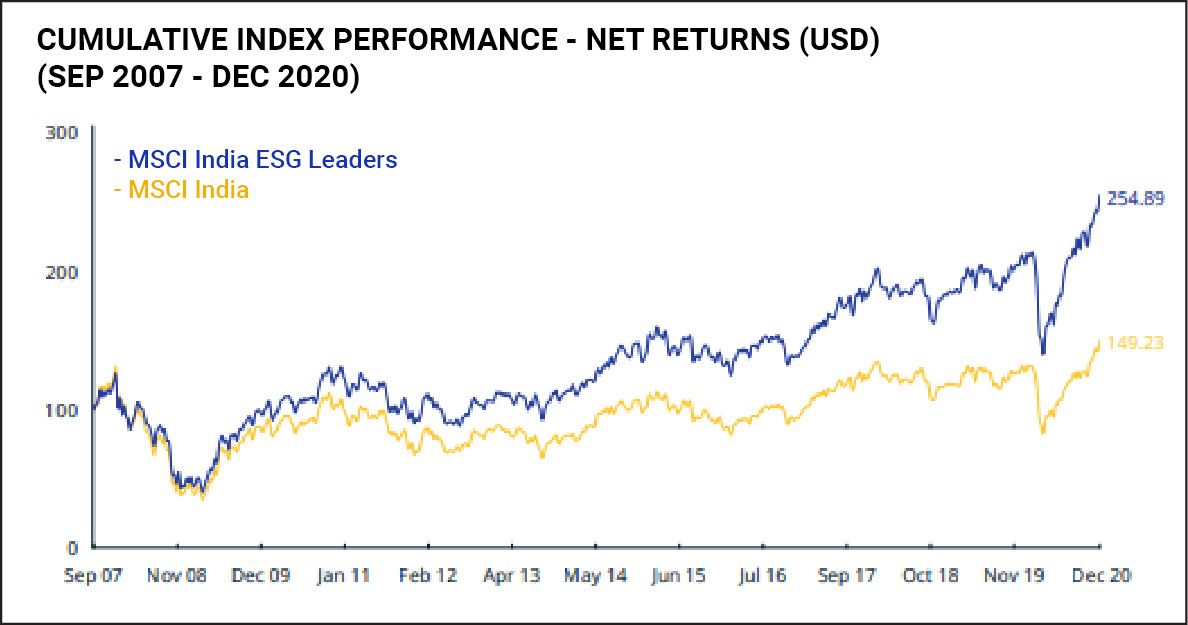

ESG has outperformed the Equity Index

ESG index has not only outperformed the Equity index over the period, but it has also protected downside risk better as represented in the chart as depicted below:

Data Source: MSCI Indexes supplied by MSCI Inc, and MSCI ESG Indexes supplied by MSCI ESG Research Inc, a subsidiary of MSCI Inc.

Past performance may or may not sustain in future

Deloitte Center for Financial Services (DCFS) expect ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025. In this scenario, ESG assets in the US is likely continue to grow at a 16% CAGR, totalling almost $35 trillion by 2025.

We believe that the scope for ESG investing and consequent alpha generation is even bigger in emerging markets like India.

What can you do

As we wrote to you about the importance of asset allocation, we also highlight the key aspects you need and taking care of the financial health of your portfolio:

1. Set short term and long term investment goals. Make sure the goals set are S.M.A.R.T (Specific & Sustainable, Measurable, Adjustable, Realistic and Time-bound).

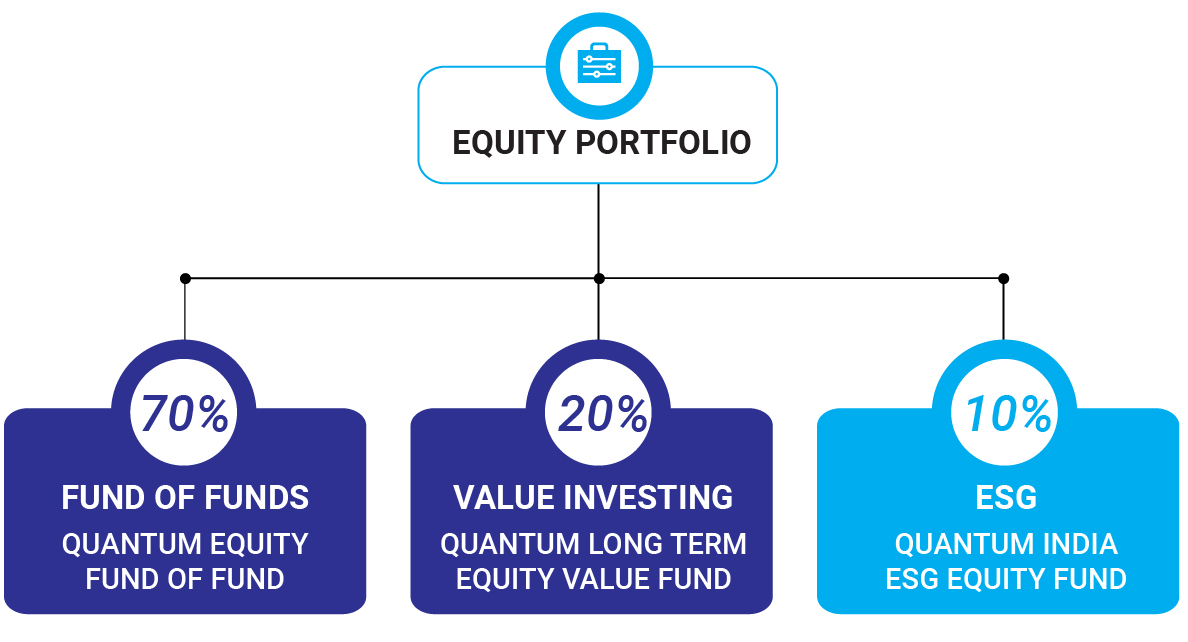

2. Diversify your equity portfolio using the evolving ESG criteria and allocate 10% to ESG investing**.

3. Stagger your investments through an SIP with a long term horizon to plan for retirement and your personal financial goals.

4. Review the investment portfolio, so that you are on track to accomplish the envisioned goals.

Take a look at how Quantum banks on its own proprietary research which has evolved over the last 5 years going through our own learning curve in the ESG space.

Start your commitment towards sustainability this 2021.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years | |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies | |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on December 31, 2020.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More