Invest in Gold This Dhanteras

Posted On Friday, Oct 21, 2022

India, as you know, is a land of several customs and traditions. One such tradition is buying gold on the auspicious muhurat of Dhanteras or Dhanatrayodash (the first day of Diwali). It is believed that buying gold, shall bring good luck and prosperity to the family. Gold symbolises wealth and is a mark of Goddess Lakshmi. It is an asset class that can be on to generations and has strengthened family bonds.

This Dhanteras could not be a better time to add gold to your portfolio for these reasons:

1. Rising Geopolitical Tensions - In many other parts of the world, geopolitical tensions are escalating. It’s been around eight months since Russia invaded Ukraine, and it doesn’t seem to be ending soon. On the contrary, Russia is putting up a nuke threat now which may prove devastating, observes NATO. China-Taiwan, relations aren’t good and there are fresh tensions between the two. North Korea has been provocative with nuclear activity build-up and missile launches, passing on a message to the navy drill between the U.S. and South Korea. India too has border disputes at the Line of Actual Control (LAC) with China and the Line of Control (LOC) with Pakistan. In the gulf, there are regional conflicts.

2. Spiralling Inflation - The spillovers from geopolitical shocks have led to supply chain disruptions. An erratic monsoon this year also has inflicted risk on food inflation, and the outlook for brent crude remains uncertain. What’s worsening the inflation trajectory is the pass-through of input cost across manufacturing and services, plus a stronger U.S. Dollar (USD). It appears that the cost of living is likely to remain elevated in 2022 and perhaps even next year.

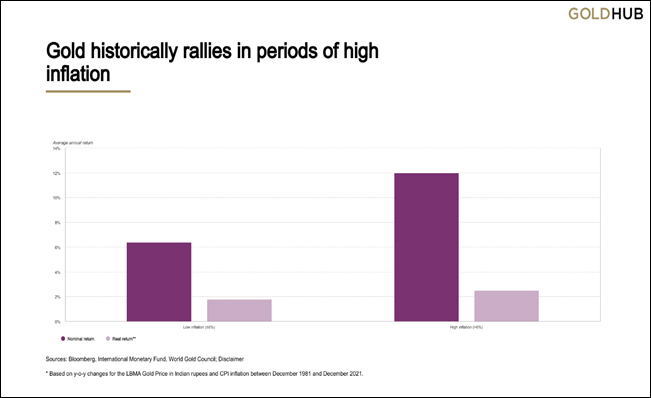

(Source: World Gold Council)

Past performance may or may not be sustained in future

Usually, in periods of high inflation of over 6%, gold turns bold or exhibits its sheen, thus proving to be a hedge against inflation highlights the World Gold Council’s (WGC) study.

3) Rate hikes to tame inflation not likely to put pressure on gold - Successive rate hikes, on the contrary, would slow down economic growth and lead to stagflation (which we are currently witnessing).

4) Chances of a Global Recession - the World Bank and the IMF foresee the world edging into a recession in 2023 and a string of financial crises in the emerging market and developing economies. If this turns out to be the case, gold would shine.

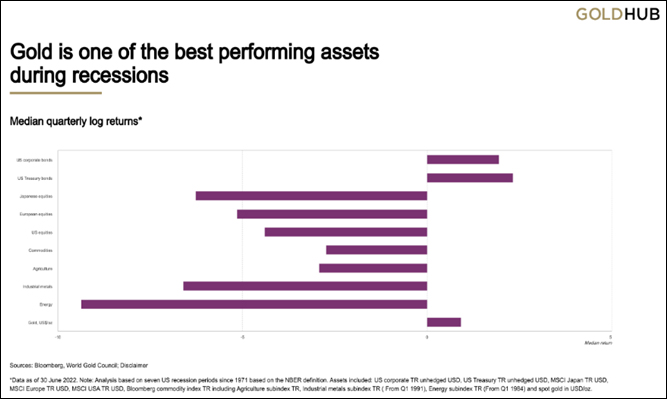

(Source: World Gold Council)

Past performance may or may not be sustained in future

A WGC study reveals that gold has proven to be one of the best-performing assets when the U.S. slips into a recession and when many major economies (developed and emerging) aren’t insulated or decoupled.

5) Intensifying stock market volatility - Due to aforesaid factors, the stock market going forward is likely to display intense volatility. In such times, gold would display its trait of being a safe haven and an effective portfolio diversifier.

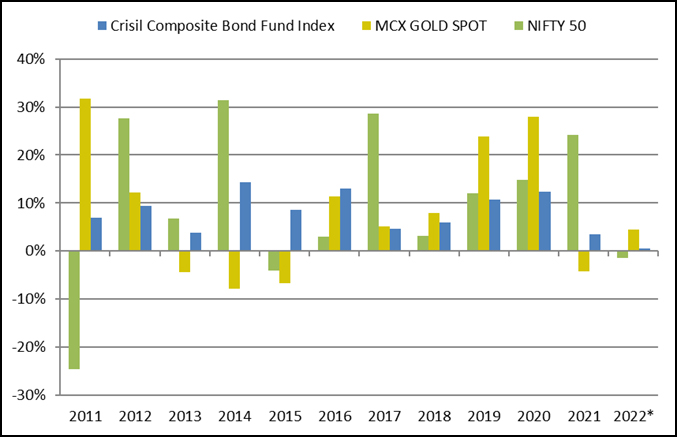

*Data as of September 30, 2022

(Source: ACE MF)

Past performance may or may not be sustained in future

As seen in the graph above, gold has remained relatively firm (generated ~+4.5% absolute returns on a YTD basis, as of September 30, 2022), while equities have dipped, and debt barely has yielded positive returns.

We are of the view that adding gold to your portfolio amidst uncertainty would prove to be an effective diversifier. Unless the interest rates increase significantly further and that makes bond yields attractive in real return terms (on an inflation-adjusted basis), gold is likely to do well.

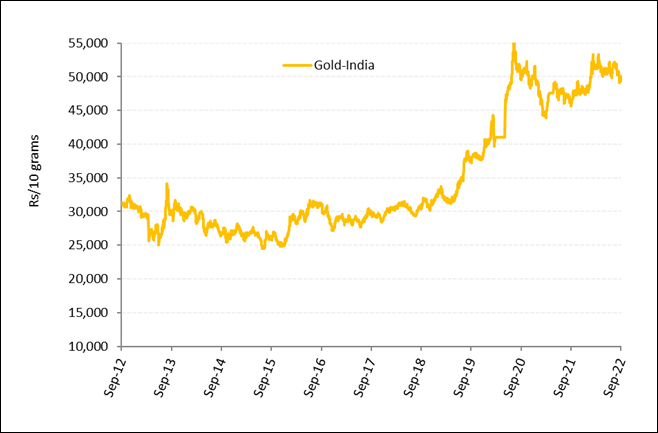

MCX spot gold price, data as of September 30, 2022

(Source: MCX)

Past performance may or may not be sustained in future

The long-term secular uptrend gold has exhibited cannot be ignored and highlights the importance of owning gold in the portfolio as a diversifier. Since India’s independence in August 1947, gold has generated a compounded annualised return of nearly 9.0% as of September 30, 2022.

For investment purposes, it makes sense to invest in digital gold formats, such as a Gold ETF and/or Gold Savings Fund - the smart ways of investing in gold.

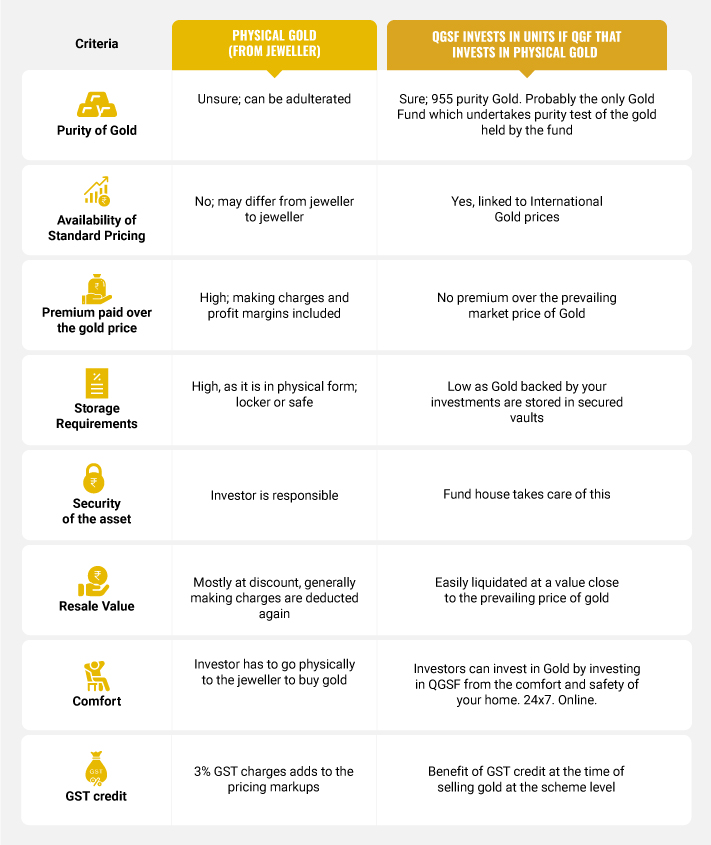

Consider investing in the Quantum Gold Savings Fund and/or the Quantum Gold Fund this festive season and you will not have to worry about purity, pricing, or issues related to the storage of physical gold.

As a strategy, allocate around 20% of the investible surplus to gold by following a sensible 12-80-20 Asset Allocation model, wherein 12 months of regular expenses (including EMI on loans) may be parked in a separate savings account and/or a liquid fund (which shall take care of your emergency needs); 80% of the portfolio in various sub-categories of equity mutual funds (helping you to potentially beat inflation and achieve the envisioned financial goals), and 20% of the entire portfolio in gold (with a long-term view) which shall help you diversify your portfolio.

Watch this video from our CIO Chirag Mehta where he sheds light on how you need to make more wiser and efficient choices when Gold is used for Investment purposes,

Happy Investing! Wish you all a Very Happy Diwali!

|

|

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on September 30, 2022

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Gold Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

After a strong September, gold extended its bullish momentum into October, marked by heightened volatility and significant price swings.

Read More