Gold monthly view for February 2021

Posted On Tuesday, Mar 02, 2021

March 02, 2021

The first month of 2021 was marked by rising yields, choppy equity markets, strengthening dollar and weakening gold. These trends continued in February, with gold trading at multi-month lows and ending the month 7% lower in USD terms.

Market sentiment was mixed. Improving earnings, plummeting virus numbers, impending stimulus and indicators suggesting an economic recovery on the one hand and rising bond yields, expectations of higher inflation, concerns about rich equity valuations and sluggish vaccinations on the other.

We’re not out of the woods yet

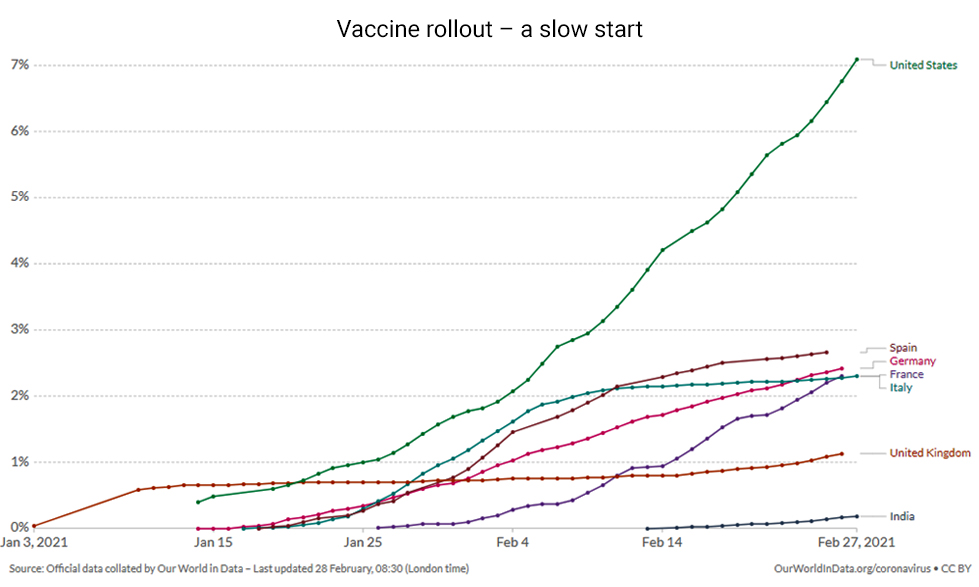

The expectation was that vaccines would end the pandemic and the world would quickly return to normalcy. However, the rollout of vaccinations has been very slow. As of February, only about 7% of Americans have been fully vaccinated. The figure is even lower across the Atlantic.

There is also the problem of mutations and new strains which are pushing ahead the goal of herd immunity. The longer and bumpier the road from vaccine to vaccination, the slower restrictions and social distancing measures will be lifted, and the later we come back to normalcy. The longer the pandemic’s economic shadow, the easier fiscal and monetary policies will be. This bodes well for gold.

Markets may be nervous about inflation, but the Fed isn't: Powell says no unwinding

Government bonds, and particularly US Treasuries have been attracting market attention globally.

Optimism about vaccination progress, upcoming US stimulus and global economic recovery has driven up expectations of inflation and instigated a selloff in bonds around the world.US yields began to inch their way higher in January, sending the benchmark 10-year yield to hit the 1.6% mark. It is hovering above 1.4% currently. The rate has jumped almost 45 basis points in 2021 and is now at its highest level in almost a year.

A gain in yields is weighing on demand for non-interest-bearing gold. Yields have risen faster than inflation expectations pushing up real rates by 30 basis points, though still in the negative territory. This is leading to selling in gold which has got exacerbated by technical selling making gold prices over stretched on the downside. In addition, the US dollar is reaping the benefits of rising yields as they attract massive demand, further hurting its counterweight gold.

The Fed has so far chosen to anchor short term rates and let market forces determine the equilibrium on the long end. It has repeatedly denied any tapering in its $120 billion/month bond buying or hike in interest rates any time soon.

The Fed Chairman has restated that the monetary policy will be easy until a sustainable recovery returns the economy to pre-covid-19 levels. The bank wants to see inflation above 2% for some time before unwinding. However, rising yields are testing Feds resistance to intervene as it threatens to prick at least one of the many bubbles brewing as a result of abundant cheap liquidity.

Is Yield Curve Control on the horizon?

There are various ramifications of rising interest rates in the current scenario.

• Growth continues to be the focus of policy makers worldwide. Rising yields increase borrowing costs for both companies and consumers and affect the discretionary incomes of consumers. This could put a dent in the economic recovery.

• Equity markets have reacted negatively to higher yields as they are generally considered as an alternative to the dividend yield. Also plugging a higher interest rate to determine long-term cash flows results in lower valuations for most stocks which have benefited from the assumption that long-term rates will stay low over the next few years. The accommodative stance of global policymakers is unlikely to change until the vaccines restore some normalcy. However, bond markets seem to think that central bankers will soon cut back on their bond purchases or start increasing rates to accommodate higher inflation. There is thus a risk of a taper tantrum in markets similar to the one we witnessed in 2013 which could derail the stock market rally.

• Rising interest rates also increase the debt burden for governments at a time when they have expanded their balance sheets to shore up the economy throughout the pandemic.

The Federal Reserve thus has a lot of incentive for stemming surging Treasury yields, even though it seems patient for now. Going forward, it is possible that the Federal Reserve may opt for Yield Curve Control and impose interest rate caps on longer maturity bonds. Any intervention by the Federal Reserve to suppress long term yields will be bullish for gold. The question is, how long before the Fed intervenes and pushes rates lower on the long end of the curve?

Gold is waiting for dollar sell-off to resume

The US dollar has been strengthening amid the recovery in US bond yields. But with a host of factors in place to put downward pressure on the currency, we believe dollar strength will be short lived.

By committing to keep interest rates where they are now for the next couple of years, Powell has endorsed a decline in the dollar. Combine that with more spending with Biden’s $1.9 trillion fiscal stimulus and expected infra splurge and you have ballooning deficits and further increase in debt which will keep the dollar under pressure. With more money trickling down to the real economy due to additional spending, the market is expecting robust inflation going forward. This too will be a contributing factor to the dollar’s downtrend.

A weakening dollar, growing inflationary pressure, debt accumulation and monetary expansion are all drivers for a positive gold price. International Gold may thus see a some positivity in the coming weeks.

INR appreciation could hurt gold in near term

The Indian rupee has been appreciating off late with the currency hitting a near 1 -year high in the month, hurting INR gold prices. The appreciation in the rupee is primarily due to a positive economic outlook for India and robust fund flows in Indian equities by FIIs. If investment flows are sustained then the rupee could appreciate. If the flows slowdown or reverse, the currency could be back to its gradual depreciating trend, giving a push to gold.

Use this correction in gold prices to build your allocation

Gold prices in India have fallen relatively more due to a combination of falling International gold prices, appreciating rupee and reduction in customs duty. The macro economic uncertainties like rising deficits and debt, lower rates for longer, threat of high inflation, lower real rates and bursting of asset bubbles, all seem plausible and therefore warrant an allocation to gold which remains an effective portfolio diversifier and counterweight to paper money which is losing credibility as a store of value.

Source - Bloomberg, World Gold Council

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Gold Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

After a strong September, gold extended its bullish momentum into October, marked by heightened volatility and significant price swings.

Read More