Worried about Portfolio Diversification & Fund selection? Don’t miss this solution

Posted On Friday, Mar 12, 2021

In the last few years, the Mutual Fund industry has seen a lot of confidence from investors. The total Assets Under Management through SIP stands at INR 4,21,538 cr during the period between April-Feb 2021. *However, fundamentally, the challenge remains for investors on:

a. How can I ensure proper diversification of my equity investments?

b. How do I select the right scheme?

If these questions keep bothering you, then this is the article especially for you.

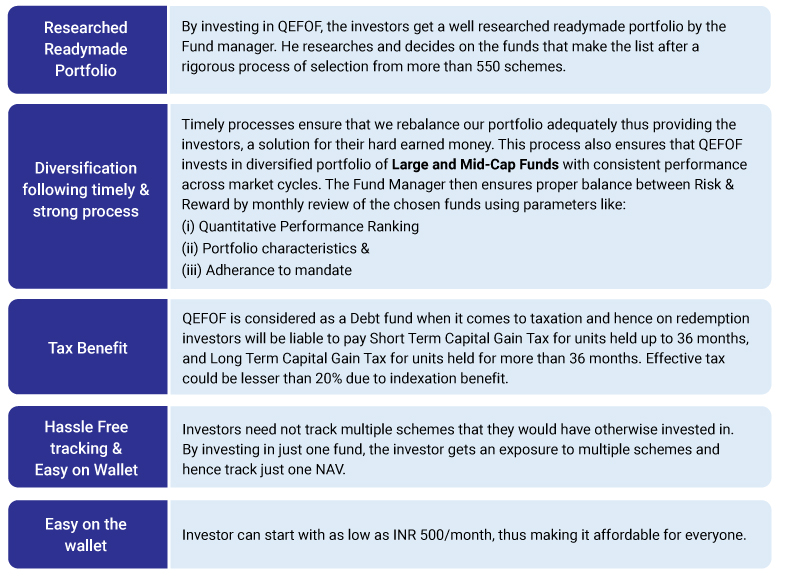

Quantum Equity Fund of Funds (QEFOF) addresses the above questions, by investing in third party mutual funds with a consistent track record across market cycles as an outcome of a robust investment research-backed process. It invests in 5-10 equity funds that are actively managed and enables investors of QEFOF to rely on the fund manager's capability to take advantage of market opportunities and build a robust portfolio to create wealth over the long term.

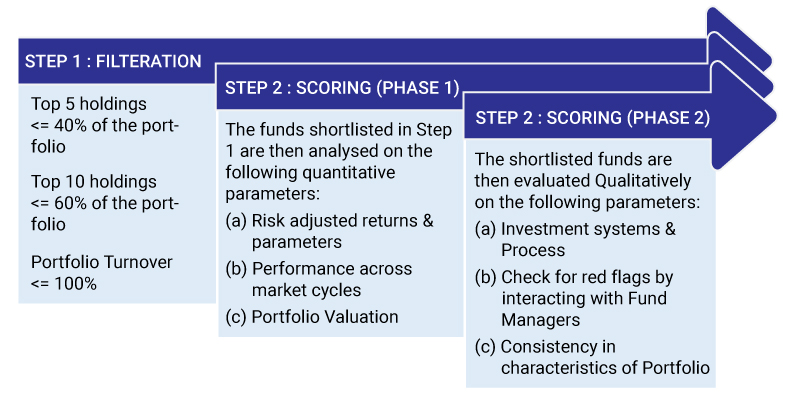

OUR FUND SELECTION PROCESS

Our selection is a rigorous two Step process which is ardent and prudent. It takes care of a combination of micro, quantitative and qualitative factors, which at the end of the day helps you invest in the top qualitative funds from around 550 equity funds.

The Fund manager searches for Actively managed Equity Funds that are not Sector or Index Funds. The shortlisted funds are then analysed for their diversification and 3 years track record based on y-o-y returns. And finally a list is prepared by analysing the top holdings of the portfolio which is as follows:

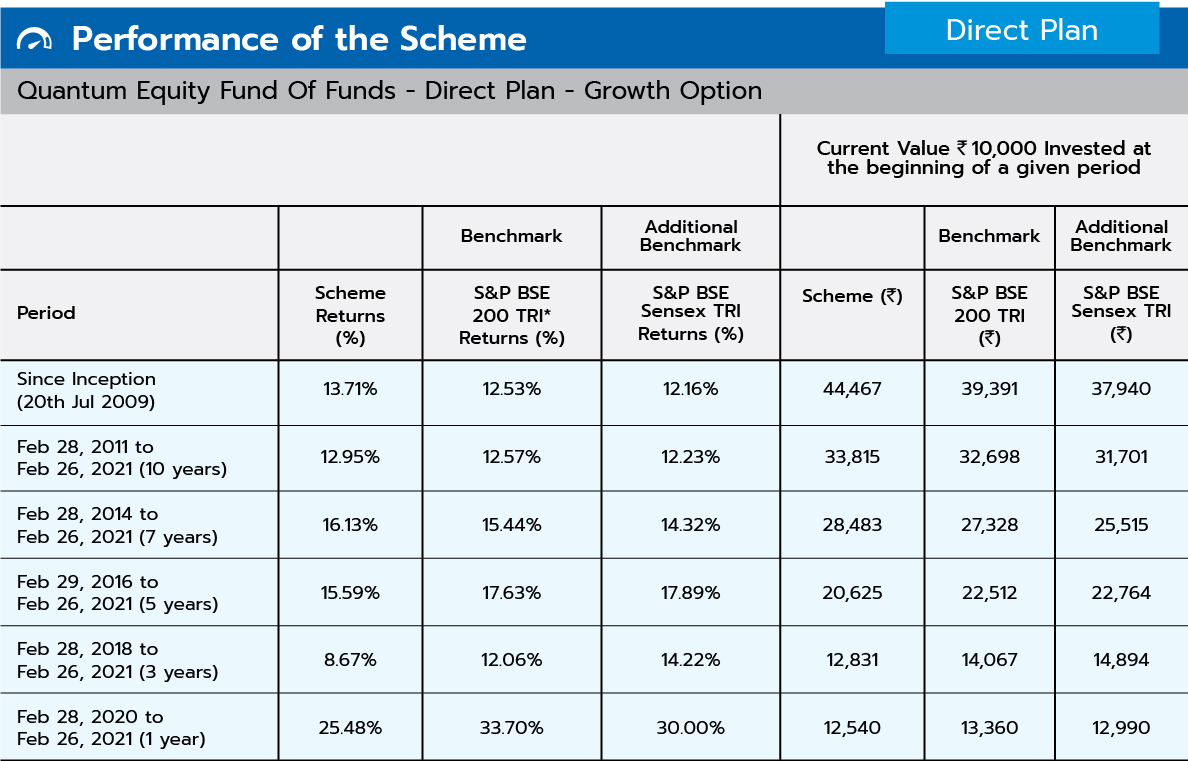

FUND PERFORMANCE

Based on the selection criteria, that our Fund Manager follows, our funds have been able to manage the risk & rewards for our investors.

Data as on February 26, 2021

Past Performance may or may not sustained in future

Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

The fund is managed by Mr. Chirag Mehta, since Nov 2013. For performance of other schemes managed by Mr. Chirag Mehta please click here.

The Quantum Equity Fund of Fund (QEFOF) simplifies the investment process of the customer by ensuring proper researched backed investment solution.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on February 28, 2021.

except for Quantum Equity Fund of Funds as on January 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for December 2025

Posted On Wednesday, Dec 03, 2025

Markets continued the rising trend in October with Sensex gaining 2.2%.

Read More -

Equity Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

Markets continued the rising trend in October with Sensex gaining 4.7%.

Read More -

Equity Monthly for October 2025

Posted On Friday, Oct 03, 2025

Markets bounced back in the month of September with Sensex gaining 0.6%.

Read More