Balancing Emotions While Investing

Posted On Monday, Jun 20, 2022

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals. Several investors allow their personal biases and emotions of fear and greed shroud their judgment during investing decisions.

During the market rally of 2021, when valuations were looking expensive, we saw widespread enthusiasm in investor sentiment bordering on greed. Today, for many investors, the euphoric sentiment of the equity rally of 2021 has broken.

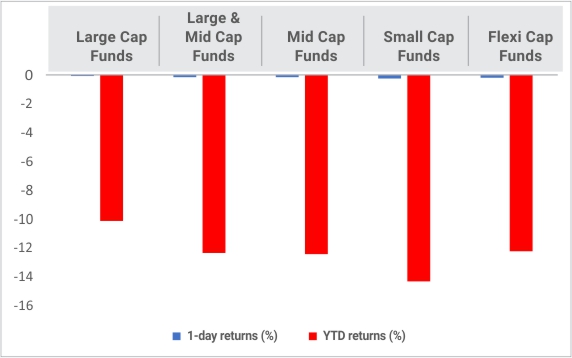

The equity market is undoubtedly experiencing a tough phase. The BSE Sensex tumbled southwards around 1,500 points in a single day on June 14, 2022, amid concerns over inflation numbers in the US touching a record 40-year high of 8.6% and above 7% in India. Equity mutual funds across categories have been deep in the red. The rising commodity prices and aggressive interest rate hikes have led to fear trumping greed.

Source: Economic Times as of Data as of Jun 15, 2022. Past performance may or may not be sustained in the future

Dealing with bad phases in the market has never been easy. But then so aren’t overcoming our emotions of fear and greed. The key question on everyone’s mind is what next? Is the scenario going to be doom, gloom, or boom?

Today on the occasion of International Yoga Day, find out how to control your emotions and decide whether it’s time to exercise restraint or should you be bold and take the plunge?

Balancing Emotions

While no one can predict the future, investing wisdom calls us to be fearful when markets are greedy and greedy when markets are fearful. Remember that fear and greed often come from a place of ignorance. At this juncture, it helps to be unbiased and take cognizance of the macroeconomic trends that have been shaping up in the market.

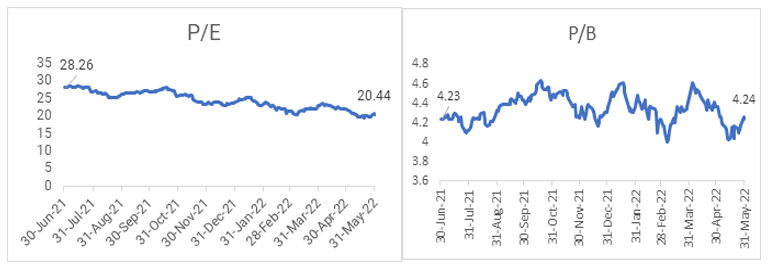

Valuations Look Favourable

In response to the interest rate hikes, FPI (Foreign Portfolio Investors) have been pulling out of Indian Equity markets. However, consistent DII and retail inflows have cushioned the fall.

Despite the headwinds, large listed companies have showcased resilience. Nifty and Sensex at current levels of PE below 20 are looking favourable.

Considering the markets are approaching fair value and earnings are continuing, the FII flows might return to the Indian Market and this would boost India’s growth potential over the long term.

Source: Nifty 1 Year Data as of May 31, 2022. Past performance may or may not be sustained in the future

How Do You Position Your Portfolio To Overcome The Influence Of Emotions?

1. Exercise discipline: We believe that market fluctuations should continue for the next couple of quarters, therefore, you need to exercise patience. While you will get ample opportunities to use the market correction to your advantage, instead of deploying all the investment surplus in one shot, it would be the right time to stick to a disciplined approach to investing.

• Consider investing lump sums in a piecemeal manner. This would help you take a calculated risk and manage the risk better.

• Another way to exercise discipline and patience is by starting an SIP (Systematic Investment Plan). An SIP can often be the simplest way to help you resist the urge to pull out from the markets and stay on track on your financial journey. If you already have an SIP, avoid discontinuing or stopping your SIPs in the current market cycle. It would prove counterproductive and put brakes on your goals.

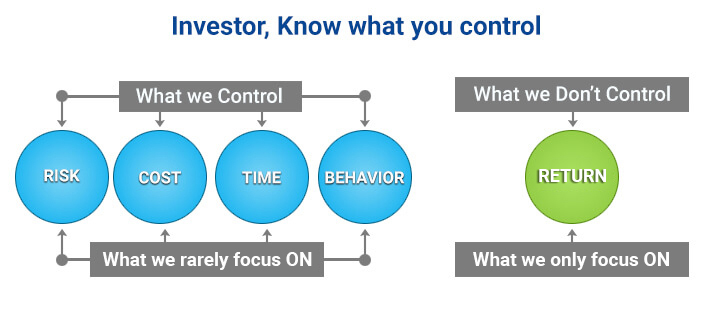

2. Go long term with a diversified equity portfolio: While no one has a crystal ball to predict the near-term market levels and the impact on your investments, it's usually within our control to ignore the overriding emotions of fear and greed and accept the market dynamics and rise to the opportunities it presents. The effect of inflation and interest rate hikes may not be consistent across all companies. Thus, it makes sense to build a diversified portfolio that could be geared for growth over the long term and offer better downside protection. Keep a minimum investing horizon for five years to build your growth block.

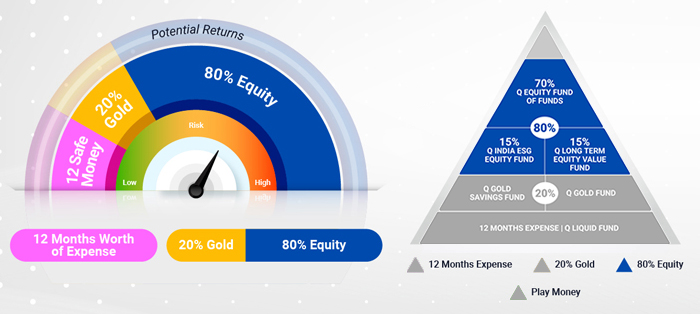

You can use the 70:15:15 ratio as part of the overarching 12-20-80 asset allocation strategy to rebalance and strengthen your equity block.

Please note that the above is a suggested fund allocation and is not to be considered as an investment advice/recommendation.

It makes sense to add the Quantum Long Term Equity Value Fund which comprises of stocks at reasonable valuations and a lower leverage that will be less sensitive to the increases in the cost of capital and rate hikes than a portfolio with high PE multiples. You can additionally diversify with Quantum India ESG Equity Fund positioned for sustainable growth over the long term. Finally, diversify across different market cap and styles using Quantum Equity Fund of Funds.

| Sr. No | Fund | Allocation | Benefit |

|---|---|---|---|

| Equity Fund 1 | Quantum Equity Fund of Funds | 70% | 1 Fund = 5-10 well researched diversified Equity schemes |

| Equity Fund 2 | Quantum India ESG Equity Fund | 15% | Shortlists funds based on environmental, social and governance parameters |

| Equity Fund 3 | Quantum Tax Saving Fund or Quantum Long Term Equity Value Fund | 15% | Follows value style lowering downside risks and helps achieve long term goals |

Please note that the above is a suggested fund allocation and not to be considered as an investment advice/recommendation.

Instead of allowing the dominant market sentiment to influence your investment decisions, overcome your emotions with sound investment principles of evaluating your goals, staying disciplined and sticking to an asset allocation plan over the long term. Relax, do not panic, and believe in the Indian growth story and the long term growth prospects of the equity market.

|

|

| Related Articles | ||

| Is Your Portfolio in a Free fall? Or Are You on Your Dream Vacation | ||

| Why Market Crashes Don't Rattle Thoughtful Investors | ||

| 4 Ways to Protect Yourself from Yourself |

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation •Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit. | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at High Risk |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Tax Planning Season is Coming - Don’t Wait Till the Last Moment

Posted On Tuesday, Nov 15, 2022

It is around the time when companies start requesting investment proofs for tax planning.

Read More -

How Can ESG Investing Safeguard Your Future?

Posted On Thursday, Aug 11, 2022

Three waves of the pandemic, the Russia-Ukraine war, record-high inflation - the last three years have been challenging...

Read More -

Balancing Emotions While Investing

Posted On Monday, Jun 20, 2022

Emotions are an essential part of what makes us human but when it comes to investing, emotions can either make or break your goals.

Read More