Equity monthly view for November 2022

Posted On Thursday, Dec 08, 2022

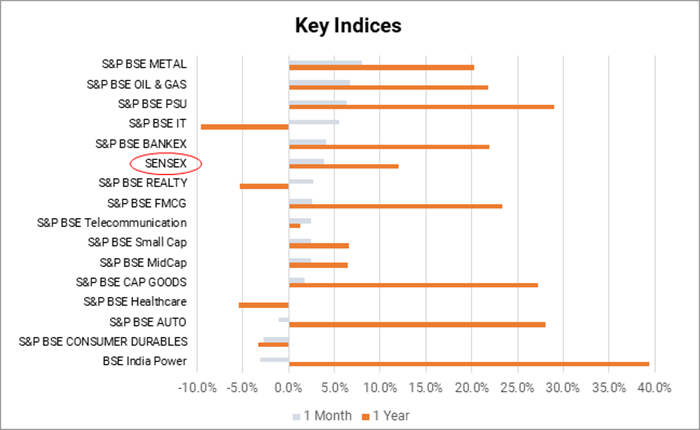

The S&P BSE SENSEX advanced by 3.9% on a total return basis in the month of Nov 2022 while S&P BSE Midcap Index & S&P BSE Small cap Index advanced by 2.5% each. The rally was fuelled by easing inflation (CPI for Oct-22 at 6.8% Vs 7.4% in Sep-22, WPI at 8.4% in Oct-22 Vs 10.7% in Sep-22), moderation in crude prices (Brent Crude price declined by 7.9% in Nov) and Fed’s indication of moderate rate hikes.

Source: Bloomberg, Data as of Nov 30, 2022.

Past performance may or may not be sustained in the future.

Most of the sectoral indices gained during the month. Metals rallied on hopes of China opening up. Fed’s indication of moderate rate hikes fuelled rally in IT index. Advance in Oil & Gas index was triggered by amendments in gas pipeline tariff regulations which is positive for gas transmission companies. Banks especially PSU Banks performed well supported by persistence of credit growth and improving margins along with benign asset quality. Laggards during the month were Auto, Consumer Durables and Power indices. Barring tractor segment, Auto volumes were lower than expectation. Margin disappointments and intense competition led to muted performance of consumer durable index. Higher fuel costs and profit booking led to a decline in power index.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 3.8% in its NAV in the month of Nov 2022. This compares to an increase of 3.5% each in its Tier I benchmark S&P BSE 500 and Tier II Benchmark S&P BSE 200. Oil & Gas, IT and Banks were major contributors to the outperformance. Cash in the scheme stood at approximately 5.9% at the end of the month. The portfolio is valued at 12.2x consensus earnings vs. the S&P BSE Sensex valuations of 17.1x based on FY25E consensus earnings.

Federal Funds rate in US was hiked by 75bps in November-22 policy meet. Fed hinted at slower pace of rate hikes as it will consider the lag effect of large rate hikes delivered in the past few months. Inflation print is expected to ease across globe due to high base and moderation in growth. S & P 500 and Dow Jones Industrial Average recorded gains of 5.6% and 6.0% respectively. Chinese markets saw sharp gains supported by ease in covid zero policy. Gains in China was reflected in 14.8% gain in MSCI Emerging Markets Index. FPIs turned buyers in Indian equities as pace of future rate hikes is expected to slow down. FPIs purchased stocks to the tune of USD 4.4 bn while DII sold equities worth USD 181 mn. during the month (Data as of Nov 28, 2022).

Though market valuations are marginally above its long-term average, healthy earnings growth would support markets in the medium term. Consumer spending remains buoyant as reflected in recent quarterly GDP print. Indian economy is unlikely to see a material deceleration as ~60% of our GDP is derived from domestic consumption. Loan growth trends remain healthy (Bank Credit Growth at 17.8% in Oct-22 Vs16.4% in Sep-22 & 6.8% in Oct-21) supported by retail and working capital demand. Industrial credit is showing signs of revival backed by improving utilisation trends (>70% as per RBI Survey). Tax collections remain healthy aiding the Government to continue its robust capex programs. The recent correction in crude augurs well for India’s inflation and economic stability. Expectations of good rabi crop and elevated crop prices are expected to support rural demand.

Interest rate actions by central banks, geo-political situation, oil price trajectory, private capex revival and rural demand recovery trends are the key watchpoints in the near term. We remain constructive on Indian equities with a long-term perspective.

Sectors referred above are for illustrative and not recommendation of Quantum Mutual Fund/AMC. The Fund may or may not have any present or future positions in these sectors. The above information of sectors which is already available in publicly access media for information and illustrative purpose only and not an endorsement / views / opinion of Quantum Mutual Fund /AMC. The above information should not be constructed as research report or recommendation to buy or sell of any stocks from any sector.

Data source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More