Equity Monthly View for August 2024

Posted On Thursday, Sep 05, 2024

After the recent run up, Indian markets remained range bound in August; BSE Sensex registered a growth of ~1%. BSE Midcap Index advanced by 1.0% & BSE Small cap Index advanced by 1.4%.

Global markets performance continue to be in positive zone with S&P 500 advancing by 2.4%, majorly supported by US Tech majors. MSCI Emerging Markets Index advanced by 1.6% during the month with China being a drag.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 2.2% in its NAV in the month of Aug 2024; Tier-I benchmark BSE 500 and Tier-II Benchmark BSE 200 increased by 1.0% and 1.1% respectively. Among sectoral indices, IT and Pharma recorded better performance. Rally in IT was supported by an anticipation in demand revival as rate cuts are expected in the near term. Pharma continues to benefit from a decent launch pipeline along with favorable pricing environment in US market. Portfolio holding within utilities, IT and healthcare helped our performance; Financials and absence of holdings in Consumer Staples negatively contributed to the performance. During the month, we continue to trim in consumer discretionary (auto), pharma, utility and a select NBFC (Non-Banking Financial Company) due to valuation reason. Though the month saw more trims than addition, we have re-allocated a portion of the capital to private sector banks. Cash in the scheme stood at 14.0%.

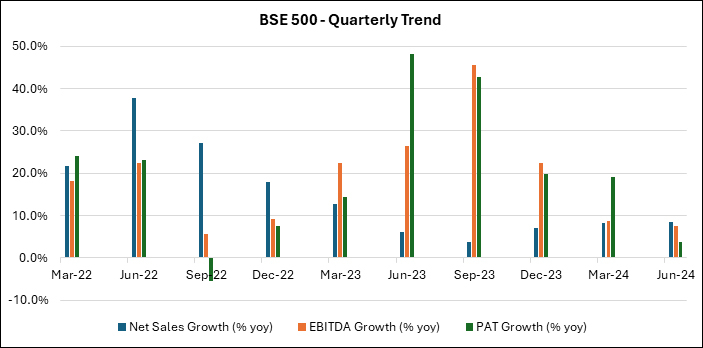

As shown in the below graph, the recently concluded quarter saw modest rise in revenue and profit growth (<10%) for the broader universe, as can be seen in the growth trends of BSE 500 aggregate. While margin expansion supported earnings growth in most part of FY24, earnings growth from hereon should be supported by an improvement in demand environment. An above average monsoon and moderating inflation is likely to support demand pickup in rural economy and mass segments. However, above average valuations in most pockets suggest moderate return possibility in the medium term.

Source: Ace Equity; Data as of June - 2024 quarter

During the month, Supreme Court allowed states to levy royalty on minerals retrospectively, starting from April 2005. While state wise royalty rates are yet to be finalized for most states, prohibitive rates could adversely impact the industry growth, especially in commodities where pricing is decided based on global cost curve. Among other key portfolio related developments, the promoter of a gas utility company has announced a scheme of amalgamation with its subsidiary (Majorly into City Gas Distribution) and parent company (Gas distribution and exploration company). The amalgamation would simplify the corporate structure and aid in unlocking synergy from the related businesses of the group. The major value unlocking would emerge from removal of holding company discount (Market generally discounts value of subsidiary company for the limited control).

Key macro indicators continue to remain reasonable during the month. Two-wheeler volume growth remain reasonable while passenger vehicles and commercial vehicle sales have seen moderation. Residential sales in top 8 cities for 1QFY25 remain buoyant with a growth of ~11% yoy (Source: PropEquity), on the back of a strong base quarter. Cement volume remain subdued and is expected to pick up as the monsoon recedes. Peak power demand clocked a reasonable growth of ~8% in July, 2024. GST collection clocked a growth of ~10%. Non-food credit growth has remained reasonable at ~15%, majorly supported by retail and agriculture. CPI inflation is expected to remain moderate as the good monsoon would keep a check on food prices. CPI inflation for July stood at ~3.5% yoy, partly supported by favorable base effect. Global dynamics suggest a possibility of moderation in crude oil prices. Globally, Fed has indicated rate cuts in the near term which could trigger rate cuts in other parts of the globe.

The key near term risks are emanating from global macros such as global growth/inflation trajectory and central bank policies around these. While India continues to enjoy favorable macros, valuation remains on the higher side. Thus, investors should moderate their return expectations; maintain the right asset allocation and prudently invest towards equity.

Data source: Bloomberg, CMIE, Ace Equity

|

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I & Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy. Tier I Benchmark: BSE 500 TRI Tier II Benchmark: BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for March 2026

Posted On Sunday, Mar 01, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More