ELSS Investment – A Friend of The Salaried Class

Posted On Monday, Dec 13, 2021

| Table of Contents | |

| Sr no | Header |

1 | What are ELSS Investments & Its Benefits |

2 | What is an ELSS Investment Calculator |

3 | How to get ELSS Investment Proofs |

4 | ELSS Investment Plans |

If you are a new investor or a salaried class one, ELSS Investment is something you must know about.

Especially if you wish to start your journey towards a savvy investor.

After all, you want to invest your hard-earned money in an asset class which has potential to grow and help you, right?

But before we go ahead with the details of how ELSS investments work, you should also know some basics about them.

What are ELSS Investments?

If you read our articles regularly, you would know what ELSS investment means. ELSS stands for Equity Linked Savings Scheme

ELSS Schemes basically invest minimum 80% portion of their portfolio monies into equity or equity-related instruments.

Here are some of the benefits of ELSS Investments:

I. Biggest One - Tax Savings

This mutual fund scheme category allows investors to not only save tax but also create wealth. You can save tax upto Rs 46,800 annually (if falling in the highest income bracket).

II. Lowest lock–in period:

ELSS investments have the lowest lock-in period when compared to the other tax saving options. FD’s have a lock-in of 5 years, PPF has 15 years. ELSS Investment have a lock-in of just 3 years.

III. Tax on Gains

Since the lock-in period is that of 3 years, any gain is basically a long-term gain in case of ELSS investments. And as per current Income Tax rules, long term capital gains above ₹ 1,00,000 shall be taxable at the rate of 10%.

IV. Compounding

It is generally suggested to be invested in ELSS for a long time period. Because given the lock-in period, it brings about a disciplined long-term investment approach. This in turn helps an investor to take benefit from the power of compounding.

V. SIP Option Available

An investor can choose to go the SIP (Systematic Investment Plan) way of investing. One can start with as low as Rs 500 a month. This is great for the salaried class as it allows them to invest a fixed sum every month.

So now you know what ELSS investment means and also the benefits.

And you are probably even considering investing in one.

But how much should you invest and what type of returns can you expect.

Well, that is where the ELSS investment calculator comes into play.

An ELSS investment calculator is basically a simulation, that helps you in estimating what you can expect from your ELSS investments. All you have to do is input some numbers into the same.

The ELSS investment calculator will need you to input the chosen mode of investment, whether a systematic Investment Plan or a lumpsum amount, followed by the amount you have decided to invest, frequency of investment in case of an SIP, your expected annual rate of return and duration for which you plan to stay invested.

Based on all these inputs, the ELSS investment calculator can give you a fair idea about what type of returns you can expect at the end of your investment tenure.

Hence, an ELSS investment calculator helps you align your investment with your goals.

Now, we also told you that the biggest benefit of ELSS Investments is the Tax Saving.

But for any tax saving, you need to have your investment proofs in place.

Similar is the case with ELSS Investment proofs.

As you know, when you invest in ELSS investments, you can save upto Rs 46,800 annually on taxes (if you are in the highest tax bracket). Also, returns of over Rs 100,000 from ELSS investments is taxed at 10% (Long Term Capital Gain).

You can simply ask your mutual fund distributor, AMC or RTA (Registrar and transfer agent) for your ELSS investment statement.

Alternatively, thanks to the initiative by the Association of Mutual Funds in India, if you have registered your email address with mutual funds serviced by either KARVY or CAMS, you can get a consolidated PDF Account Statement on your email address.

With that being said, you should now also know about the ELSS Investment Schemes that are available for you to invest in.

There are many ELSS Investment Schemes you could consider investing in, based on what your goals are.

Assuming that you are looking forward to save tax, we can tell you more about the ELSS Investment schemes here at Quantum mutual funds.

The Quantum Tax Saving Fund – An Open ended Equity Linked Saving Scheme with a statutory lock in of 3 years and tax benefit

The Quantum Tax Saving Fund is an open-ended equity linked savings scheme that has potential to help you build wealth over the long term and help you save tax, simultaneously.

This fund invests in equities and also allows you to save tax u/s 80 C of the Income Tax Act.

But you should also know that this being an ELSS Investment Scheme, your investments in this fund, like all ELSS funds, are subject to a minimum lock-in period of 3 years.

Here are some reasons you should consider investing in Quantum’s ELSS Investment Plan:

1. Optimizes tax-saving under Section 80C.

2. Minimizes risk by pursuing bottom-up stock selection.

3. Has a low portfolio turnover.

4. Holds cash when stocks are overvalued - no derivatives and no hedging.

5. Has among the lowest expense ratio in its category.

So we spoke about ELSS investment calculator, what ELSS investment means, how can you get your ELSS investment proof and ELSS investment.

So, if you want to start investing in the Quantum Tax Saving Fund, you can start right here.

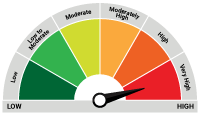

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  Investors understand that their principal will be at Very High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Nov 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Understanding AMC: The Asset Management Company to Mutual Funds

Posted On Friday, Sep 06, 2024

In the world of mutual funds, the term "AMC" might appear frequently. AMC stands for Asset Management Company, and it manages the operation and management of mutual funds.

Read More -

IDCW Option in Mutual Funds: A Simple Guide for Investors

Posted On Thursday, Aug 29, 2024

The Indian mutual fund industry has grown incredibly fast over the past 10 years.

Read More -

How to Calculate Returns From an ELSS And Its Tax Implications

Posted On Friday, Feb 10, 2023

As you may know, there are multiple tax-saving options in India to save taxes under Section 80C of the Income Tax Act

Read More