Debt monthly view for July 2021

Posted On Monday, Aug 09, 2021

Fixed Income Monthly Commentary – July 2021

July was a mixed month for the bond market. The old 10-year benchmark bond sold off by about 18 basis points to end the month at 6.23% compared to 6.05% at the end of June 2021. Part of this selling in the 10-year bond was due to the issuance of a new benchmark paper.

The issuance yield (coupon rate) on the new 10-year benchmark bond was set at 6.10% and it moved up in the latter part of the month to close at 6.20% on July 30, 2021.

Other long-term bond yields also moved up by about 5-10 basis points during the month due to rising inflation risk and supply pressure. While the yield on the shorter-maturity segment (up to 3-year maturity) came down by about 20-30 basis points following an increase in surplus liquidity.

The RBI continued its market interventions as it conducted two OMOs of Rs. 200 billion each under the GSAP 2.0 and purchased government bonds worth Rs. 67.7 billion in the secondary market between 1st to 23rd July 2021. It also devolved cumulative Rs. 291 billion of government bonds on primary dealers in the weekly auctions in July 2021 to set cutoffs at a lower yield.

CPI inflation though softened marginally compared to the previous month, remained close to 6.3%, which is above the RBI’s upper tolerance band of 4%+/-2%. Inflationary pressure was seen across all major components, except for housing which remained below the 4% mark since April 2020. Headline CPI inflation is expected to average between 5.5%-6.0% in FY22.

In the monetary policy review announced on August 6, 2021, the Monetary Policy Committee (MPC) of the RBI left the policy repo rate unchanged at 4.0% and the reverse repo rate at 3.35%. It also maintained the forward guidance to keep an ‘accommodative stance’ as long as necessary to revive and sustain growth on a durable basis while ensuring that inflation remains within the target going forward. However, the MPC split on the ‘accommodative stance’ to 5-1 vote first time since the onset of the Coivd-19 pandemic.

The governor in his statement characterised the recent jump in inflation as ‘transitory’; however, the RBI revised its CPI inflation forecast significantly higher. The RBI now expects the headline CPI inflation to average at 5.7% in FY22 compared to 5.1% in the last policy meeting.

The RBI also announced a phased increase in the amount under Variable Rate Reverse Repo auctions (VRRR) from current Rs. 2 trillion to Rs. 4 trillion by the next month. This seems like a nascent attempt by the Reserve Bank of India to take steps to ‘normalise’ the monetary policy operations.

Over the next six months, we would expect RBI to reduce the excess liquidity in the banking system. We would expect an increase in the reverse repo rate from 3.35% to 3.75%, and as growth stabilises, a subtle move away from the accommodative stance and then to a gradual beginning of rate hikes.

Higher Variable Rate Reverse Repo Auction (VRRR) should lead to an increase in overnight to short-term rates. This should bode well for liquid and money market funds in comparison to bank savings account rates.

As the market factors in a change in the policy stance going ahead, we should expect an increase in bond yields, particularly in the short to medium term segment, but the RBIs G-SAP operations will smoothen the impact. The above 10-year segment of the bond market will also rise but it has already priced in inflation risks and we do not expect a large increase in yields in that space for now.

The larger risk for the bond markets remains oil prices and global commodity prices. The brent crude oil price is sustaining above USD 75 per barrel. Given the sharp pick-up in economic activity globally and the gradual opening up of economies, it may remain elevated for some time. In the near, term the bond market will closely follow the movement in crude oil prices.

On the positive side, the central government tax collections have been significantly higher than budget estimates in April-June 2021 quarter. The government cash balance has risen to over Rs. 4.5 trillion July 23, 2021. If the trend sustains, there is a possibility of a significant reduction in the government’s borrowing program. If happens, it will be a big positive for the bond market.

There is still very high uncertainty on the future trajectory of interest rates. Thus, for long-term asset allocation in fixed income space, investors should go with dynamic bond funds over longer duration funds. Dynamic bond fund gives flexibility to the fund manager to change the portfolio positioning depending on the evolving market condition.

However, for any such allocation, investors should be prepared to hold for a longer time horizon while also tolerate some volatility in the intermittent period.

Conservative investors should stick to categories like money market or liquid funds that invest in very short maturity debt instruments and tends to benefit from rising interest rates.

We also suggest investors lower their return expectation from debt funds as the potential for capital gains will be limited going forward.

Source: Worldometer.info

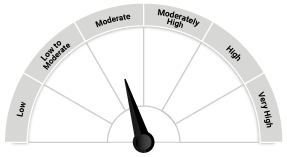

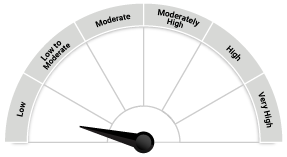

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on July 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More