Debt Market Observer - Sep 2020

Posted On Friday, Oct 09, 2020

Fixed Income Monthly Commentary - September 2020

In the last month, bond markets started on a positive note following supportive measures announced by the RBI. The RBI announced to conduct series of special OMOs (operation twists) to buy long term bonds and simultaneously sell short term bonds. This was meant to support long maturity bonds and to bring down the long term bond yields.

They also increased the HTM limit for banks to allow them to hold higher quantity of central and state government bonds without having mark to market on those. The HTM (Hold to Maturity) limit for banks has been raised from 19.5% to 22.0% of NDTL (Net Demand and Time Liabilities). This increase can boost banks’ demand for government bonds by about INR 3.5 trillion.

These measures were supportive for the bond market. Bond yields across the maturity curve, fell sharply after the announcement. Yield on the 10 year benchmark government bond fell by about 20 basis points on September 1st, from 6.14% to 5.95%.

After the initial rally, the market entered into a narrow range and remained there throughout the month. Market sentiment weakened on fear of potential increase in government borrowings in the second half of FY21.

The RBI conducted operation twist/OMOs every week and devolved 10 year bond auctions on primary dealers multiple times to guide bond yields lower. But it couldn’t change the market sentiment in material way. The 10 year benchmark was oscillating around 6.0% throughout the month.

Short term money market rates remained suppressed below the reverse repo rate in the month. The yield on 2-3 months treasury bills remained in the band of 3.25%-3.35%.

The CPI inflation for the month of August 2020 came in at 6.7% yoy as against the market expectation of about 7.0%. The reading for the month of July also got revised downward from 6.9% to 6.7%.

In our opinion the recent spike in inflation is a temporary phenomenon and we expect the headline CPI inflation to cool down by the year end. That may open up some space for rate cut though we do not expect any reduction in policy rates in the October MPC meeting.

The government announced its market borrowing program for the second half of FY21 on September 30th. It kept the full year market borrowing unchanged at earlier planned Rs. 12 trillion and accordingly plan to borrow Rs. 4.34 trillion in the H2 FY21. We believe this is a temporary respite on supply front and the government will increase its market borrowing by the end of third quarter when they will have a better estimates of shortfall in revenues and spending requirements.

Looking ahead we expect the RBI to continue to intervene in the bond markets through Open Market Purchases and Operation Twists to put a lid on long term bond yields. Thus bond yields may remain range bound in the near future.

At current levels we see scope for short to medium term bond yields to go down. However, we expect the yield on long term bonds beyond 10 year maturity to move up with rise in supply pressure.

Given our above view on interest rates, in the Quantum Dynamic Bond Fund (QDBF) portfolio we continue to focus on the 3-5 year maturity segment of the government bond curve. We expect this maturity segment to benefit for the RBI’s OMOs/operation twists and prevailing surplus liquidity condition.

Quantum Dynamic Bond Fund (QDBF) takes higher interest risks, but does not take any credit risks and invests only in Government Securities, treasury bills and top rated PSU bonds.

We always suggest e investors to have a longer time frame if they invest in bond funds and should also note that the bond fund returns are not like fixed deposit and can be highly volatile or even negative in a shorter time frame.

Quantum Liquid Fund (QLF) prioritizes safety and liquidity over returns and invests only in less than 91 day maturity instruments issued by Government Securities, treasury bills and top rated PSUs.

We suggest debt fund Investors to choose Safety (over Credit) and Liquidity over Returns while investing in debt funds.

Data Source: Bloomberg, RBI

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

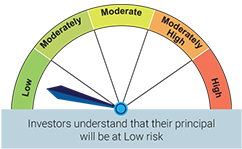

| Quantum Liquid Fund (An Open Ended Liquid Scheme) | • Income over the short term • Investments in debt / money market instruments |  |

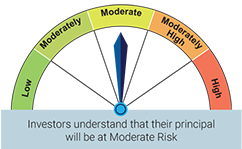

| Quantum Dynamic Bond Fund (An Open Ended Dynamic Debt Scheme Investing Across Duration) | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More -

Inevitable Pivot: Resetting Market Expectations

Posted On Tuesday, Apr 26, 2022

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation.

Read More