Balanced Funds: Perception Not Equal to Reality

Posted On Monday, Jun 03, 2019

Balanced funds (now correctly renamed by SEBI as Aggressive Hybrid funds) are no substitute to the Indian saver’s favorite instrument – the monthly-income generating investments.

Conservative investors and retirees in India are learning this the hard way.

With fixed deposit rates on the decline in 2017, balanced funds were thought to be a natural progression and were perceived as a low risk product with monthly dividends.

With few better alternatives to park their savings, and surging equity markets it was easy to convince even first time investors with low risk appetite to invest in the equity markets through this product.

As investors viewed this product as a regular income asset class; balanced funds gained immense popularity, but investors were generally set for disappointment from the very start.

Now the word “balance” is defined as “establish equal or appropriate proportions of elements in”.

And so it is fair to assume a typical “balanced” mutual fund to have almost equal weightage to asset classes equity and debt, their objective being between growth and income, thus being best suited for investors with medium risk appetite.

But with balanced funds in India investing a minimum of 65% in equity, these funds had significant equity exposure.

The favorable equity taxation and the race to generate returns ensured that these funds were not truly “balanced”, hence exposing him to higher risk than what he perceived he was taking on.. Even when the fund manager was not comfortable taking high equity exposure, he was compelled to, because of the fund mandate.

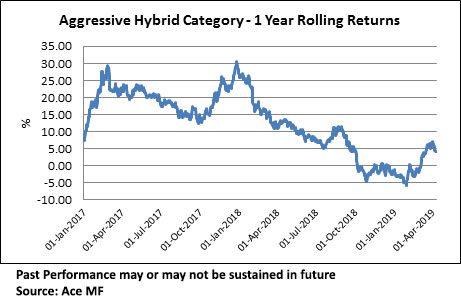

All was well till the equity markets changed tide. With average returns declining, balanced funds failed to protect their investors’ returns in the stock market volatility of 2018. This was obviously followed by inconsistency of dividends, and to further the blow- the imposition of tax on such dividends.

As expected, these funds have started losing their sheen. Compared to the massive net inflows of Rs 58,000 crore in FY17-18, net inflows have more than halved to Rs 22,800 crore in FY18-19.

Further, AMFI data on balanced funds suggests net outflows from this category over the last 3 months. Have investors now started to realize that this product doesn’t suit their risk appetite and regular income needs? If yes, then they could be using the rising markets as an opportunity to exit. Thus we are seeing the AUM trend in these funds normalizing over the last few months.

| Mutual Fund flows | |

| Month | Balanced Funds (Rs crore) |

| Mar '19 | -3181 |

| Feb '19 | -1077 |

| Jan '19 | -952 |

| Dec '18 | 45 |

| Nov '18 | 215 |

| Oct '18 | 519 |

| Sept '18 | 731 |

This isn’t surprising because when large number of investors entered this space in 2017, the stock market was in a good mood. Investors enjoyed regular dividends, and sometimes even higher returns than the index.

But this is when investors should have gotten alert. True balanced funds, by structure, are expected to underperform the index on the way up but protect the downside when the stock market declines

But with high risk bets taken to generate good returns and stay competitive to attract investors, these funds became further skewed and much farther from its perception as far as the risk was concerned. Investors might as well have bought a pure equity fund!

As can be seen from the below table, the balanced fund category struggled through the volatility of 2018-19. The category took on higher risks, comparable to the large cap equity category, and failed to minimize downside. On the other hand, the Multi Asset category of funds gave a higher average return and minimized the downside.

| One year Rolling returns during the volatility of financial year 2018-19 | |||

| Equity Large cap category | Aggressive hybrid category (balanced funds) | Hybrid: Multi asset category | |

| Minimum return | -7.48 | -5.79 | -1.55 |

| Maximum return | 14.67 | 13.60 | 9.44 |

| Standard deviation | 6.26 | 5.62 | 3.09 |

| Average return | 4.51 | 4.09 | 4.15 |

Past Performance may or may not be sustained in future

*Data from Ace MF as on 31st March 2019

**The standard deviation tells us how much the return on a fund is deviating from the expected returns based on its historical performance

It’s clear that there has been a big divergence in investor’s perception of these funds and reality. Broadly speaking, investors made the right move of moving out of fixed income products to investment led products but underestimated the risks of such products or may be the high returns from balanced funds overruled their risk appetite. But should investors shy away completely now? We don’t think so, they just need to pick their investment choices wisely if investors now correctly understand what a pure balanced fund is, and wish to enjoy its benefits, the Hybrid: Multi Asset Fund category of mutual funds could prove to be a good choice.

Reason being that this category does exactly what it is supposed to - minimize downside when the markets fall, and give you a better return, compared to fixed income generating, low risk assets over the long term, though not beating the index! Importantly, unlike Aggressive Hybrid Funds, this category tends not to be biased to any particular asset class. They are more balanced in the asset allocation mandate and so the fund manager need not be at least 65% invested in equities despite them sensing the riskiness.

And how is this done? Funds in this category invest in non-correlating assets like Equity, Debt and Gold, thus effectively offering investors exposure to various asset classes in a single investment.

These funds are based on the logic that all asset classes go through cycles of optimism and pessimism. This means that returns in an asset class could be highly volatile between these cycles. This volatility can be tide over by investing in multiple low or negative correlation asset classes – for example, equity and gold or equity and debt. This ensures that the overall portfolio doesn’t suffer major downside as one asset’s down cycle is balanced by another asset’s up cycle.

This diversification strategy across asset classes reduces the portfolio risk and optimizes gains.

If you’re a medium risk investor and when previously choosing a balanced fund thought it to be the ideal way to get a flavor of equity investing with limited risk, a Multi Asset fund could be the way to go.

By ensuring that allocations are not biased to any particular asset class, these funds can generate a fair share of growth for your portfolio through the equity allocation, and at the same time provide cushion from volatility through the debt and gold allocation, thus giving you moderate returns with moderately high risk.

Though this category of funds may not enjoy equity taxation, it would be prudent not to take on more risk than your appetite in order to save a few bucks in tax.

Also, for a 3 year and above holding period, debt taxation due to indexation benefits is less daunting then the headline number suggests and in some cases even better for investors as compared to equity taxation.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Multi Asset Fund of Funds (An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund) | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk< |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More