What Is a Liquid Fund?

Posted On Friday, Sep 23, 2022

In the finance domain, the term ‘liquid’ refers to something that is easily accessible in times of need as actual cash. Something that can be sold immediately during emergencies to generate cash and address contingency needs.

Liquid Funds are a kind of open-ended debt mutual funds that are designed for this purpose. It is an avenue for the investors to invest their money for a very short period and redeem them anytime they are in need of funds. They are generally considered to be safer and liquid amongst the debt mutual funds category.

Liquid funds invest predominantly in short‐term debt and money market instruments such as government securities, repos, Certificate of Deposit, Commercial Papers, Treasury Bills (T-bills), etc. According to SEBI norms, liquid funds are mandated to invest in debt and money market securities with residual maturity of up to 91 days. Parking your surplus money in liquid funds can be considered as an option along with bank savings account or fixed deposits as Liquid funds have potential to generate better market linked returns. However, note the comparison with Bank Savings Account or Fixed Deposits has been given for the purpose of the general information only and not a recommendation to invest. Investments in mutual funds should not be construed as a promise, guarantee on or a forecast of any minimum returns. Unlike fixed deposit with Banks there is no capital protection guarantee or assurance of any return in mutual funds investment. Investment in Mutual Funds as compared to Fixed Deposits carry moderately high risk, different tax treatment and subject to market risk.

How do Liquid Funds work?

According to the investment mandate of the fund, the fund managers allocate the funds in very short maturity debt instruments in varying proportions. The market value of the securities held by a liquid fund determines the fund's return. Due to short maturity of underlying instruments, the NAV of liquid fund units generally does not fluctuate much during sharp interest rate fluctuations in the economy.

Advantages of investing in Liquid Funds

• Liquidity – Liquid funds typically invest in instruments having a maturity of less than 91 days and can be liquidated immediately. It offers high liquidity and an easy exit option to investors. The redemption proceeds are available to investors within T+1 days. Quantum Liquid Fund has insta-redemption facility which allows immediate redemption of upto Rs.50,000 per day.

• Low-Interest Rate Risk – The interest rate risk possessed by liquid funds is generally low as compared to other debt funds as the underlying securities in the portfolio have a maturity of less than 91 days.

• Exit load – Liquid funds have shorter holding periods; however, a small exit load is charged for redemption within 7 days. There is no exit load on liquid funds after 7 days.

• Tax Benefits - Liquid Fund Taxation is similar to debt funds. Long-term capital gains (holding period of more than 3 years) are taxed at 20% with indexation benefit. Short-term capital gains (holding period of less than 3 years) are taxed as per the income tax slab of the investor. The long-term gains earned on Liquid funds are more tax-efficient due to indexation benefit.

Why should you invest in liquid funds?

“Uncertainty is very much a part of the world in which we live.”- Michael A. Bean

Life is uncertain, and it may throw curveballs at you when you expect it the least, impacting your financial wellbeing. Unforeseen events like income loss, pay reductions, medical issues, natural disasters, etc., can have a negative impact on your financial stability. The COVID-19 pandemic caused havoc on the finances of many people. Notably, during such a crisis, the majority of people withdrew funds from their investments to pay bills, which could jeopardise their financial future. But the best way to deal with such exigencies is to build an emergency fund.

A liquid fund is thought to be ideal for an emergency fund because it will keep risk exposure moderate to low, prioritise liquidity, and not pursue yield hunting or credit risk for high returns. An ideal emergency fund is equal to 12 to 24 months' worth of regular monthly expenses, including EMIs.

However, liquid funds are not entirely risk-free. The movement in interest rates impacts bond yields across the maturity curve and even the prices of debt instruments, which would have an effect on the returns of the liquid funds.

Therefore, when you choose a pure Liquid Fund, address the following elements:

✓ Read the offer document and assess the track record of a liquid fund for consistent performance across interest rate cycles.

✓ Check the credit ratings of the debt instruments in the portfolio of a liquid fund; it can help you assess the credit risk associated with the fund.

✓ Evaluate the average maturity, Yield-To-Maturity (YTM) (measures the expected interest income generated by the bonds) and the Modified Duration (MD) of the portfolio.

✓ Ensure that the liquid fund holds a lower expense ratio, which maximises the returns.

✓ Consider the fund manager’s experience and the overall investment processes, philosophy, and systems followed at the fund house.

✓ Apart from the above, it is essential to evaluate liquid mutual fund returns across time periods. Do not invest in liquid funds solely based on their past returns.

Quantum Liquid Fund prioritises safety and liquidity over returns and invests in government securities and AAA rated PSU bonds. It is managed by Mr Pankaj Pathak and invests primarily in instruments issued by Government and Public Sector enterprises.

Quantum Liquid Fund has no exposure to private corporate credit risk papers, thus reducing chances of default risk.

The scheme manages assets worth Rs 540.61 crore (as of Aug 31, 2022) and has an expense ratio of 0.15% p.a. (Direct Plan) and 0.25% p.a. (Regular Plan). Consider investing 12 months of your regular unavoidable expenses, or safe money, into Quantum Liquid Fund.

Happy Investing!

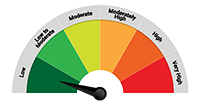

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on Aug 31, 2022.

| Potential Risk Class Matrix - Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |