Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023. Central banks, though somewhat less aggressive than last year, remain in inflation-fighting mode. Markets are divided on whether to follow central banks in fighting inflation or fight the central bank itself against raising rates.

Amidst all this, inflation numbers have started showing some interesting trends. The headline CPI inflation dropped by 169 basis points in the fourth quarter of 2022, from 7.41% YoY in September 2022 to 5.72% YoY in December 2022.

Some softening in inflation numbers was widely expected due to seasonal drop in vegetable prices with winter crop arrivals and base effect turning favorable. But, the quantum of disinflation in the last two months surprised almost everyone on the street.

As per market consensus estimates, CPI inflation was expected around 6.3% in November 2022 and 5.9% in December 2022. Actual headline CPI came at 5.88% and 5.72% respectively. The gap was almost entirely contributed by a larger than expected drop in vegetable prices which fell by a cumulative 21% in the last two months of 2022.

The CPI inflation ex-vegetables inched up to 7.2% and the Core CPI (CPI excluding food and fuel) remained sticky around 6.1%. Thus, at a broader level inflation remained elevated when calculated as year-on-year price changes.

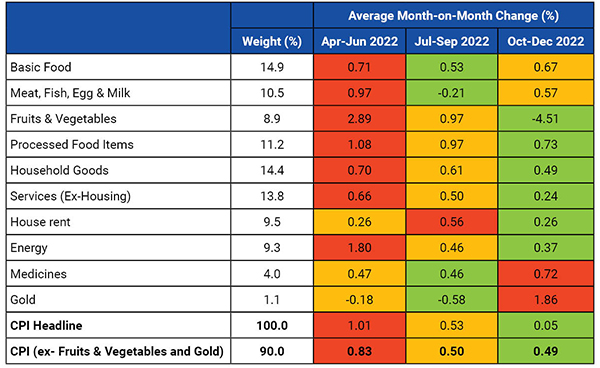

However, on a sequential basis (month-on-month price changes) inflation has been cooling off across various household goods and services. Energy prices have also stabilized after a sharp jump in the last year.

Food inflation ex-vegetables though remain elevated, should also come down as increased Rabi sowing and colder winter are expected to boost food output and thus reduce price pressure.

With the current trend, inflation should fall closer to 5% in FY24.

Chart – I: Incremental inflation has been moderating across many items

Source - MOSPI, Quantum Research, Data upto December 2022

Policy Implication

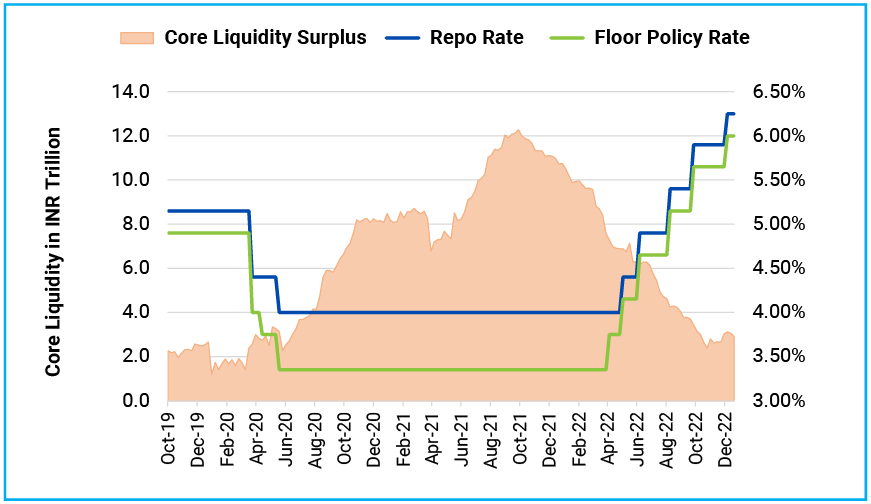

Though inflation is still above the RBI’s 4% target, it would take comfort from the declining sequential momentum. The RBI has covered significant ground in reversing monetary policy from historically low policy rates and highest ever liquidity buffer to something more consistent with long-run neutrality in the Indian context.

Chart - II: RBI Frontloaded Monetary Tightening to Tackle Inflation

Source - RBI, Quantum Research, Data as of December 30, 2022

Past performance may or may not sustained in future.

Now, the most likely scenario for the monetary policy seems like a one of a long pause with the repo rate staying at 6.25% for the entire 2023. This view is based on the following:

• Inflation is moderating on a sequential basis and is likely to remain well within the RBI’s upper tolerance threshold.

• Real policy rate (Repo Rate minus CPI inflation) are now more than 100 basis points based on expected average 12 months forward CPI inflation.

• Sluggish recovery in domestic demand keeping GDP growth below the long-run potential.

• The external monetary environment is showing some signs of easing amid falling global inflation and slowing pace of rate hikes by the US FED.

Chart – III: Rapid rate hikes took the policy rate above expected inflation

Source- MOSPI, Bloomberg, Quantum Research; Data upto December 2022

@12 months Forward inflation during 2022 is based on estimates of the Quantum Research team.

Past performance may or may not sustained in future.

Impact on Market

Pause in monetary policy in itself will be positive for the fixed-income market. At current valuations, the bond market has built-in significant uncertainty premiums for future monetary policy.

The 10-year government bond yield is currently trading around 7.3% which is over 100 basis points above the Repo rate. Considering monetary policy is around peak rates, this spread between the 10-year bond and the repo rate seems too wide. This makes the medium to long-duration bonds attractive buy at current valuations.

However, there are other factors that will have a significant impact on the bond market in the months to come. We are particularly concerned about the following:

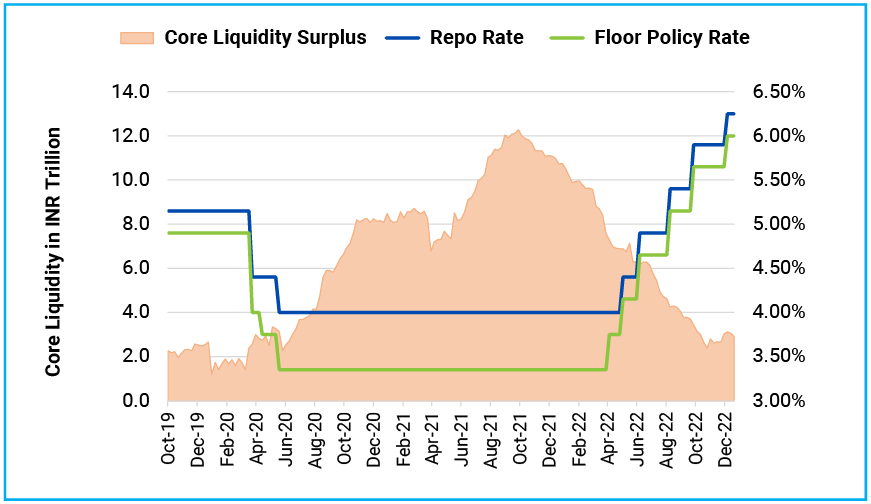

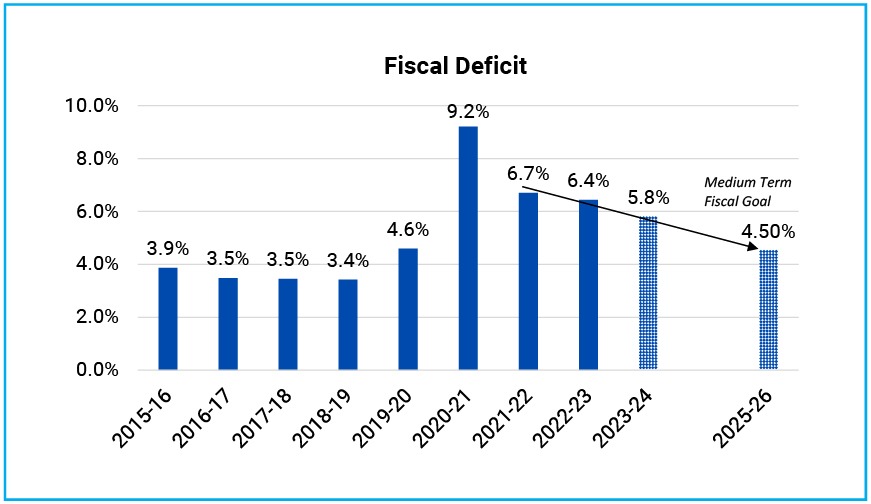

1. Fiscal Discipline: The union budget for 2023-24 will be presented against the backdrop of a slowing global economy and sluggish domestic demand. This will also be the last full budget before the general elections in 2024. Thus, there will be a need and temptation to boost spending. While on the other hand, tax collections will likely moderate in FY24 in line with the decline in nominal GDP growth.

The bond market will be highly sensitive to the government’s fiscal consolidation path. The market is prepared for a fiscal deficit of around 5.8% of GDP and a gross market borrowing of around Rs. 16 trillion. Any meaningful deviation on the upside will be negative for the bond market and will push yields significantly higher.

Chart – IV: Fiscal Consolidation to 5.8% of GDP required to reach the 4.5% medium-term goal

Source- Indiabudget.gov.in, Quantum Research; Actual Data upto FY23

@Quantum Research estimates for FY24

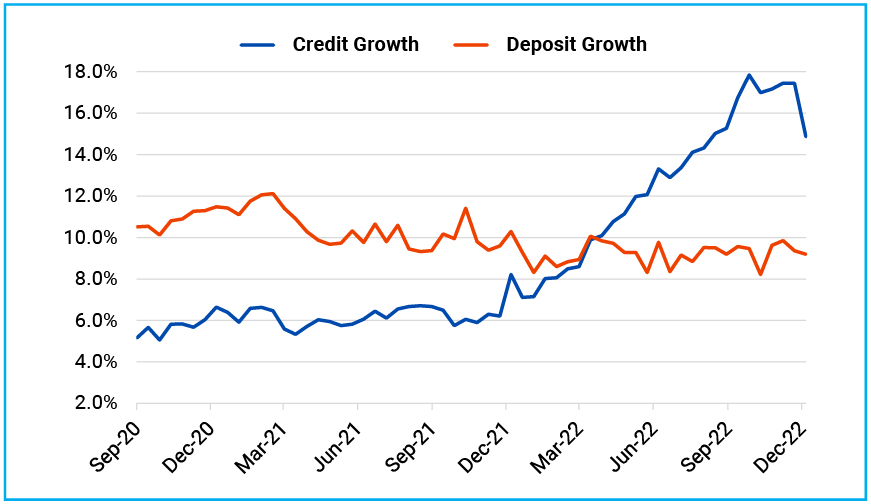

2. Bank Credit-Deposit gap: Bank credit growth is currently hovering around 15%-17% year on year. While deposits growth is around 9%.

In order to fund the increasing credit demand, banks will have to – (i) increase market borrowings, (ii) raise wholesale deposits at a higher cost, or (iii) liquidate investments in bonds.

The pressure on banks’ resource profile will increase as the liquidity condition tightens at the system level. Based on historical trends, we would expect cash withdrawals to pick up during January to May period reducing the core liquidity by around Rs. 2.8 to3.2 trillion by April-May 2023.

In absence of any durable liquidity infusion by the RBI, short-term yields will move significantly higher and credit premiums will widen across the yield curve. This could also reduce the bank's demand for bonds in FY24.

Chart - V: Wide gap between Credit and Deposit Growth Risk for Bond Demand

Source – RBI, Quantum Research; Data upto December 30, 2022

In conclusion, the bond market will face intense push-pull forces from falling inflation and stabilizing monetary policy on one side, and deteriorating demand-supply dynamics on the other side.

Although the near-term outlook is clouded by the uncertainties around the demand-supply balance, we remain positive on the bond market from a medium-term perspective. We broadly expect the 10-year government bond yield to trade in the 7.0%-7.5% range.

What should Investors do?

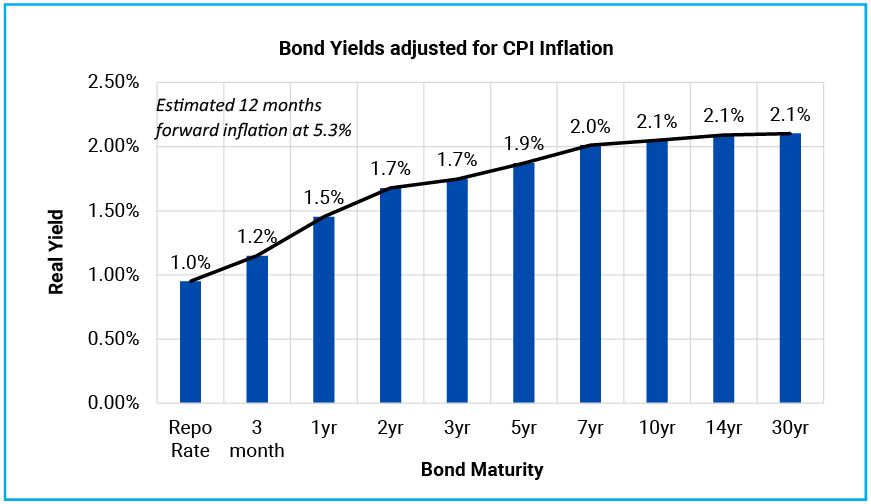

With most of the government bond yield curve above 7%, the accrual yield has improved significantly in the bond market. Currently, government bonds across all maturities are trading above the expected 12-month forward CPI inflation.

Higher starting yields auger well for fixed-income returns as it increases the interest accrual on fixed-income instruments. Also, with monetary policy stabilising, there is room opening up for capital appreciation over a medium-term horizon.

Chart – VI: The real rate is positive across the yield curve

Source – Refinitiv, Quantum Research, Data as of January 20, 2023

Past performance may or may not sustained in future.

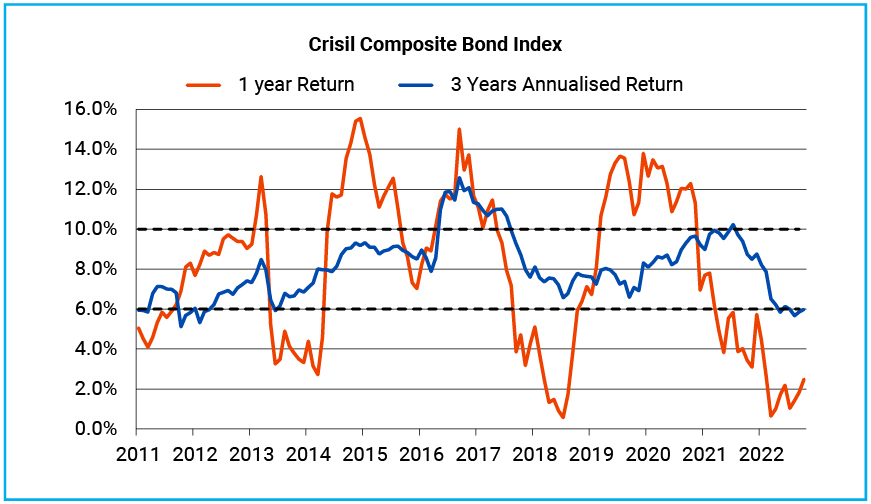

All in all, the return potential of fixed-income funds has improved and the next three years are likely to be more rewarding for fixed-income investors than what we witnessed in the last three years.

We suggest investors with 2-3 years holding period should consider adding their allocation to dynamic bond funds.

Dynamic bond funds have the flexibility to change the portfolio positioning as per the evolving market conditions. This makes dynamic bond funds better suited for long-term investors in this volatile macro environment than other long-term bond fund categories.

A Dynamic Bond Fund or any other debt fund which invests in long-term debt instruments are highly sensitive to interest rate movements. Thus, in a short period of time, returns could be highly volatile and can even be negative. However, over a longer time frame of over 2-3 years period, returns tend to normalize along with the interest rate cycles.

Chart - VII: Bond Fund Investments require a longer holding period

Source – AMFI Portal, Crisil, Quantum Research; Data as of December 30, 2022

Past performance may or may not sustained in future.

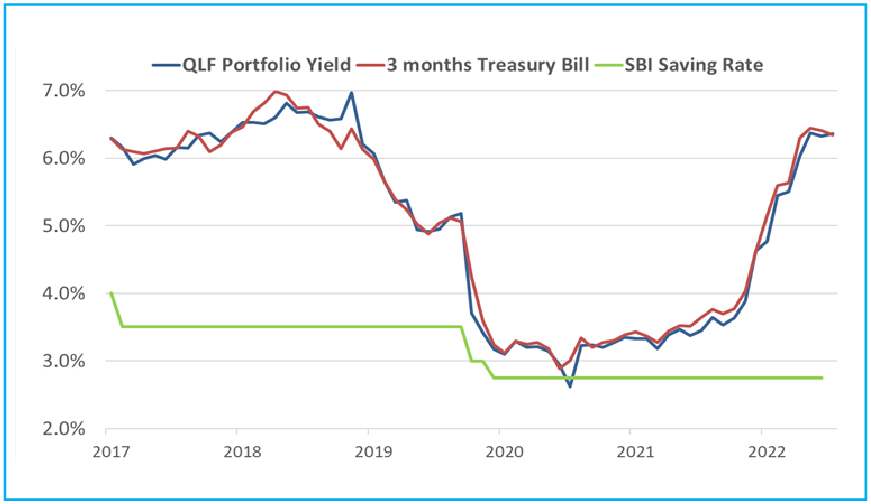

Investors with shorter investment horizons and low-risk appetite should stick with liquid funds. With the increase in short-term interest rates, we should expect further improvement in potential returns from investments in liquid going forward.

Since the interest rate on bank saving accounts are not likely to increase quickly while the returns from the liquid fund are already seeing an increase, investing in liquid funds looks more attractive for your surplus funds.

Chart - VIII: Liquid Fund Yields Moved up Tracking Treasury Bill Rate

Source – Refinitiv, Quantum Research; Data as of December 30, 2022

Past performance may or may not sustained in future.

Investors with a short-term investment horizon and with little desire to take risks should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Portfolio Positioning

Scheme Name | Strategy |

The scheme continues to invest in debt securities of up to 91 days of maturity issued by the government and selected public sector companies.

| |

The scheme continues to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio’s sensitivity to interest rates in line with Interest Rate Outlook. The bulk of the QDBF portfolio is currently into 1-3 years maturity Gsec and PSUs. This tactical position is consistent with our near-term uncertain outlook. We remain positive from a medium-term perspective. But will wait for some of the near-term uncertainties to pass before adding risk to the portfolio. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks, read all scheme related documents carefully.Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More