Unlock Potential to Earn Better Returns than Your FDs - With This Investment Option

Posted On Wednesday, May 12, 2021

Are uncertain times making you invest in a Fixed Deposit?

Is your money lying invested in a 3 year Fixed Deposit?

Given the way Fixed Deposit interest rates have fallen since the past few years, you should look out for an investment option, which has the potential to provide better risk-adjusted returns and retain the flexibility of getting some or all of your money when you need it the most.

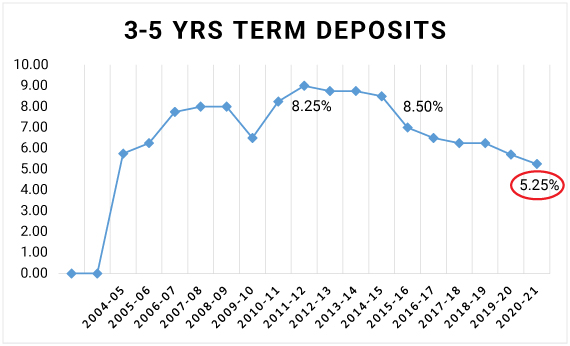

Chart - 1 : Low interest rates on your Bank Fixed Deposits

Source: STRUCTURE OF INTEREST RATES - RBI as on Sept 05, 2020

Consider investing in a diversified Mutual Fund instead. Quantum Multi Asset Fund of Funds (QMAFOF) has a 9-year track record of skillfully navigating the market uncertainty by diversifying across the three asset classes of equity, debt and gold.

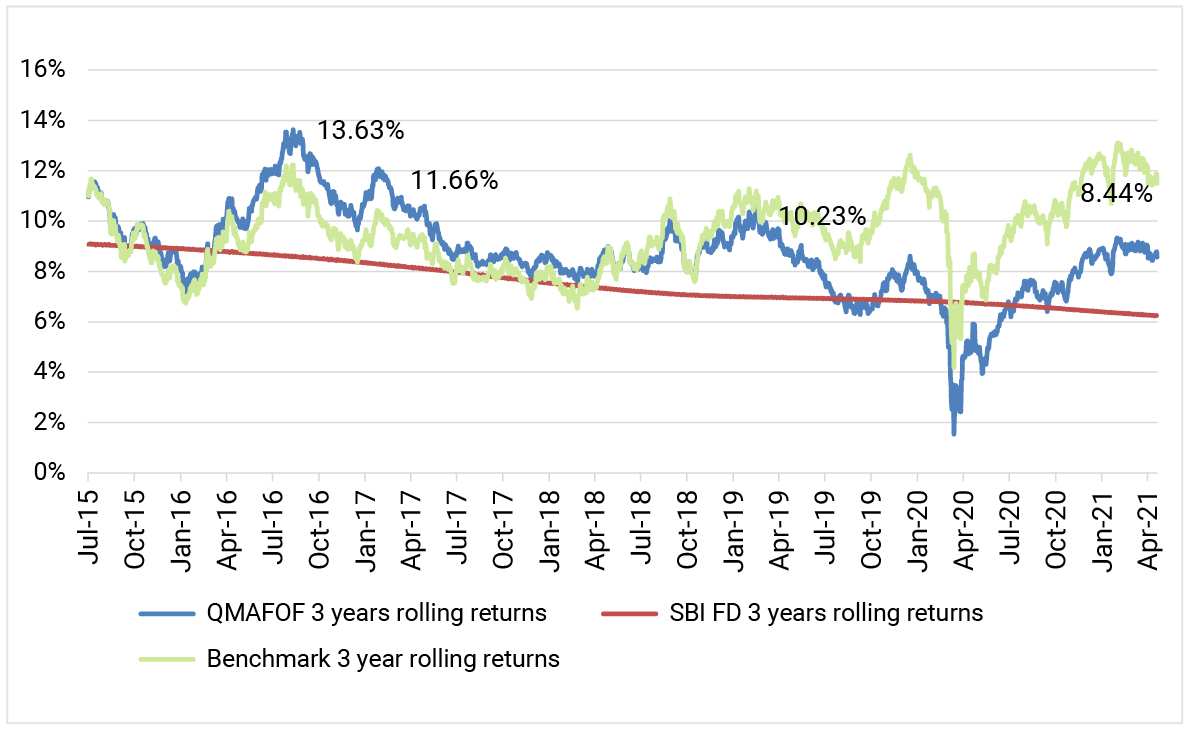

1. Potential to earn long term risk-adjusted returns

It has been observed that QMAFOF has historically given better returns than FDs over the long term (3 years and above). As you can see in the charts below, the fund has performed better than the 3 year rolling FD return, 84% of the times during the given period*.

Chart - 2 : 3-year rolling returns: FD vs QMAFOF

| Total days | Down days | % of outperformance |

| 2090 | 336 | 84% |

Note: The graph above has to be read in conjunction with performance of the scheme provided in the table below and *Note/ Disclaimer given below. Past Performance may or may not be sustained in Future.

| Performance of the Scheme | Direct Plan | |||||

| Quantum Multi Asset Fund of Funds - Direct Plan | ||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||

| Period | Scheme Returns (%) | Benchmark Returns (%)# | S&P BSE Sensex TRI Returns (%) | Scheme (₹) | Benchmark Returns (₹)# | S&P BSE Sensex TRI (₹) |

| Since Inception (11th Jul 2012) | 9.50% | 10.42% | 13.84% | 22,254 | 23,944 | 31,329 |

| Apr 30, 2014 to Apr 30, 2021 (7 years) | 9.26% | 10.54% | 13.23% | 18,596 | 20,175 | 23,874 |

| Apr 29, 2016 to Apr 30, 2021 (5 years) | 9.21% | 11.22% | 15.15% | 15,544 | 17,026 | 20,260 |

| Apr 30, 2018 to Apr 30, 2021 (3 years) | 8.55% | 11.49% | 12.85% | 12,795 | 13,863 | 14,377 |

| Apr 30, 2020 to Apr 30, 2021 (1 year) | 16.00% | 20.01% | 46.26% | 11,600 | 12,001 | 14,626 |

Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation.

Data as of April 30, 2021

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#Indicates CRISIL Composite Bond Fund Index (20%) + to CRISIL Liquid Fund Index (25%) + S&P BSE SENSEX TRI (40%) + Domestic price of Gold (15%). The benchmark of the scheme has been changed w.e.f. April 01, 2021. Earlier benchmark was CRISIL Composite Bond Fund Index (40%) + S&P BSE SENSEX Total Return Index (40%) + Domestic price of Gold (20%). It is a customized index and it is rebalanced daily. The fund is managed by Mr. Chirag Mehta and Mr. Nilesh Shetty. For performance of other Schemes managed by them please click here.

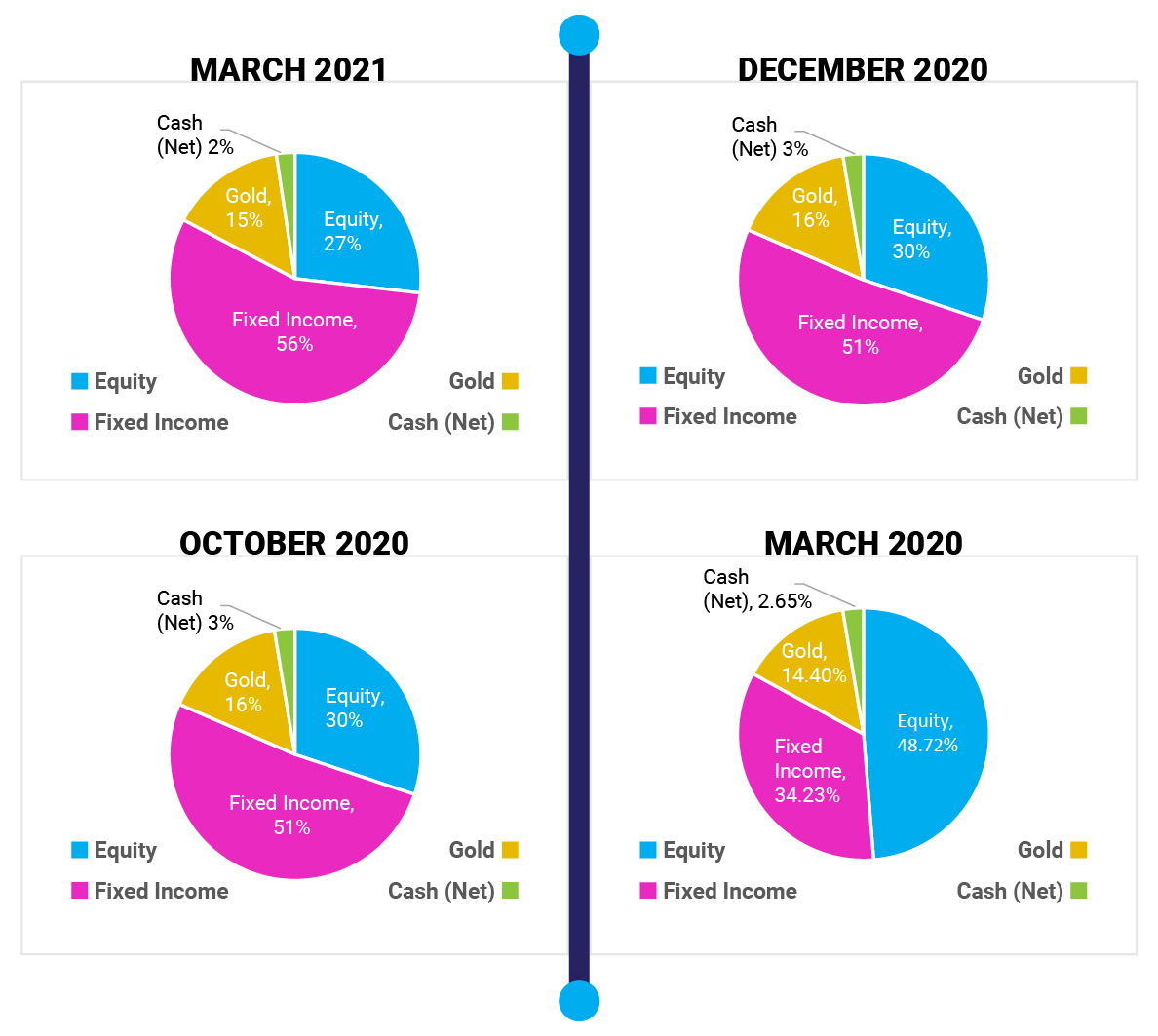

2. A 9 year track record of balancing risk with reward across market cycles

The fund manager of QMAFOF has the agility to strategically position the portfolio depending on the prevailing market cycle, thereby reducing your investment portfolio risk. He has the flexibility to balance 25% - 65% of weightage to equity and debt and the balance 10% - 20% to Gold.

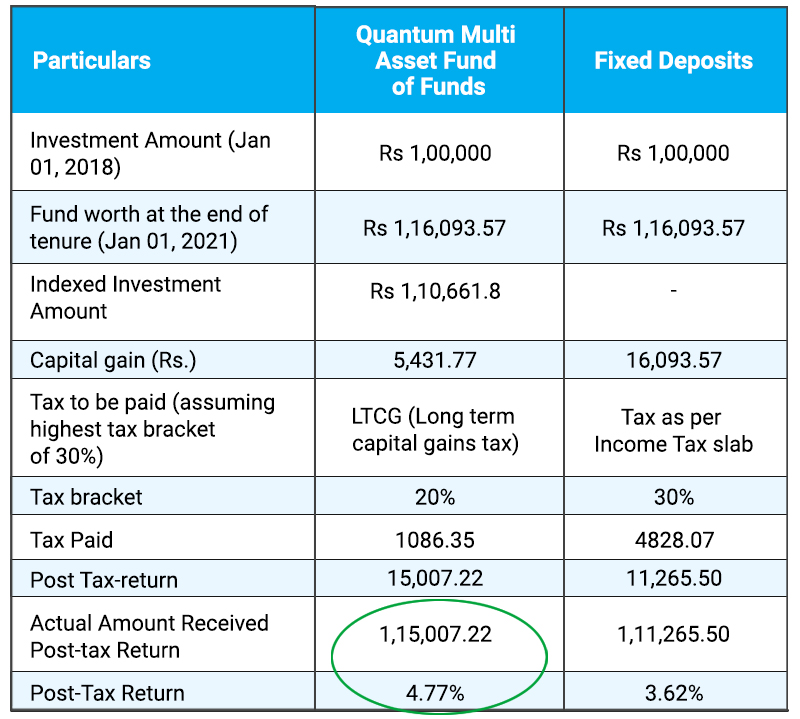

3. Better tax-efficiency with indexation benefit

You can save more tax when you invest in the Quantum Multi Asset Fund of Funds than parking your money in FDs for the duration of 3 years and above. Unlike fixed deposit returns which are taxed as per the income tax slab of the investor, Quantum Multi Asset Fund of Funds' long term capital gains are taxed at 20% with the benefits of indexation. This translates to a better return on investment, especially for investors in the highest income tax bracket.

Let’s understand the indexation benefit with an illustration. Suppose an investor invested Rs.1,00,00 in Jan 2018 and redeemed his investment 3 years later in Jan 2021. For the sake of comparison, the rate of return on Multi Asset Fund of Funds has been assumed at the same rate of an FD at 5.1% for a period of 3 years.

Indexation Benefit Table:

The above table is for illustration purposes only to explain the benefit of indexation. As you see in the illustration above, you can save Rs. 3741.22 / earn 1.15 % more return in the form of indexation benefit on your long-term capital gains.

4. Cope better with inflation

Inflation can drastically curtail the real return on your fixed deposit, thereby capping your wealth creation goals. On the other hand, the equity component in Quantum Multi Asset Fund of Funds gives your investments the potential to grow over the long term and the potential to cope better with inflation.

So if you are looking for a better risk-reward potential than a 3-year FD, start investing in the Quantum Multi Asset Fund of Funds today!

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Multi Asset Fund of Funds An Open Ended Fund of Funds Scheme Investing in schemes of Quantum Mutual Fund | • Long term capital appreciation and current income • Investments in portfolio of schemes of Quantum Mutual Fund whose underlying investments are in equity , debt / money market instruments and gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on April 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More -

Why Adding Quantum Multi Asset Fund of Funds Makes Sense in 2023

Posted On Tuesday, Jan 24, 2023

The Indian equity market, compared to its global peers, continued to ascend and yielded positive +4.4% returns for investors in 2022.

Read More -

Multi Asset Strategy to Save Your King (Portfolio)

Posted On Wednesday, Nov 30, 2022

Investments and Chess have a lot in common. Sometimes it requires you to take defensive positions and other times it expects you to step out of your comfort zone.

Read More