Large, Mid or Small Cap Fund: How Do You Position Your Portfolio to Ride Out The Market Uncertainty

Posted On Tuesday, Jul 13, 2021

We have all gone through much this second wave!

Now the market is throwing mixed signals.

On one hand it indicates positive recovery triggers such as momentum in vaccination, reducing Covid-19 cases & falling unemployment levels as per CMIE estimates.

However, there is a looming probability of a third wave and downside risks such as rising inflation. Where do you invest during this time - large caps, mid-caps, or small caps.

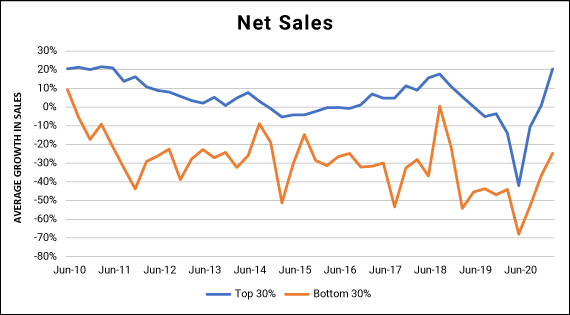

Corporate India: Larger Companies Are Faring Better

Source: CMIE- Economic Outlook, Data as on Mar 2021

Smaller companies were impacted most during the Covid-induced macro shocks.

In contrast, large listed companies survived better in FY 2021.

What worked in favour for them? A stronger balance sheet, better cost controls, and business continuity measures.

Market Performance of Large caps vs Mid-caps & Small caps

Now, if you look at the performance of all the indices (Mid Cap, Small Cap & Large Cap), you might see better numbers in the 1-year performance of small caps or midcaps.

But in the long haul, say 10 years, the large cap performance is similar to the other two indices and is more stable which means lower volatility.

| Index | 1 yr | 3 yr | 5 yr | 10 yr |

| S&P BSE Large Cap TRI | 55.07% | 14.94% | 15.17% | 12.23% |

| S&P BSE Mid Cap TRI | 74.42% | 14.72% | 15.24% | 14.11% |

| S&P BSE Small Cap TRI | 105.38% | 17.51% | 17.44% | 13.25% |

| Source: BSE Indices as of Jun 30, 2021. Past performance may or may not be sustained in the future. | ||||

| Annualized Risk | ||||

| Parameters | 3 YEAR | 5 YEAR | 10 YEAR | |

| S&P BSE LargeCap TR | 21.97% | 18.38% | 17.44% | |

| S&P BSE MidCap TR | 25.88% | 22.26% | 21.08% | |

| S&P BSE SmallCap TR | 29.74% | 25.60% | 24.44% | |

| Past performance may or may not be sustained in the future. | ||||

| Annualized Risk-Adjusted Return | |||

| Parameters | 3 YEAR | 5 YEAR | 10 YEAR |

| S&P BSE LargeCap TR | 0.68 | 0.83 | 0.7 |

| S&P BSE MidCap TR | 0.57 | 0.68 | 0.67 |

| S&P BSE SmallCap TR | 0.59 | 0.68 | 0.54 |

Risk is defined as standard deviation calculated based on total returns using monthly values.

Past performance may or may not be sustained in the future.

Large caps generally are better posed for upward growth over the long term, along with protection from downside, because of their strong fundamentals.

Here are 4 reasons investors generally prefer large cap companies:

On the other hand, if you are looking at a balance of risk with reward, you can look at building a diversified mutual fund portfolio which is market-cap agnostic and varying across styles.

Watch our recent webinar video on Pandemic Impact, Economic Recovery. Investment Strategy - Insights Revealed! where Sorbh Gupta, Fund Manager, Equity & Chirag Mehta, Sr. Manager, Alternative Investments share further insights into the discussion.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More