Questions to Ask before Deciding an Asset Allocation Strategy

Posted On Monday, Nov 23, 2020

Asset allocation simply means dividing up your assets in the right proportions among equities, debt, bonds, and gold to maximize your chance of achieving your financial goals while also trying to control investment risk.

Investors are always looking for the “Best Mutual Fund” to invest in. There is no one best mutual fund, which shall have all traits suiting to achieve all the financial goals. What works for you may not work for other investors. The proportion that you choose to allocate to each of these assets is what determines your success as an investor.

It might be a good idea to relook at your investment portfolio based on your risk appetite and ask yourself these questions to help decide your asset allocation strategy.

1. Is my investment portfolio concentrating on one asset class?

Investing in just one asset class could hamper your financial goals.

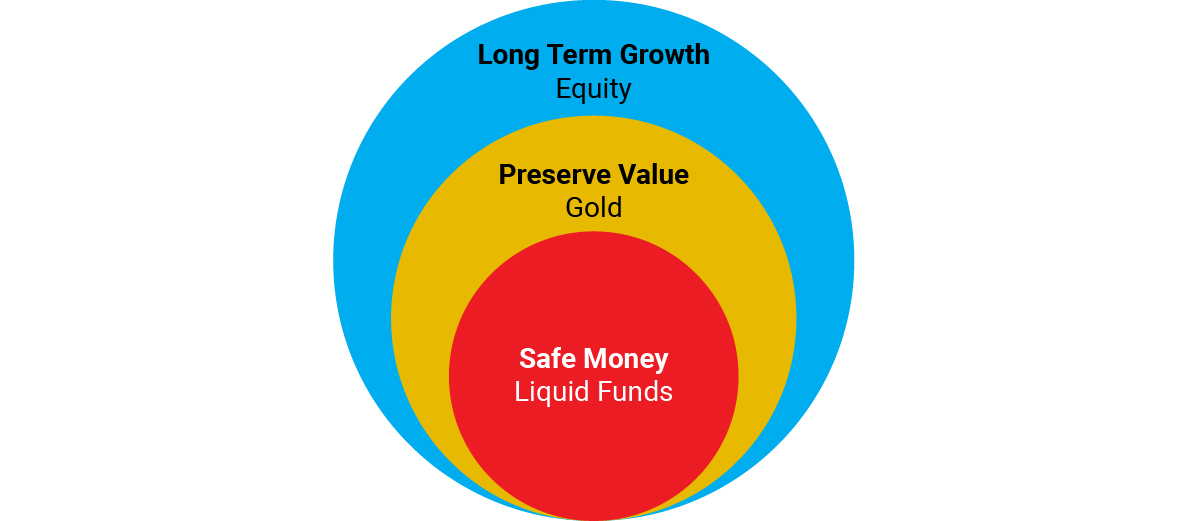

As you see in the Venn chart above, it is suggested to have a safe money in the form of liquid assets such as Liquid Mutual Funds at the heart of your portfolio. This liquid fund helps to to meet short term cash and contingency needs and at the same time may help earn higher returns than those offered by savings bank accounts. You can then have equity and commodities like Gold in your portfolio. The advantage of diversifying your investments is to reduce dependency on a single asset class to generate risk adjusted returns. This introduces other dimensions of the market that are imperfectly correlated and are expected to respond differently to the ever-evolving economic situation. A well-diversified portfolio can help mitigate downside risk of your investments while growing it.

2. Does it bring a good mix to my portfolio?

All asset classes generally don’t move at the same pace or in the same direction and that’s why having the right mix is important.

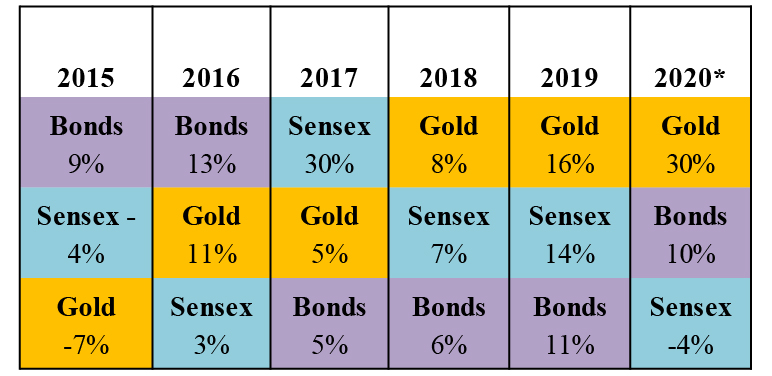

The chart below shows how asset classes react to different market cycles.

*YTD as of October 2020

The chart ranks the best to worst performing indexes per calendar year from top to bottom. Past performance may or may not be sustained in future.

Indices Used: S&P BSE Sensex Total Return Index; MCX Gold Commodity Index and CRISIL Composite Bond Fund Index

Source: Bloomberg

Past performance may or may not sustained in future

Source: Bloomberg

There have been years when equity markets had a dream run. Debt have seen times when they were touted as the most dependable of assets. At times it’s Gold that has shined the brightest. When equities are witnessing a correction, the presence of other asset classes in your portfolio could help you garner net positive returns. The chart shows how imperative it is to have Gold as a part of your portfolio to diversify risk.

3. Does it match my risk profile?

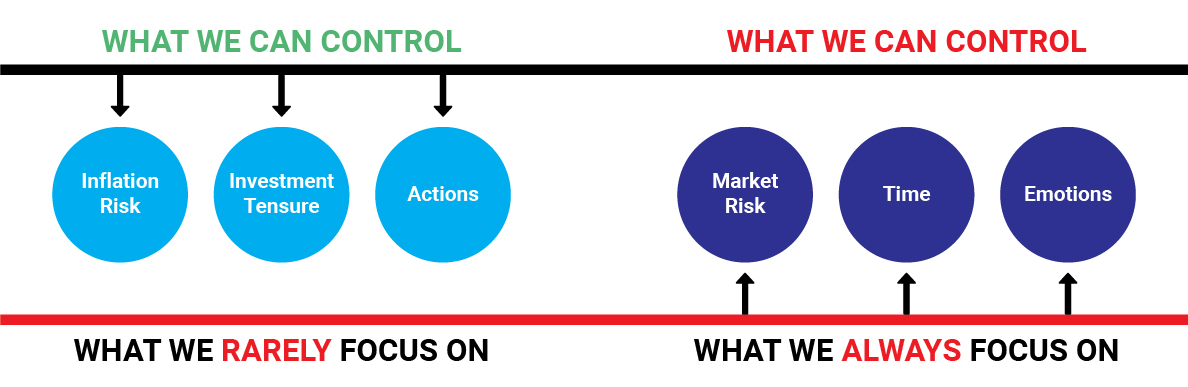

The key for building a successful investment portfolio is to focus on the risk you can control (inflation) and reduce the risk you can’t (market risk). See the infographic below, our focus is on things that we don’t control (Market Risk, Time, Emotions) while we rarely focus on factors we can control (Inflation, Investment Tenure, Actions).

KNOW WHAT YOU CAN CONTROL

Even in the most conservative investment portfolio, it is advisable to allocate a portion of assets to equities to diversify your portfolio from inflation risks.

4. Does the asset mix have the potential to help me reach my goals?

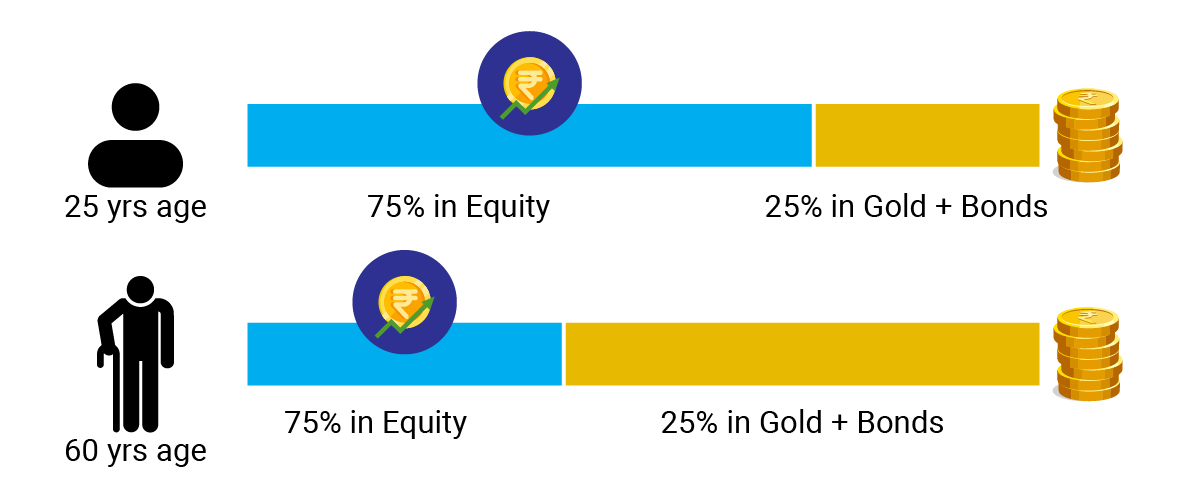

The first step in determining your asset mix in relation to your investment goal is to think whether your portfolio can fulfil your goals. Consider your investment horizon carefully during this exercise.

The old thumb rule of subtracting your age from 100 works fine in most cases. See infographic below:

PORTFOLIO ALLOCATION BASED ON YOUR AGE

The above chart is for illustrative purpose only

5. Are the assets relevant to the emerging themes?

The Year 2020 has been ground-breaking for Gold and ESG funds globally.

Take advantage of emerging investment trends to enable your portfolio to capture maximum benefits from the market cycles.

In conclusion, the key takeaways are:

- Investing in just one asset class could hamper your financial goals.

- All asset classes don’t move at the same pace or in the same direction and that’s why having a right mix is important.

- The key to building a successful investment portfolio is to eliminate the risk you can control (inflation) and reduce the risk you can’t (market risk).

- Tailoring your asset allocation to your investment tenure improves your chances of achieving your financial goals.

- Take advantage of emerging investment trends to enable your portfolio to capture maximum benefits from the market cycles.

The important thing to remember is that building that well-diversified portfolio with the right balance of assets is not a one-off exercise. Remember to perform periodic rebalancing to realign your portfolio.

This new-year get a headstart to strengthen your asset allocation strategy.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity investments and Tax saving - Tick both boxes with ELSS funds

Posted On Friday, Jan 10, 2025

With domestic equity markets down from their 2024 highs, now can be an opportune time for investors to buy into one of the growing economy in the world at reasonable valuations.

Read More -

Gold - Dus Reasons to Buy on Dussehra

Posted On Friday, Oct 11, 2024

Lord Rama defeated the 10-headed Ravana on the day that we fondly celebrate as Dusshera.

Read More -

IPO: Initial Public Offerings or Instant Profit Opportunities? Finding Balance Between Hype and Thoughtful Investing

Posted On Friday, Oct 04, 2024

The latest headline in the red-hot IPO space is: ‘41 companies file for IPO in September, 15 in 1 day’.

Read More