heading

About The Fund

The NIFTY 50 is an index of the NSE, which is a barometer by which the Indian economy can be measured. The Quantum Nifty 50 ETF (QNF) is a replica of the NIFTY 50; the stocks that form a part of NIFTY 50 also form a part of QNF`s portfolio in the same proportion and weightage as that of the NIFTY 50.

5 Reasons to invest in the Quantum Nifty 50 ETF

1. Passively replicates the portfolio and performance of Nifty 50 index.

2. Enables you to own shares in the Index for a fraction of their value.

3. Has one of the lowest Expense Ratios in the category.

4. Makes it possible to clock returns in line with the benchmark index.

5. Allows you to diversify across the top companies in different sectors through a single investment.

Note: Please note the expense ratio for Quantum Nifty 50 ETF is 0.08% excluding statutory levies and taxes.w.e.f February 28, 2018.

Portfolio

Fund Managed By

-

Funds Managed:

Qualification:

- B.com Graduate and Masters in Financial Management.

- Click here to view Tracking Error and Tracking Difference

- Click here to view Norms for Market Making Framework

How To Invest

Since the scheme is listed on Stock Exchange (BSE and NSE), please contact your Demat Service Provider/Stock Broker for Investing . Get Started and plan your Asset Allocation!

Product Label

-

Name of the Scheme and Benchmark

Quantum Nifty 50 ETF

(An Open Ended Scheme Replicating / Tracking Nifty 50 Index)

Tier I Benchmark : Nifty 50 TRI -

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Investments in equity and equity related securities of companies in Nifty 50 Index

-

Risk-o-meter of Scheme

-

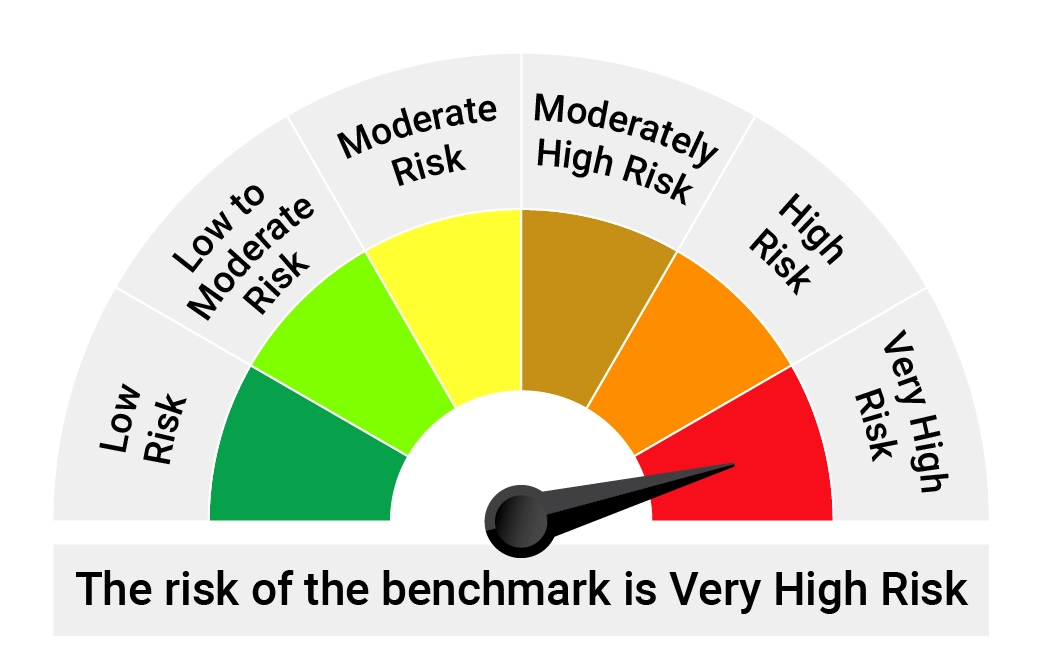

Risk-o-meter of Tier-I Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Frequently Asked Questions

Nifty 50 is a blended word derived from NSE (National Stock Exchange) Fifty. True to its name, it comprises of the top 50 blue chip companies of the NSE by market capitalization. Sensex and Nifty are the two indices that reflect the performance of Indian stock market at large. These companies are large cap and liquid. The Nifty 50 comprises 13 different sectors such as Financials, Oil & Gas, Pharmaceutical, Automobile, etc., among others.

Nifty 50 is the flagship index of National Stock Exchange (NSE). It acts as a barometer of the Indian economy. It is a benchmark used by mutual fund companies to compare their performance. When actively mutual funds have delivered an alpha, it means that the performance has exceeded than that of the index. Passively managed mutual funds such as index funds and ETFs generally perform in line with the benchmark index.

Nifty 50 ETFs is an exchange-traded fund that tracks or replicates the Nifty 50 index.

Nifty 50 ETFs are traded on stock exchanges similar to an equity share and can be bought or sold anytime during market hours. The cost of ETF units on the stock exchange is determined by the demand and supply of ETF Units. You can purchase units of Nifty 50 ETF through stock exchanges through a Demat account.

Since June 30, 1999, for the period ending Dec 21, the Nifty 50 Total Return (TR) index has given annualized returns of 14.2% CAGR with an annualized volatility of 22.9%. An index ETF fund tracking this index would give similar returns after tracking error and expenses. Thus, it is important to select a fund with low tracking error and a low expense ratio, which can indirectly impact your returns.

Source NSE for the period between Nov 95 – Dec 21. Past performance may or may not be sustained in the future,

An index ETF passively replicates the index in terms of its portfolio composition. An Index ETFs is meant for long-term investing. When selecting an index ETF, you need to evaluate the tracking error. Index ETFs disclose their tracking error in the factsheet. The tracking error is a measure of how much the fund performance has deviated from its benchmark, impacting your returns. Tracking error can be when the index fund outperforms or underperforms the index.

For instance, if the difference in returns between an Index fund A and the benchmark index is 0.5%, the tracking error would be 0.5%.

| Returns from Index Fund A | 10.5% |

| Returns from Benchmark Index | 11% |

| Returns from Benchmark Index | 0.5% |

Here are some important things to keep in mind before you invest in a Nifty 50 ETF fund:

● Performance of the fund: An ETF Fund tracks an underlying index. The performance of the fund depends on the underlying benchmark. Before selecting a fund, assess the tracking error.

● Expense Ratio: Another important criterion to invest in is the expense ratio. Choose an index fund that is lower than the category average.

● Investment Tenure: An index fund or ETF like any other equity investment is ideal if you invest over the long term. Over the long term, these offer the potential to deliver risk-adjusted returns.

To summarize, Total Expense Ratio and Tracking Error are the two critical parameters when selecting an Index Fund or ETF. You can consider Quantum Nifty 50 ETF Fund of Fund as it has a competitive cost and the underlying ETF has a low tracking error.

You can additionally consider the following parameters when assessing the tracking error:

1. How much is the annualized index fund tracking error?

2. How much is the degree of variance in the index fund tracking error?

3. What is the index fund portfolio turnover ratio?

You need to remember that not every ETF may be suited to your goals. When investing in sector-specific funds, you need to take into consideration that these funds are limited to a smaller universe. As an investor, you can diversify your portfolio by investing in an index mutual fund and add ETFs.

To invest in Mutual Funds or Fund of Fund schemes such as the Quantum Nifty 50 ETF Fund of Fund, you do not need a DEMAT account. On the other hand, to transact in a Nifty 50 ETF, you will need a DEMAT account since they are traded on exchanges similar to stocks

Investing in a Nifty 50 ETF can be an advantage if you can take the opportunity of the price movements that occur during the day based on your analysis of the market or the index.

In contrast, if you require the convenience and simplicity associated with a mutual fund, you can consider investing in Nifty Index fund or Nifty 50 ETF Fund of Fund that does not require extensive tracking and allows you to invest using an SIP of Rs. 500.

If you are looking to benefit from the growth potential of India’s top 50 companies at a low investment cost, you can consider investing in Quantum Nifty 50 ETF (QNF).

Here are a few benefits of investing in Quantum Nifty 50 ETF:

1. Passively replicates the Nifty 50 index and are a simple way to invest for a first time investor.

2. Allows you to own the shares in the Index for a fraction of their value.

3. returns in line with the benchmark index

4. Diversify across the top companies in different sectors through a single investment

Nifty 50 ETF Fund like any other equity fund is subject to market volatility. As we have witnessed in the past Indian equity markets have experienced several challenging downcycles be it during GFC (Global Financial Crisis – 2008), or the Covid-induced market crash in 2020. However, over the long term, equity markets have stayed resilient. Thus, you should invest in nifty 50 ETF Funds only if you are willing to stomach the volatility and have a longer investment horizon.

Nifty 50 ETF Fund like any other equity fund is subject to market volatility. As we have witnessed in the past Indian equity markets have experienced several challenging downcycles be it during GFC (Global Financial Crisis – 2008), or the Covid-induced market crash in 2020. However, over the long term, equity markets have stayed resilient. Thus, you should invest in nifty 50 ETF Funds only if you are willing to stomach the volatility and have a longer investment horizon.