When markets sync up and sink — what keeps you afloat?

Posted On Tuesday, Aug 26, 2025

Most investors diversify between equity and debt — an approach that often works across cycles. Equity for growth, debt for stability.

But here’s the truth: true diversification goes beyond just these two.

It’s about spreading across asset classes, especially those that don’t always move in sync — like gold.

Let’s understand why when interest rates rise, equity and debt may fall together?

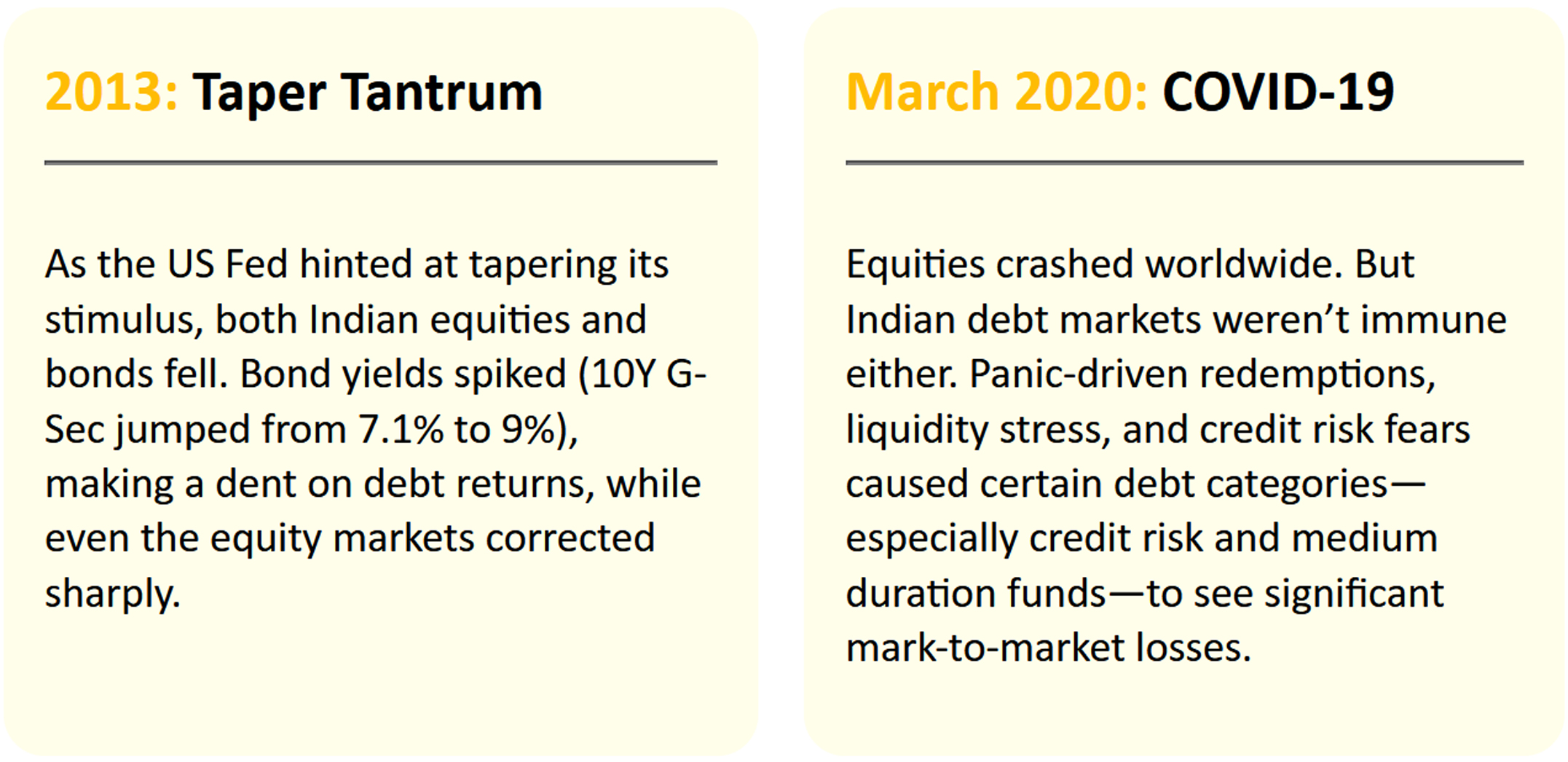

Over the years, we’ve seen many instances where both equity and debt lost value at the same time — leaving portfolios neutral.

So, when both slip at once—what’s your safety net?

That’s where low-correlation assets come in. Especially during crisis, they offer a different rhythm—a true counterbalance when other asset classes sync up in a fall.

It’s not about returns. It’s about resilience.

Gold serves as a counterweight — a safeguard when other asset classes are falling.

But then there are the hassles of lockers, purity checks, and finding the right time to sell?

That’s old-school.

Here’s a smarter way to own gold — without ever touching a gold bar.

Quantum Gold Savings Fund is a modern, convenient solution that brings the power of gold into your portfolio with just a few clicks - No storage stress. No quality doubts.

Adding Gold helps create a portfolio that doesn’t just chase return — but builds resilience. Because when equity and debt fall in tandem, it’s not just returns that take a hit — it’s conviction.

Quantum’s 12|20:80** (Barah-Bees-Assi) Asset Allocation Approach builds on this time-tested relationship between asset classes and suggests a 20% allocation to gold to balance out the 80% equity component in a portfolio. Whether you choose Active or Passive Investing – Gold should be a vital component.

Aim to achieve balance in your investments with Quantum’s 12|20:80** (Barah-Bees-Assi) Asset Allocation Approach

|

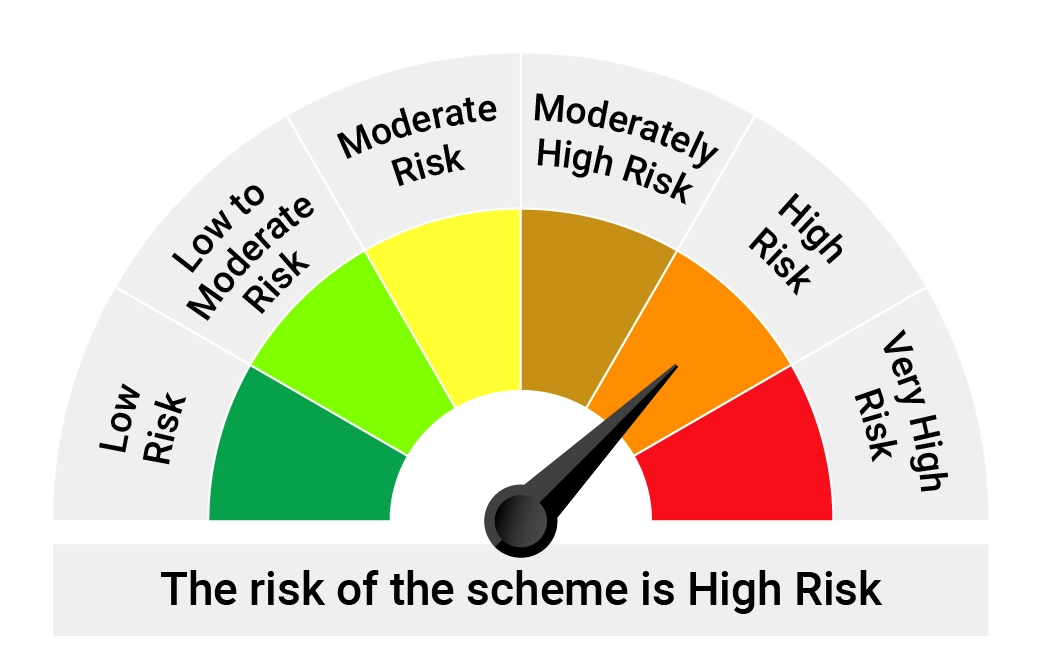

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme |

Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Investors may please note that they will be bearing the recurring expenses of this Scheme in addition to the expenses of the underlying Schemes.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Gold Monthly for January 2026

Posted On Thursday, Jan 01, 2026

Gold Market Review and Outlook: 2025–2026

Read More -

Gold Monthly for September 2025

Posted On Tuesday, Sep 02, 2025

August 2025 saw renewed strength in gold, with international prices rising 4.79% for the month and posting a robust 37.75% year-on-year gain.

Read More