Want to save taxes? With ELSS Tax - Saving Fund YES you can!

Posted On Wednesday, Sep 01, 2021

This article covers

• Saving income tax with mutual funds

• How much can you actually save under Section 80C?

• What is ELSS

• Benefits of investing ELSS investments

The last 3 months of the year are busy for taxpayers.

Especially for those that are looking to obtain tax deductions under Section 80C of the Income Tax, this is the time when investors consider the many options available to obtain tax redemptions.

Choosing a suitable tax-saving product is not easy. Some products claim to offer assured returns while others offer returns that are linked to the performance of the markets.

How much can you actually save by investing in ELSS under Section 80C?

As per Section 80C, if you fall within the highest tax bracket of 30%, considering the entire Rs 1.5 lakh tax savings in a financial year, one can save around Rs 46,800 as per the current tax laws (which includes 4% cess).

Saving income tax with mutual funds

So which product is better? A tax-saver that offers market returns or one that offers fixed returns?

With a fixed-return product you may be able to protect your princi-pal but the returns associated with these instruments are not equity market linked.

If your objective however is to not just obtain a tax redemption but also to build wealth, then a tax-saving mutual fund scheme is ideal for you.

There are several market-linked tax saving products available to the investor today. Of these, the equity linked savings scheme (ELSS) - which is an equity mutual fund category have one of the lowest lock in period.

What is ELSS?

An Equity Linked Savings Scheme (ELSS) is a mutual fund product that allows a deduction from your total income, of up to Rs. 1.5 lakh rupees, as per the prevailing Section 80C of Income Tax Act 1961.

Investments in ELSS should have equity exposure of at least 80% to qualify as an equity fund. ELSS tax-saving funds also has the flexibility to invest across market capitalization, making it a truly unique investment prospect among equity funds.

If an investor invested Rs. 50,000 in an ELSS tax-saving scheme, then this amount is eligible for deduction from his total taxable in-come.

ELSS schemes have a lock-in period of three years from the date of allotment of units. After the lock-in period is over, the units may be redeemed or switched.

With both growth and dividend options offered by ELSS schemes, these are sought after product.

Benefits of ELSS investments

So why choose an ELSS tax-saving scheme?

Here we have the top reasons for you to invest in an ELSS invest-ment scheme today!

Ease of investing with SIP

As ELSS is a mutual fund product, investors can easily invest in it by availing either Systematic Investment Plans (SIP) or lump sum investment routes.

ELSS schemes provides long term risk adjusted returns

Exposure to equity markets means that this product has the poten-tial to earn returns that can beat inflation compared to the many fixed return tax saving options available to investors.

ELSS investments are tax-efficient

This product has potential to provide good post-tax returns be-cause the long term capital gains (LTCG) of up to Rs 1 lakh a year from ELSS mutual funds are exempt from income tax, and gains above this limit being taxed at 10%.

The lock-in period is actually an advantage

The mandatory lock-in period and tax savings are very useful to the first-time investor. This allows the investor to capture the bene-fits of long term market movements and also has the potential to beat inflation.

Experienced investors too can benefit from tax-efficient, market-linked returns to easily meet their financial goals by including ELSS into their investment portfolios.

Amongst the variety of tax-saving instruments available to you, you may discover that ELSS tax-saving investments in fact have one of the shortest lock-in periods of just three years.

ELSS is certainly a unique product that can save you taxes and help you boost your wealth corpus at the same time, one that is useful to every investor.

What you should do next

Begin by calculating how much you need to set aside to obtain a tax redemption.

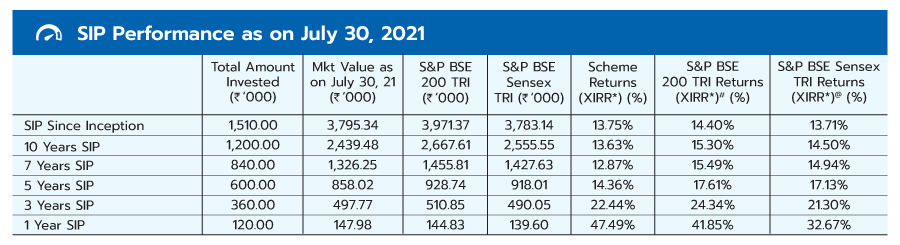

Select a fund like Quantum Tax Saving Fund which has potential to provide long term rusk adjusted return. Below is a snapshot of the fund’s SIP performance as on July 31, 2021.

Past performance may or may not be sustained in the future. The above SIP performance is for Quantum Tax Saving Fund - Direct plan - Growth option. Scheme performance has been calculated using applicable NAV on the SIP day (5th of every month). Return on SIP and Benchmark are annualized and compounded investment return for cash flows resulting out of uniform and regular monthly subscriptions as on 5th day of every month (in case 5th is a non-Business Day, then the next Business Day) and have been worked out using the Excel spreadsheet function known as XIRR. XIRR calculates the internal rate of return for series of cash flow. Assuming `10,000 invested every month on 5th day of every month (in case 5th is a non-Business Day, then the next Business Day), the 1 year, 3 years, 5 years, 7 years, 10 years, and since inception returns from SIP are annualized and compounded investment return computed on the assumption that SIP installments were received across the time periods from the start date of SIP from the end of the relevant period viz. 1 year, 3 years, 5 years, 7 years, 10 years and since Inception. *XIRR - XIRR calculates the internal rate of return to measure and compare the profitability of se-ries of investments. Returns are net of total expenses

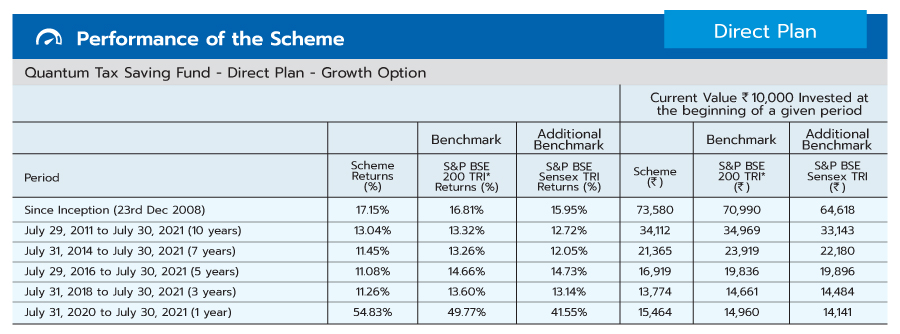

The Quantum Tax Saving Fund was launched in 2009 and has deliv-ered CAGR of 17.15% since inception as on July 31, 2021.

Complete fund performance as on July 31, 2021 -

Past performance may or may not be sustained in the future. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Gro wth Rate (CAGR).*with effect from February 01, 2020 benchmark has been changed from S&P Sensex TRI to S&P BSE 200 TRI.

• As TRI data is not available since inception of the scheme, benchmark per-formance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

• The Scheme is managed by Mr. Sorbh Gupta effective from Oct 01, 2016. For the performance of other schemes Managed by Mr. Sorbh Gupta, please click here

Mr. Sorbh Gupta, Fund Manager, Equity at QAMC, recently gave his expert opinion on the benefits of investing in ELSS and why the Quantum Tax Saving Fund could be an ideal scheme to help you capture these benefits.

Select either an SIP or lump sum investment route to easily start your tax savings with ELSS.

So, make the most of this opportunity to save tax & start your jour-ney towards achieving your goals.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years |  Investors understand that their principal will be at Low Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on July 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimerto read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Want to save taxes? With ELSS Tax - Saving Fund YES you can!

Posted On Wednesday, Sep 01, 2021

The last 3 months of the year are busy for taxpayers.

Read More