Invest with Confidence: Quantum Mutual Fund

Posted On Wednesday, Mar 27, 2019

As an investor, your immediate financial goals could be getting that hi- tech gadget or a fancy car, but in the long run the areas you also need to focus on are wealth creation, your marriage, child higher education abroad, retirement planning, the list seems endless. While short term goals are fine and all of us would like to flaunt the latest iPhone, creating wealth for long term goals also cannot be put on the back burner infinitely and needs to start now. The process of wealth creation, retirement planning etc needs a long term investment strategy. It’s better to start now to obtain the full benefits of a long term investment plan.

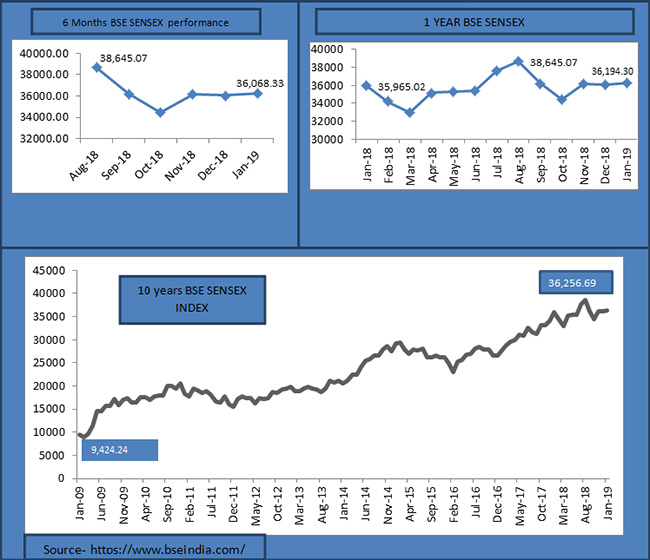

There are many vehicles for wealth creation however investment in equity mutual funds is the most suitable option, why? The immediate answer is wealth creation is a long term process. You need to be invested for long time to achieve wealth creation goal. The below graph can be consider as a proof how well equity markets perform in long term. In short run markets have always been volatile. Have you seen journey of Indian stock markets. Let’s look at the graph below, which has 6 months, 1 year and 10 years of BSE Sensex performance (closing average value of the month).

Past performance may or may not be sustained in the future.

By looking at the above graph you can easily understand that compared to 6 months, 1 year; volatility is much lower for the 10 year period. In first and second graph you can see markets has generate low return however in 10 years period markets has performed well which show the benefit of long term investment. The BSE Sensex was 9,000 in Jan 2009 and in January 2019 index has crossed 36,000 mark.

As stated above the equity market is indeed an advisable investment option for long term investments where volatility is less in long term than the short term. There are many ways you can choose to invest in equity markets however investment in mutual funds is an advisable route.

Quantum Mutual Fund is the end of your search if you are planning for your investments (short term / long term). Quantum Long Term Equity Value Fund (QLTEVF) is the most suitable investment opportunity. The name of the fund itself highlights its features which are unique, like long term and value.

Let see in details how QLTEVF will help you achieve your financial goals

QLTEVF has the following key benefits which will help you in accomplishing your goals

1) Value investment - Value investment is an investment style where the fund manager selects stocks based on value and not purely on price. In QLTEVF, Quantum Fund Manager selects stocks based on value and not purely on price of the stock. We have a specific investment philosophy which identifies stocks and then the investment takes place. The buying and selling decisions are based on this philosophy which works well in the long term and helps you to achieve your goals. Remember, value creation is a long term process.

2) Portfolio diversification - On an average, QLTEVF invests in 25-30 stocks which achieves the most important objective of long term investment – diversification. You can click here to see portfolio details of QLTEVF. The biggest advantage of diversification is minimizing risk in portfolio. If some stocks underperformed at the exchange, the outperforming ones can make up for the losses, indeed you cannot escape all risks but you can minimize it by way of diversification.

3) Professional Management - QLTEVF is a professionally managed fund by Fund Managers who are well aware about the Quantum Philosophy, investment process and style of value investment.

Now you are aware about benefits of the long term investment and why you should invest in QLTEVF. Please call 1800-22-3863 and complete your investment in 3 clicks. All you need to do is simply visit invest online section on our website and click the ‘start’ a ‘new investment’ option. By following 3 simple clicks which helps you to fill in your 1) identity 2) personal details, and 3) investment details

Let’s convert your savings into wealth. Allow your money to grow.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More