Pull Back or Reversal

Posted On Wednesday, Apr 24, 2024

April turned out to be a brutal month for bonds. The RBI pushed back on rate cut hopes, geo-political tensions intensified, crude oil surged, global bond yields spiked up and foreigners sold Indian bonds.

Domestic bonds sold off with the 10-year Indian government bond yield moving up 11 basis points in April so far from 7.05% on Mar 29, 2024, to 7.16% on April 23, 2024.

These developments posed a crucial question - Is this a temporary pull back or reversal from the downward trend in yields?

We see it more like a temporary pull back than a trend reversal. Our assessment is based on following:

Limited Global Influence

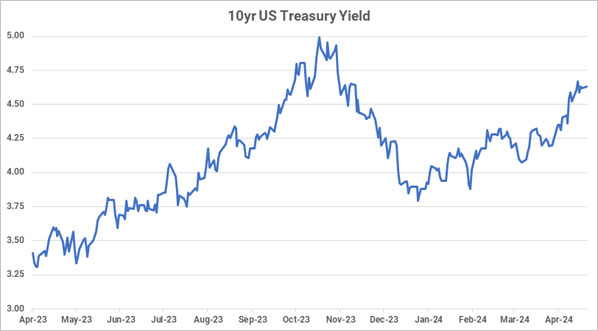

Much of the recent sell-off in Indian bonds can be attributed to the sharp rise in US treasury yields which has been on up move since start of the year. Currently at 4.63%, the 10-year US treasury yield is up 43 basis points in April so far. From year till date, it is higher by 77 basis points.

Chart – I: US treasury Yields moved up on resilient US economy and stubborn inflation

Source – Bloomberg, Data upto April 22, 2024

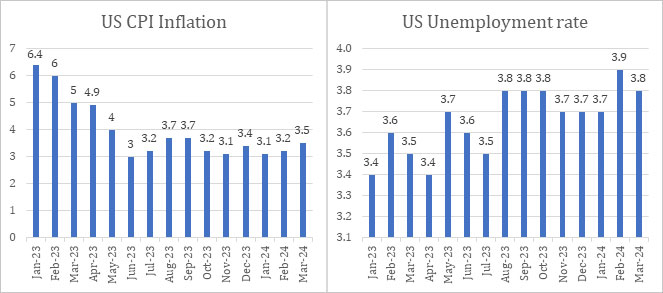

On the back of falling inflation last year, the US Fed had guided for upto three rate cuts in 2024. But, with the recent stickiness in inflation numbers above 3% and relative strength in employment and growth numbers, many fed officials have dialled back their rate cut expectations.

The Fed Chairman Jerome Powell said “recent data have clearly not given us greater confidence” that inflation is moving towards the FED’s 2% goal. Clearly, rate cuts are not coming as soon as was expected earlier.

Chart- II: US inflation remained sticky above 3% and labour market resilient with unemployment rate below 4%

Source – Bloomberg, Data upto March 2024

However, from India’s perspective, one should appreciate that the recent inflation disappoints have been quite a US specific phenomenon. While the inflation in other parts of the world have been turning incrementally softer.

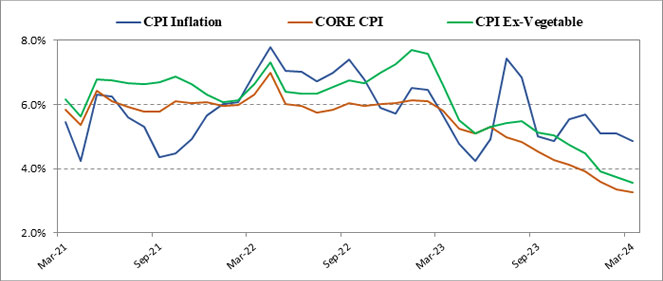

In India too underlying inflation has been on a downward trend, much below the RBI’s 4% target (refer The last Mile). In March 2024, the headline CPI inflation fell to 4.85% from 5.09% in the previous month. At the same time, the CPI ex-vegetable which captures around 94% of the total CPI basket, fell to 3.55% (vs 3.77% in Feb 2024) and the core CPI (ex-Food and Fuel) fell to 3.26% (vs 3.34% in Feb 2024).

Chart – III: Underlying inflation trending below 4% while the Headline CPI remaining elevated due to volatile vegetable index

Source – MOSPI, Quantum Research; Data upto March 2024

Clearly, India’s inflation trend is more domestic than global. We expect the divergence between the US and India inflation trends to persist going forward.

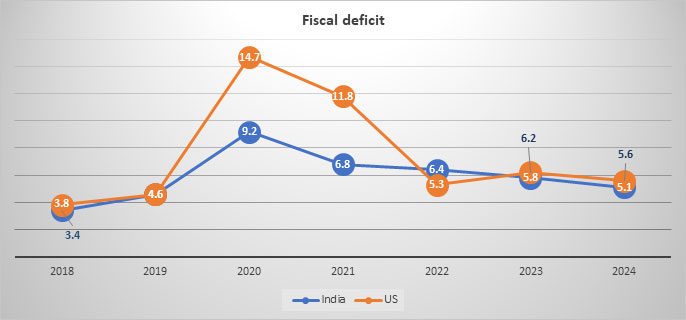

Unlike the US, domestic consumption demand in India is muted due to limited fiscal support and weak rural economy. Furthermore, the government is on a path of faster fiscal consolidation in India against a fiscal loosening in the US. Thus, any rapid recovery in the domestic consumption demand looks unlikely in near future. This should keep the India inflation on downward trend.

Chart - IV: Continued Fiscal consolidation in India to keep Inflation under check while fiscal loosening in the US is limiting impact of monetary policy on inflation

Source – IndiaBudget.gov.in, St. Louis Fed

India Fiscal deficit numbers are for financial year ending March 31st; while US fiscal numbers are for calendar year ending December 31st.

Bull case for India Bonds Intact

We continue to hold our positive outlook on Indian bonds (refer The Bull Case) supported by a structural shift in demand supply balance, and a cyclical turn in inflation and monetary policy.

India’s inclusion in the global bond indices and rapidly growing domestic financial savings will continue to boost demand in the bond market. At the same time, government’s fiscal consolidation is reducing supply of bonds making demand supply balance in favour of long-term duration bonds.

India’s inflation is on a cyclical down-trend. We believe the recent shift in the US monetary policy outlook will not have any material impact on domestic inflation and monetary policy though it might keep Indian yields elevated for some time.

We see the recent selloff in the Indian bond market as a tactical opportunity to build long duration position with a medium-term outlook.

What should Investors do?

Considering a strong case for long term yields to decline over the next 1-2 years backed by the reasons described above, we believe long term government bonds offer a rewarding opportunity.

Dynamic Bond Funds are probably best placed to capture this opportunity with a flexibility to change if things don’t pan out as expected. However, investors need to have a longer holding period of at-least 2-3 years to ride through the intermittent volatility.

Investors with shorter investment horizons and low-risk appetites should stick with liquid funds.

Source: Bloomberg, MOSPI, Quantum Research, IndiaBudget.gov.in, St. Louis Fed

Portfolio Positioning

Scheme Name | Investment Approach |

The scheme invests in debt securities of up to 91 days of maturity issued by the government and selected public sector companies. | |

The scheme to invest in debt securities issued by the government and selected public sector companies. The scheme follows an active duration management strategy and increases/decreases the portfolio duration (sensitivity to interest rates changes) in accordance with the Interest Rate Outlook. Given our positive view on the bond market, we are maintaining reasonably high duration in the scheme and added more long duration position during the recent market sell off. |

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Low Risk |

Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. |

|  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Positioning for Disinflation

Posted On Friday, Jan 27, 2023

We are well past the peak inflation of 2022. Yet, inflation continues to be the focal point of all the policy discussions and investment thesis in 2023.

Read More -

Fixed Income - Year End Wrap Up & Outlook 2023

Posted On Thursday, Dec 22, 2022

2022 started with a hope of normalcy after two back-to-back years of dealing with the Covid-19 pandemic.

Read More -

Inevitable Pivot: Resetting Market Expectations

Posted On Tuesday, Apr 26, 2022

After 3 years of growth supportive monetary policy regime, the RBI has pivoted to manage inflation.

Read More