Perhaps the Most Noteworthy Investment Idea of 2020 and Beyond...

Posted On Saturday, Aug 15, 2020

Earlier this week, we introduced you to an excellent investing opportunity.

It's called ESG investing.

Our Senior Fund Manager - Chirag Mehta's interview, covered the preliminary questions on ESG, what sustainable investing is and how it can generate better returns.

We also shared details of a survey of managers who are overseeing US$ 12.9 trillion worth of AUM which shows that ESG investing could be a good investment opportunity in the coming years and decades.

Today, we are taking this conversation forward.

As you are now aware, global value of assets invested in Environmental, Social and Governance (ESG) inclusion in investment decisions tripled in just eight years, to reach $40.5 trillion in 2020, according to data from UN PRI.

This global trend may play out in India too...

The Nifty 50 Index has been the traditional flagship index used to gauge Indian stock markets.

But as markets and trading strategies became more complex broader indices were developed.

In 2011 a broad market index called the Nifty 100 ESG Index was launched. It uses the Nifty 100 Index as a base.

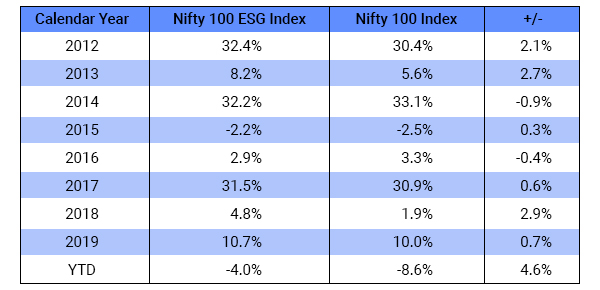

Let's consider Nifty 100 ESG Index's performance attributes in recent times.

In 2018, Nifty 100 ESG Index outperformed the Nifty 100 Index on a calendar year basis by ~2.9%.

In February 2020, the COVID-19 crisis had just begun battering markets.

But the Nifty 100 ESG Index outperformed the Nifty 100 Index by 1.73%.

By the end of July 2020, the markets had recovered most of their losses.

And what do you think happened to the Nifty 100 ESG Index?

The Nifty 100 ESG Index again outperformed the Nifty 100 Index by 2.36%.

Now that's something, isn't it?

So how does this index outperform the markets?

Although both the indices appear to be similar, the one major difference is Quality.

Nifty 100 ESG Index consists of select large cap companies that score high on risk management and ESG compliance. The companies offer additional benefit of low volatility as compared to Nifty 100.

It's this ESG filter that gives them to edge to outperform.

This Nifty 100 ESG Index has indeed majority of times have outperformed the Nifty 100 Index.

Source: NSE India, July 2020- Past Performance may or may not be sustained in future.

If there was ever a more profitable Nifty large cap index across business cycles, your search ends here...

Editor's Note: To learn more about adding ESG funds into your overall portfolio write to us at [email protected]

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at High Risk. |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More