New Investing Opportunity for 2020

Posted On Tuesday, Aug 11, 2020

In this exclusive Q&A Chirag, Fund Manager of Quantum India ESG Equity Fund, explains the positive correlation between sustainability and economic return. Read on to know more about this latest investment opportunity.

1. Global wealth is being invested into ESG funds at a rapid rate. Can you share some numbers?

ESG is a fast growing investment approach globally. As per data from UN PRI, the value of global assets signing up for ESG inclusion in investment decisions has almost doubled over four years. Further it has tripled over eight years, to $40.5 trillion in 2020.

So far ESG investing has been widely adopted in Europe. Investors realize the importance of ESG metrics. So to analyze a company's long term sustainability, ESG investing is gaining ground elsewhere too. This trend is being further amplified by the Covid-19 crisis. Let's look at Deloitte Center for Financial Services (DCFS). They expect ESG-mandated assets to comprise half of all professionally managed investments in the United States by 2025. In this scenario, ESG assets in the US should continue to grow at a 16% CAGR, totaling almost $35 trillion by 2025.

We believe that the scope for ESG investing and consequent alpha generation is even bigger in emerging markets like India. These are laden with ESG risks. As per AMFI data, ESG funds in India too have gained traction during the Covid-19-triggered market selloff and attracted over Rs 1,700 crore in January-March largely due to growing investor interest in environmental, social and governance issues. Category AUM currently stands at 4400 crores.

2. Why the sudden interest in ESG funds? Is there an investment rationale to it or is it just a passing fad?

The world is becoming increasingly complex and interconnected. Corporates are facing new set of challenges. The importance of actively managing risks and opportunities related to emerging environmental and social trends. In combination with rising public expectations for better accountability and corporate governance. These challenges come in the form of litigation, bad reputation, product boycotts, strikes and factory shutdowns, etc.

For instance, Company A which has good ESG practices will deliver long term risk adjusted returns, will be less risky compared to company B in the same sector which does not...

Company A will typically be less exposed to tail risks. These risks are like environmental accidents or punishment from regulators. Thus will indirectly impact its profitability and sustainability over the long term.

As highlighted by the Global Risks Report published by the World Economic Forum. The top 5 global risks in 2020 are all Environmental in nature. This is starkly different from a decade earlier. Back then Economic risks dominated the business environment. Thus, ESG risks which may have been ignored earlier, are demanding investor attention now.

For investors to determine which companies are best equipped to handle. It has become essential to evaluate their ESG practices.

Broad features of ESG funds are:

- ESG funds provide exposure to businesses that are responsible. Sustainability drives their long term performance.

- ESG funds tend to provide exposure to Quality and Low volatility factors

- ESG generally tends to do well in down markets

- ESG focus help mitigate tail risks

- ESG endeavors to deliver long term risk adjusted performance

3. What are the chances that the E-S-G will get in the way of picking quality stocks?

Investing as per ESG methodology can enhance returns.

E, S, G factors comprises of response to climate change, waste management, fair labor policies, ethical supply chains etc. These factors impact on a firm's long term financial prospects. They are often underestimated because of their non - financial nature. These tail risks are hidden beneath a company's business activities

But like it or not, they can have a material impact on the firm's earnings and valuation over the long term. Thus making them important considerations for long term investors.

It is often wrongly assumed that ESG funds do not generate returns. Rather, responsibility and profitability are wholly complementary. For example, the Nifty 100 TR index YTD performance as of July stands at -7.90% vis-a-vis -3.18% of the Nifty 100 ESG TR index. Evidently, the ESG index better protected downside risk in the stock market mayhem caused by the pandemic.

The long term performance of the ESG indices showcase a significant outperformance as compared to the well-known stock market indices. Thus negating the claim that you have to compromise returns when investing the ESG way. The evidence showcases that investors would have generated more returns with less risk by ESG investing.

4. ESG funds have made an entry in India too. How's their performance been?

Even though ESG funds have been around for a short time, the track record has been encouraging. This has been demonstrated in Answer3; the Nifty 100 TR index YTD performance as of July stands at -7.90% vis-a-vis -3.18% of the Nifty 100 ESG TR index.

5. When allocating money to equity funds, how much would you allocate to ESG funds?

So far the track record of ESG index has been encouraging. We believe that in the long term ESG funds can deliver good long term risk adjusted returns. But considering that ESG is a relatively new concept, it's advisable that investors completely understand it. Investors can start with allocating 20% of their equity portfolio to ESG funds.

As they get comfortable with ESG investing, they could increase their exposure if desired.

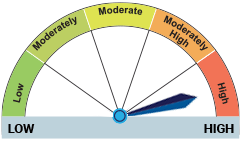

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation •Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at High Risk. |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More