Gold monthly view for December 2021

Posted On Tuesday, Jan 11, 2022

Gold shined in 2020 as a result of risk aversion due to the Covid-19 pandemic as well as the coordinated easing of monetary policies and softening of global interest rates. In the first half of 2021, gold consolidated from 2020 highs as successful vaccines and global economic recovery improved investor sentiment but got back in favour in the second half due to the firming of inflation and repeated Covid outbreaks.

As the world learns to live with Covid-19, gold prices in 2022 will be influenced by how inflation shapes up and central banks’ reaction to it. The persistence of higher inflation could boost the demand for the yellow metal, but it also increases the odds of a more hawkish Fed, hurting prices.

Moving into 2022, US consumer inflation has hit a near 40-year high and the Federal Reserve finally dropped the word “transitory” from its inflation view as it remains terribly behind the curve. This set the stage for a hawkish pivot by the US central bank. The Fed has announced doubling the pace of tapering to $30 billion a month which increased the chances of it raising rates a few months earlier than planned, which is negative for non-yielding gold. Other central banks aren’t far behind. The Bank of England has raised its interest rate for the first time in three and half years and the European Central Bank too has announced the end of its bond-buying program by March.

Globally, financial conditions have always been sensitive to what the Fed does. And the pandemic has increased that sensitivity. So, the question is how hard can the Fed press the QE brakes without large costs to employment, growth, and financial markets? Especially with the background of the Omicron variant threatening growth, and record debt levels.

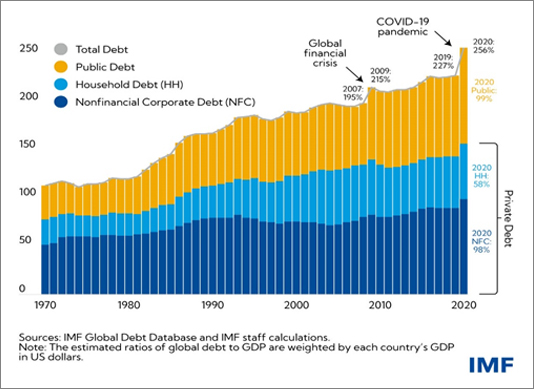

Debt levels in the US as well as globally have surged to historic highs since 2020 rising to $226 trillion or 256% of global GDP as borrowers - corporates, households as well as the government took advantage of lower rates and stimulus measures put in place to support the pandemic-stricken economy. If borrowing costs rise from currently low levels, it could create financial stability concerns especially if the economy slows in response to tighter monetary policy. Also, the malinvestments thriving under abundant cheap liquidity may go belly up under pressure from tighter liquidity and rising costs, casting a shadow over rising risk appetite and stable growth.

Looking back at the taper tantrums of 2013 and 2018 suggests a tightening Fed isn't good news for markets. Especially, given that asset prices are already elevated. Equity markets in the US and India look stretched by any measure of historical or relative valuations, justified by lower interest rates. However, that justification will be under pressure from rising interest rates without a compensating earnings expansion. As such, Indian investors will benefit from holding gold to protect their portfolios from possible equity market corrections. The continued inflows into gold ETFs in 2021, with AUM touching 18,000 crores as of November, is proof of investors' concerns about heightened equity valuations amidst the threat of inflation and thereby highlighting gold’s perceived utility as a diversifier.

If inflation is persistent, which it will likely be, given the trillions of dollars of stimulus that have trickled down to the real economy, the pandemic-induced supply disruptions and the transition to cleaner energy, the Fed must aggressively hike rates. Asset valuations will suffer as a result. Severe market swings have led the Fed to change course before, like in 2018 when it paused after raising rates and went on to cut rates in the following year fretting about the risks of a recession. Thus, as it prioritizes financial stability, it won’t be surprising if the Fed is forced to take a U-turn again. But in that case, it will risk inflation getting out of hand and gold will return to strengthening on the back of inflationary pressures and low real rates.

Premature tightening of monetary conditions on the other hand come with risks of recession and market volatility which will keep gold relevant. In any case, the conditions are incrementally set for slowing growth and if confidence reduces, we could be staring at recessionary conditions. The bout of inflation is likely to stay for some time and may aggravate if supply-side takes longer to normalize for any reason. A stagflationary scenario cannot be ruled out which will be incredibly bullish for gold prices.

As the US Federal Reserve tightens its monetary policy, the US dollar will likely strengthen in the short-term relative to other currencies, potentially worsening the currency crisis in Turkey and Lebanon. With higher interest rates in the US, countries that have debt in dollars will be hit. In others like India, it will trigger capital outflows, hurting the rupee. The depreciation in the rupee will support domestic gold prices but will be contained given the Reserve Bank of India’s big stockpile of foreign exchange reserves, the possibility of a Balance of Payments surplus, continued flows in Indian equities including the series of IPOs attracting overseas investment in Indian firms and India’s potential global bond index inclusion in 2022.

Having said that, the dollar may not be a concern in the long term, as the US government takes the baton of supporting the economy from the Federal Reserve by fiscal spending in the form of infrastructure push, social bills etc. This should keep the dollar under pressure from deficit spending which will be supportive of gold over the long term.

With China’s economy slowing down thanks to a property market slump and zero covid policy, the country’s central bank has begun to ease monetary policy and the Communist Party has ordered more fiscal spending in 2022. This stimulus can be expected to spur growth and will support gold demand in the world’s largest gold consumer. Closer home in India, economic growth, a wedding rush and pent-up demand signal robust consumer demand in 2022.

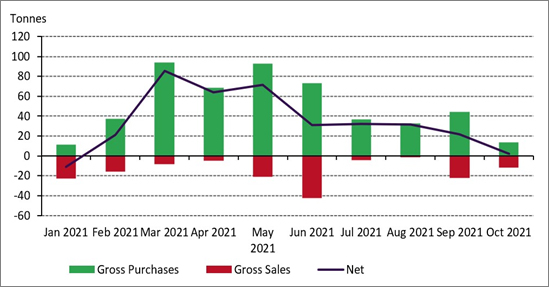

Central banks remained bullish on gold and were net buyers in 2021. In fact, the latest data from the IMF shows that it is no longer just emerging market central banks buying gold. Developed countries like Singapore and Ireland too have begun to buy gold to diversify their forex reserves. Central bank gold purchases can be expected to continue in 2022 as they hedge themselves against macroeconomic uncertainties and continue the trend of incrementally diversifying away from the dollar.

*Data to 30 October 2021.

Source: IMF IFS, Respective Central Banks, World Gold Council

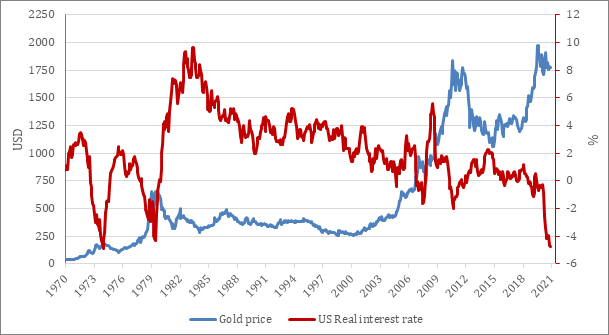

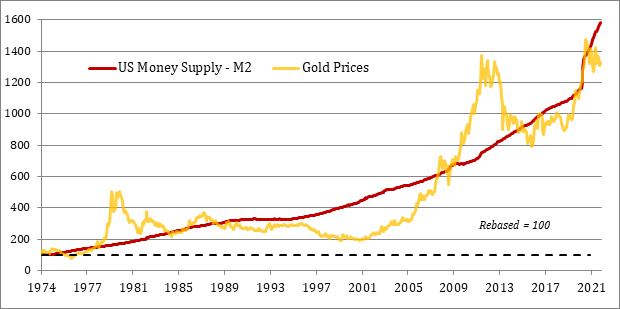

To summarize, between sticky inflation acting as a tailwind and the Fed’s tightening-induced stronger dollar taking a toll, gold because of conflicting forces is expected to stay range-bound in the first few months of the year. But long-term gold investors will have the last laugh as a hasty taper could hurt growth and trigger market tantrums making investors seek portfolio diversifiers like gold. The monetary asset’s price should also ideally catch up with the pandemic era's elevated global money supply and low real rates, as it has done historically.

Data as of Nov 2021.

Source: Investing.com, Bloomberg

Data as of October 2021

Source: fred.stlouisfed.org. Past performance may or may not sustained in future

In the meantime, investors should be patient and use any price corrections as an opportunity to build their gold allocation.

Sources: Bloomberg, World Gold Council

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for December 2025

Posted On Thursday, Dec 04, 2025

After a series of events and a strong rally in October 2025, gold demonstrated a mixed performance in November 2025, moving back and forth within a defined range.

Read More -

Gold Monthly for November 2025

Posted On Tuesday, Nov 04, 2025

After a strong September, gold extended its bullish momentum into October, marked by heightened volatility and significant price swings.

Read More -

Gold Monthly for October 2025

Posted On Friday, Oct 03, 2025

After breaking out of a consolidation phase in August, gold demonstrated strong upward momentum in September.

Read More