Sustainable Investing With ESG

Posted On Tuesday, Jun 15, 2021

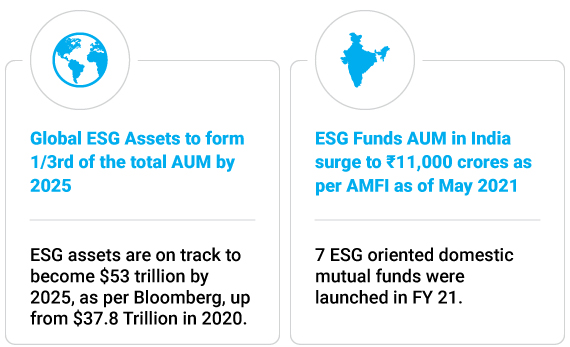

Environmental, Social and Governance are the three pillars of ESG investing, which is also called Responsible or Sustainable Investing. The disruption caused by Covid-19 has been a wake-up call to move towards a more sustainable investing model that integrates people, planet and profits. This has led to the renewed focus on ESG investing across India and the world.

A Word of Caution - Lack of Standardization in ESG Reporting

However, we would like to caution investors that unlike typical financial metrics in an annual report such as revenues, profits, cash flow, the metrics for measuring ESG are not standardized and can vary from one company to another – and differ across various industries.

Today, ESG - like beauty - lies in the eyes of the beholder whether that is the analyst or the fund manager.

As ESG investing becomes more mainstream in India, SEBI (Securities and Exchange Board of India) is on the leading edge of regulatory oversight and has prepared working papers on ESG disclosure. These will likely be implemented for the financial year ending March 2022.

In the interim, in the absence of a uniform approach, it is important for you to understand and look closely at the underlying methodology, to make a fair assessment.

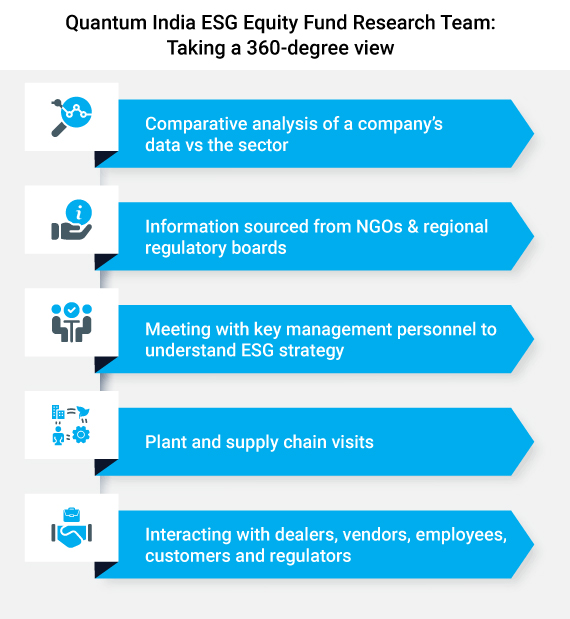

Not just a "tick the box" desk research

At Quantum, we are of the view that verification of ESG credentials still warrants a detective’s lens and you cannot and must not rely solely on self-disclosures. Our proprietary ESG scoring methodology is devised from years of in-house research and experience.

While screening companies, our ESG framework evaluates over 200 parameters across the Environment, Social and Governance parameters, backed by a blend of quantitative and qualitative data. We rely not solely on desk research, but also on groundwork and industry checks.

We look for material, tangible and relevant information concerning companies’ sustainability activities.

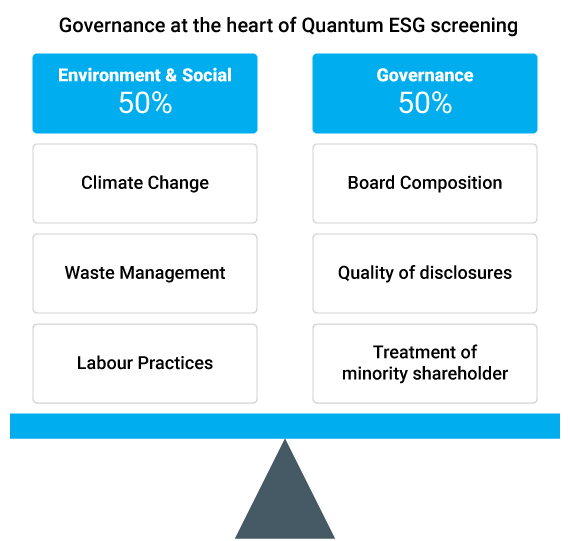

Big on G for Governance

At Quantum, the last alphabet G for Governance is the most important criteria in our assessment.

While computing the ESG score, we assign 50% weightage to the Governance aspect and the remaining 50% to the Environmental and Social aspects. Shortcomings in Governance go hand in hand with poor performance on the social and environmental fronts, making it a good proxy for wider problems.

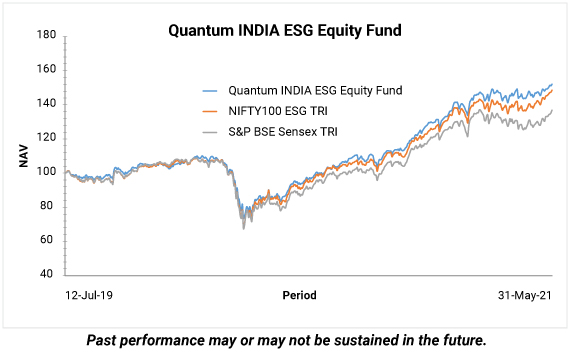

Resilient Returns amidst economic uncertainty

Many investors have turned their attention to ESG Mutual Fund due to the resilient returns it has managed to deliver.

Lower Volatility (Standard Deviation) compared to the benchmark

| Nifty 100 | Nifty 100 ESG | |

| One year | 17.06% | 16.41% |

| Five years | 18.04% | 17.86% |

| *Data based on average daily standard deviation annualized for the period ended May 31, 2021 | ||

Source: NSE

Going Above & Beyond

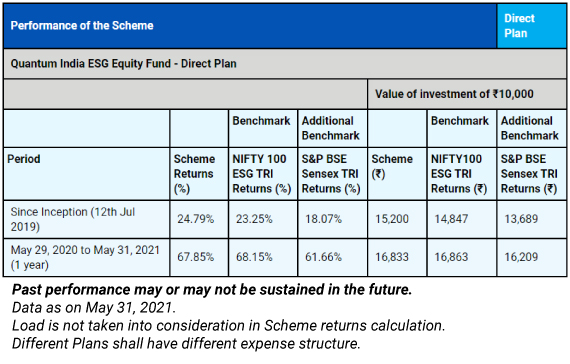

Quantum India ESG Equity Fund is one of the earliest mutual fund schemes established in India under the ESG theme and ever since inception, the fund has outperformed the bechmark and showcased potential to reduced downside risks during economic downturns. An investment of Rs.10,000 would have grown to Rs. 16, 833 over the past one year for the period ended May 31, 2021. Please refer the complete performance given in the table below.

Quantum India and has now exhibited its track record since its inception and continues to see a growth in the number of investors.

Returns are net of total expense and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). The Scheme is managed by Mr. Chirag Mehta and Ms. Sneha Joshi. Mr. Chirag Mehta is the Fund Manager effective from July 12, 2019. Ms. Sneha Joshi is the Associate Fund Manager effective from July 12, 2019. Mr. Chirag Mehta manages 5 schemes of Quantum Mutual Fund. For the performance of other Schemes Managed by Mr. Chirag Mehta please click here.

Here is a link to a recent webinar - ESG at Inflection Point, to hear from our Fund Manager Chirag Mehta and Associate Fund Manager Sneha Joshi, to give you a better understanding of the ESG approach adopted by the Quantum India ESG Equity Fund.

Invest responsibly with the Quantum India ESG Equity Fund.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Liquid Fund An Open Ended Liquid Scheme | • Income over the short term • Investments in debt / money market instruments. |  Investors understand that their principal will be at Low risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open-ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies. |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on May 31, 2021.

except for Quantum Equity Fund of Funds as on April 30, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Equity Monthly for March 2026

Posted On Monday, Mar 02, 2026

Markets were range bound with a marginal decline in Sensex. BSE mid and small cap indices

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More