Equity monthly view for July 2021

Posted On Monday, Aug 09, 2021

S&P BSE SENSEX increased by 0.36% on a total return basis in the month of July-21. After a strong rally in the months of May & June, 2021 equity markets have further added to gains this month. Sensex has underperformed in the developed market indices such as S&P 500 & Dow Jones Industrial Average Index which appreciated by 2.37% & 1.33% respectively, during the month. It has, however, had a large outperformance vs MSCI Emerging Market Index. The latter was impacted by a slump in Chinese stocks.

The broader market continued its outperformance vs. Sensex, again this month. The S&P BSE Midcap Index appreciated by 2.54% and the S&P BSE Smallcap Index rose by 6.30%. With this month’s performance, the Midcap & the Smallcap index have given the return of 29.4% & 48.6%. on a YTD basis.

Quantum Long Term Equity Value Fund saw a 1.61% appreciation in its NAV in July 2021. This compares to a 0.98% appreciation in its benchmark S&P BSE 200. Cash in the scheme stood at approximately 8.3% at the end of July. Our portfolio bets continue to be skewed towards cyclicals like large financials, select commodities, mobility focussed consumer discretionary, and utilities as they benefit the most from the economic rebound tailwind. We are sticking to names that are market leaders in their respective domains, have capable management & strong balance sheets. Technology stocks owned by us are seeing earning upgrades despite elevated expectations demonstrating their ability to benefit from a strong demand tailwind for their services.

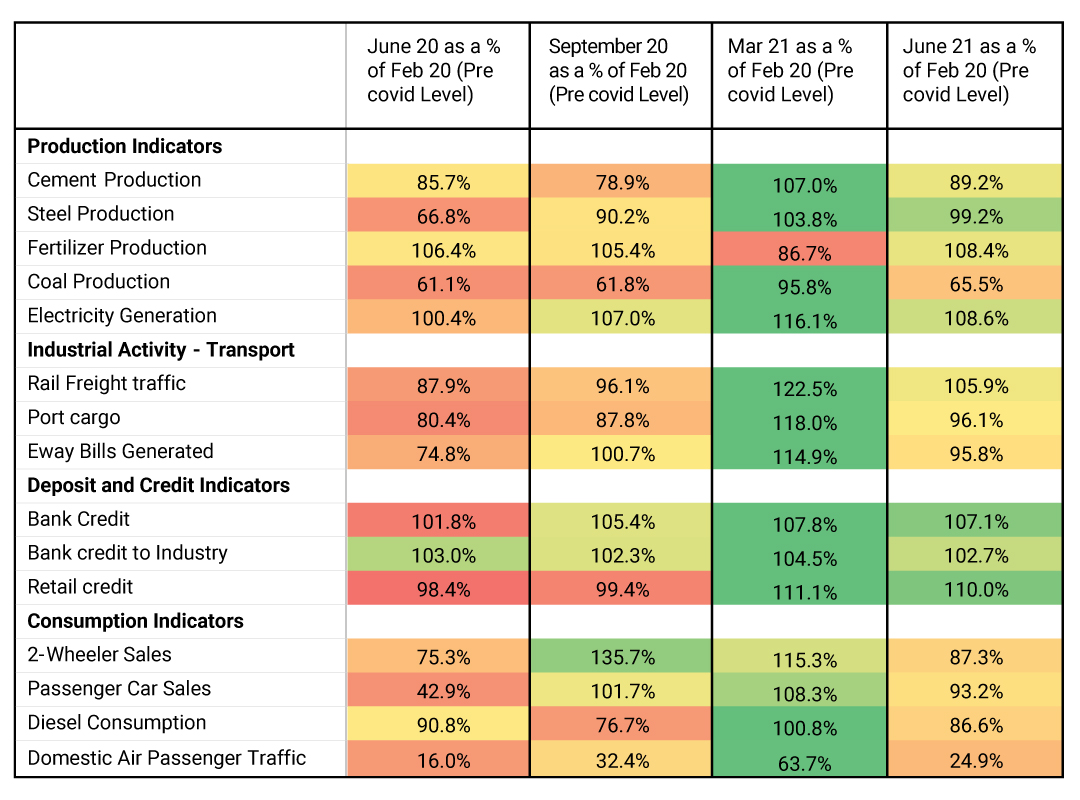

Economic activity has continued to improve in June & July (the unlocking began in the first week of June 2021). However, most indicators are soft as compared to March 2021 (before the 2nd wave lockdown). In the near term, recovery should continue as companies rebuilt channel inventories for the festive season. However, while the macroeconomic indicators are improving, credit demand in the economy, especially for a business loan is still lacklustre. The business loans have grown at anaemic levels of 1% y-o-y in July. The pickup in demand for term loans by corporates for fresh investments in capacity creation will be the key to the sustainable economic rebound. It has remained elusive for the past five years as Indian corporates have focussed on deleveraging their balance sheets rather than investing in newer capacities.

Data Source: CMIE, RBI, ewaybill.nic.in Data as on July 2021

Monsoons have recovered after a brief lull:

The southwest monsoon had started well in the month of June-21. However, there was a lull in the progress of the monsoon in the first two weeks of July. It has picked up again & sowing acreage has started improving. The second wave of covid-19 had hit rural India hard, therefore a good monsoon & Kharif harvest is important for rejuvenation of the rural & semi-urban economy.

FPIs have been sellers but domestic MFs have been buyers:

FPIs have turned sellers of Indian Equities in July-21. They have sold US$ 1.5 bn worth of Indian Equities this month. On a YTD basis, FPI inflows stand at US$ 6.54 bn. DIIs have been buyers in the month of July-21 to the tune of US$ 2.08 bn. With nominal GDP growth improving & much of the developed world still grappling with near-zero interest rates, India will attract its fair share of foreign flows.

Larger companies better placed in covid-19 induced macro uncertainty

Macro-economic shocks over the last few years like demonetisation, hastily implemented GST, IL&FS crisis & Covid-19 induced lockdowns have helped the large companies become larger & stronger, helped by scale & balance sheet strength. The smaller companies however have weakened & lost market share. In this backdrop, as Covid-19 related uncertainty still lingers on, the midcap valuations are at close to all-time highs. Markets are choosing to ignore the risks associated with investing in smaller companies, but this could reverse quickly if global liquidity dries up or we face a Covid-19 third wave. We would like to reiterate our stance to tread with caution in the midcap & small-cap space.

Retail investors should stagger their investments and diversify their equity allocation among different styles & caps for optimum results from their long-term equity allocation.

Data source: NSDL

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on July 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More