Equity monthly view for January 2021

Posted On Tuesday, Feb 09, 2021

February 09, 2021

S&P BSE Sensex declined by -3.05% on a total return basis in the month of January. On trailing twelve month basis the index has returned 15.04%. S&P BSE Sensex performance was worse than developed market indices such as S&P 500, which declined by -2.18% during the month. It was also worse than the MSCI Emerging Market Index which rose by 2.7%.

Mid-cap and Small-cap indices outperformed the Sensex in January; with the S&P BSE Mid-cap Index rising by 0.78% and the S&P BSE Small-cap Index declining much lower by -0.55%. Auto, IT, telecom & capital goods, were the winning sectors for the month. Auto stocks have rallied on the back of good monthly volume numbers and strong third quarter results. IT stocks too reacted positively to their earnings release & positive commentary on demand. Healthcare, banking & metals stocks underperformed during the month.

| Market Performance at a Glance | |

|---|---|

| Index | Trailing Twelve Months Returns %* |

| S&P BSE SENSEX | 15.0 |

| S&P BSE 200 | 16.5 |

| S&P BSE MID CAP | 18.4 |

| S&P BSE SMALL CAP | 24.2 |

| MSCI Emerging Market Index | 30.6 |

| S&P 500 | 19.4 |

* On Total Return Basis

Source-Bloomberg

YTD - Year To Date | MTD - Month To Date

| Union Budget 2021: Borrowing for growth | |||

|---|---|---|---|

| % to GDP | 2019-20 Actuals | 2020-21 Revised Estimates | 2021-22 Budgeted |

| Fiscal Deficit | 4.59 | 9.49 | 6.76 |

| Capital Expenditure | 1.65 | 2.25 | 2.49 |

| Revenue Expenditure | 11.65 | 15.46 | 13.14 |

The pandemic & lockdown hit Indian economy wanted a push for both capital & consumption in this budget. Through the provisions of the Union Budget 2021-22 government has targeted increased spending on infra & other capital expenditure to kick start the economy but, as has been the cases in multiple rounds of stimulus announced last year, there is very little to boost consumption. On the contrary, the new ‘agriculture infrastructure cess’ on petrol & diesel is inflationary and has potential to reduce real income of the households thereby impacting near term consumption.

This time the government has followed a fiscally expansionary path to put the economy back on track. Though, the headline budgeted fiscal deficit numbers for FY21 & FY22 looks higher due to reclassification of NSSF [National Small Savings Fund] loans to FCI above the line. Higher borrowings (even after adjusting for reclassification of FCI loan) by the government can crowd out the private sector demand for loans, until & unless, foreign flows in debts come to their rescue. There have been some sector specific changes like change in FDI limit in insurance & scrappage policy for autos which augurs well for respective sectors. There were no significant changes on direct taxes. Overall, the government’s planned spend on infra, if executed properly, has the potential to increase employment & expedite (though, boost to consumption would have expedited it much faster) the natural business cycle to revive corporate earnings which otherwise shall be a gradual process.

FII Flows: Inflows have continued in the New Year.

Indian Equities have seen $1.9 bn of net buying by foreign investors in the month of January 2021. This is on the back of US$ 23 bn of FII flows in CY2020. The last two months of CY20 has seen FPI inflows of US$ 8.5 bn. DIIs have been large sellers for four months now. In January they have sold USD 1.37 bn worth of stock. Indian rupee was flat during the month. India with a recovering economy is moving back to a higher nominal growth trajectory vs. the western world (which continues to struggle with 2nd & 3rd wave of Covid and related lockdowns) and looks as a credible destination for yield & growth seeking developed world investors. This means strong FII inflows can continue.

| Apr-30 2020 | Jun-30 2020 | Sep-30 2020 | Dec-31 2020 | Jan-31 2021 | |

|---|---|---|---|---|---|

| Daily Tests | 72,453 | 2,17,931 | 14,26,052 | 11,27,244 | 8,97,241 |

| Daily new infections | 1,901 | 18,522 | 80,472 | 21,822 | 13,517 |

| Cumulative Cases | 33,610 | 5,66,840 | 62,25,763 | 1,02,66,674 | 1,07,69,877 |

| Of which -Recovered | 24,162 | 3,34,822 | 51,87,825 | 98,60,280 | 1,03,69,772 |

| Deaths- Cumulative | 1,075 | 16,893 | 97,497 | 1,48,738 | 1,54,428 |

India’s Covid related data points (as given above) are comforting. Despite opening up of economy & increased mobility, daily new infections have shown a sharp deceleration & so far there are no signs of a second wave. Government has approved Oxford-AstraZeneca (manufactured by Serum Institute India), & Bharat Biotech’s (Local player) vaccines for India. Vaccination has started from Jan 16, 2021 and so far 4mn frontline health care workers have been inoculated. Government plans to vaccinate 300mn people by August 2021.

Quantum Long Term Equity Value Fund saw a 1.06% appreciation in its NAV in the month of January. This compared to a –1.95% decline in its benchmark S&P BSE 200. Outperformance for the month was driven by holdings in, Auto, IT and select NBFCs. Cash in the scheme stood at approximately 6% at the end of January.

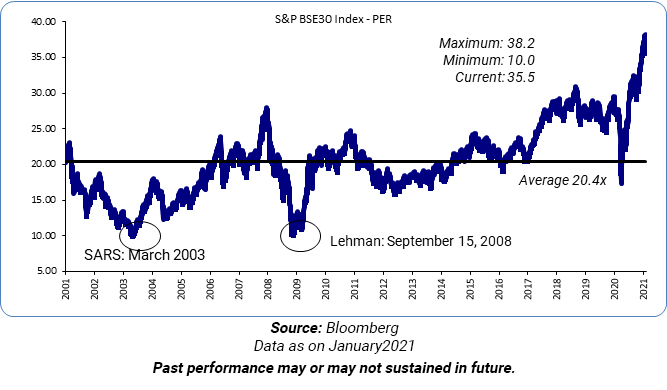

S&P BSE Sensex valuations, based on current year earnings are at a twenty year high. Even after normalising for very weak first quarter earnings (due to covid-19 induced lockdown) the benchmark indices look richly valued. From here on, the equity return will be driven by earnings upgrades cycle of corporate India, as recovery gains momentum. Any risks to the economic recovery can result in sharp correction. The government’s fiscal expansion driven spending is focussed on capital expenditure rather than consumption boost. Theoretically speaking, a capital expenditure driven economic momentum is more sustainable but it often takes more time than consumption driven boost & entails more execution challenges. We remain constructive on Indian equities with longer-term view & suggest a neutral weight. Given the sharp run-up, we believe any fresh allocation toward equities should be staggered or through SIP route.

Source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk-o-Meter is based on the portfolio of the scheme as on January 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More