Equity monthly view for October 2022

Posted On Monday, Nov 07, 2022

The S&P BSE SENSEX advanced by 5.8% on a total return basis in the month of Oct 2022 while S&P BSE Midcap Index & S&P BSE Small cap Index advanced by 2.0% and 1.3% respectively. Most of the sectoral indices gained during the month. Banks, Capital goods, and Tech indices recorded relatively higher growth. Advance in Banks was fuelled by stable asset quality trends and the persistence of high credit growth along with improving interest margins. IT companies reported reasonable growth with stable order books despite global uncertainties. Capital goods companies have reported healthy order inflows supported by a pickup in public Capex and are seeing signs of private Capex revival. Healthcare, Consumer Durables, and FMCG indices were laggards during the month. Consumer Durables and FMCG companies' results have been mixed with few companies reporting lower than expected growth.

Though US inflation remains high, US GDP is estimated to be back in the expansion zone in Q3 after two-quarters of contraction. A relief rally was seen in S & P 500 (+8.1%) and Dow Jones Industrial Average Index (+14.1%) during the month. The challenging environment in the majority of emerging markets was reflected in the persistent declining trend in the MSCI EM index (-3.1%).

Amidst rising interest rates in the US, FPIs continued to be sellers in Indian markets to the tune of USD $0.5 bn. Domestic institutional investors were buyers with purchases worth USD 1.2 bn. Since the start of the calendar year 2022, FPIs have recorded a net outflow of USD 22.3 bn while DIIs recorded a net inflow of USD 33.7 bn.

Quantum Long Term Equity Value Fund (QLTEVF) saw an increase of 4.2% in its NAV in the month of October 2022. This compares to an increase of 4.1% in its Tier I benchmark S&P BSE 500 and a 4.5% increase in its Tier II Benchmark S&P BSE 200. IT, Banks, and PSUs were major contributors to the marginal outperformance. Cash in the scheme stood at approximately 6.4% at the end of the month. The portfolio is valued at 12.2x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 17.0x based on FY24E consensus earnings.

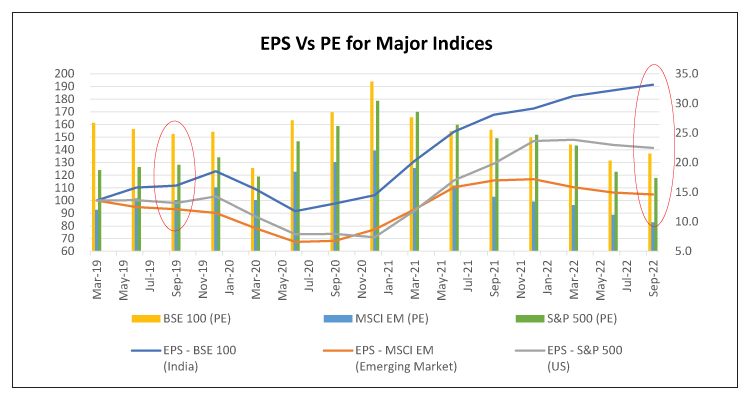

Source: Bloomberg; EPS is rebased to 100 as of Mar-2019; EPS (Left Axis), PE (Right Axis).

Past performance may or may not be sustained in the future.

Indian markets have outperformed global peers by a wide margin over the current year. The bar graph on the above chart shows the PE ratio of India and global indices (S&P 500: US, MSCI EM: Emerging Market) from pre-pandemic levels. The line graph shows the earnings per share of indices from Mar-19 till Sep-22. As can be seen from the graph, the recovery post covid has been sharpest in India compared to global markets justifying the premium valuation compared to global peers.

Though the co-ordinated global interest rate hikes could pose pressure on foreign flows and exports, domestic indicators look reasonable:

• Consumer sentiment indicated by CMIE’s “Index of Consumer Sentiments (ICS)” rose sequentially by 7.6% and 3.5% for urban and rural regions respectively during October.

• Credit growth continues to be at a strong pace. Outstanding credit of Scheduled Commercial Banks under Non-food credit recorded a healthy growth of 16.8% in September. Retail recorded a superior growth of 19.6% while Industrial credit saw a growth of 12.6.

• GST collections stood at a healthy level of INR 1.51 tn in October. GST collection above INR 1.4 tn for 8 successive months indicates the persistence of the formalisation trend in the economy.

• PMI - Manufacturing and PMI - Services stood at 55.3 and 55.1 respectively (A reading above 50 indicates expansion) in October.

• Domestic auto sales continued its growth momentum in the festive month of October. Passenger Vehicle and premium segments reported superior growth.

Notwithstanding the encouraging domestic environment, markets are likely to be volatile in the near term due to global uncertainties and interest rate hikes across the globe. Equities remain the optimal asset class to beat inflation over the long term. We recommend investors remain invested in equities and make incremental allocations in a staggered manner to benefit from the current volatility.

Data source: Bloomberg

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Riskometer of Tier I Benchmark | Riskometer of Tier II Benchmark |

Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) | • Long term capital appreciation |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on October 31, 2022.

The Risk Level of the Tier I Benchmark & Tier II Benchmark in the Risk O Meter is basis it's constituents as on October 31, 2022.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual fund investments are subject to market risks read all scheme related documents carefully.Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956. |

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After five months of decline, Sensex ended March 2025 with + 5.7% returns.

Read More -

Equity Monthly View for February 2025

Posted On Friday, Mar 07, 2025

Indian markets continued the down trend in the month of February 25 on the back of continued FPI

Read More