Equity monthly view for February 2022

Posted On Friday, Mar 11, 2022

S&P BSE SENSEX fell by -2.9% on a total return basis in the month of February 2022. It has outperformed developed market indices like S&P 500 (-3.00%) and Dow Jones Industrial Average Index (-3.29%). S&P BSE SENSEX has also outperformed MSCI Emerging Market Index (-3.0%).

The broader market has underperformed the S&P BSE Sensex marginally, this month. While S&P BSE Midcap Index has declined by -4.8% the S&P BSE Smallcap Index was down -8.6%. Metals & Consumer Durables were the only sectors that stood out giving positive returns in an otherwise declining market.

Quantum Long Term Equity Value Fund (QLTEVF) saw a decline of -4.4% in its NAV in the month of February 2022. This compares to a -3.9% decline in its Tier I benchmark S&P BSE 500 & -3.4% decline in its Tier II Benchmark S&P BSE 200. Cash in the scheme stood at approximately 7.8% at the end of the month. The portfolio is attractively valued at 11.9x FY24E consensus earnings vs. the S&P BSE Sensex valuations of 17.4x FY24E consensus earnings.

FPI outflow intensity has increased due to geopolitical risks

Feb-22 has seen a sharp surge in FPI outflows of US$ 4.6 bn (highest since March 2020). With this month’s outflows, FII’s have sold close to US$ 9.5 bn in the past four months. High global inflation risk along with increased geopolitical risk (Ukraine-Russia Conflict) is resulting in global risk off-trade. DIIs have been net buyers for the month of February 2022 to the tune of US$ 4 bn and have absorbed a lot of selling pressure from the FPIs

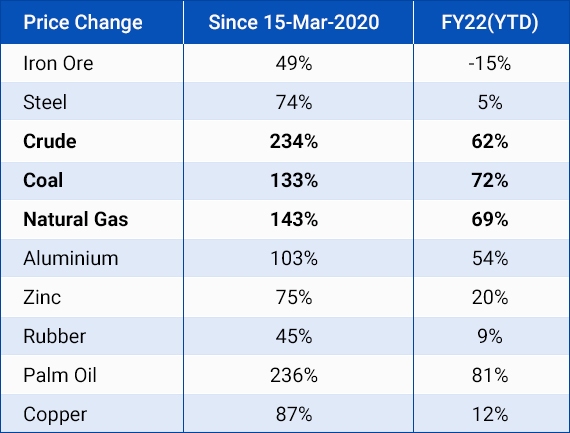

Russia Ukraine conflict has increased inflation & supply chain challenges.

The Russia-Ukraine conflict has further exposed the vulnerabilities of the global supply chain which was still struggling to recover from the blows of the Covid-19 pandemic. The global trade is still woefully short of shipping containers & semiconductor chips among other things. Commodity prices too have been on an uptrend after bottoming out in March 2020 and have got a further leg-up this year (especially the energy commodities) due to the Russia-Ukraine conflict & sanctions on Russia. There is a risk of this spilling over to global food prices as well (natural gas is a key input for urea production). This relentless increase in commodity prices is feeding into global inflation & is a risk for global economic upcycle.

From India’s standpoint, the conflict has very little direct impact on its economy. However, since it fulfils most of its energy needs via imports, the flare-up in the international crude & natural gas prices entails a risk of increasing the twin deficits (fiscal deficit + current account deficit). While it may feel like a 2013 déjà vu but there are the following buffers available to mitigate the impact this time around:

• India’s foreign currency reserves are close to US$ 600 bn giving adequate cushion against any oil shock.

• More than 50% of India’s CPI basket is food where India is self-sufficient (excluding edible oil & pulses).

• Unlike in 2013, exports are doing well this time so the impact on the current account deficit should be contained.

• Buoyant tax collection will also help manage fiscal deficit better.

While the corporates had taken price hikes over last year to take care of the rise in input cost, the current spike in commodity & energy prices would take a toll on the margins in the near term. Corporates will take another round of price hikes, but it will happen with the lag to ensure it does not curtail demand recovery. Companies with stronger pricing power will be able to pass on the impact much better.

History suggests geopolitical risks and global macro shocks have been a great time to invest in Indian equities. Right from SARS in 2003, GFC in 2008, China growth scare in Jan 2016 to pandemic related fall of March 2020. While higher crude & other commodity prices will weigh into demand & margin pressure in the near-term investors should use this market correction as an opportunity to increase allocation to equities & align it to their long-term financial goals

| Name of the Scheme | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme | Tier 1 Benchmark | Tier 2 Benchmark |

| Quantum Long Term Equity Value Fund (An Open Ended Equity Scheme following a Value Investment Strategy) Primary Benchmark: S&P BSE 500 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index. |  Investors understand that their principal will be at Very High Risk |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in scheme Risk O Meter is basis it's portfolio as on February 28, 2022.

The Risk Level of the Tier 1 Benchmark & Tier 2 Benchmark in the Risk O Meter is basis it's constituents as on February 28, 2022.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More