Can You Save Tax & Create Wealth at the Same Time?

Posted On Tuesday, Dec 08, 2020

As the year ends with all the festivities, we are also coming an inch closer to the tax saving season. The year 2020 might have impacted our savings and financial wellbeing, so this time choosing a prudent tax saving instrument becomes not just important but rather imperative.

Look beyond the Ordinary

Through the years, you've been saving taxes with Public Provident Funds (PPFs), National Savings Certificates (NSCs) and Bank Fixed Deposits (FDs). Sure, these are good and "safe" options but have you ever considered another option which has the potential of generating returns linked with market earnings along with saving taxes?

Equity Linked Savings Scheme (ELSS) is one such option. Tax-saving mutual funds, also known as ELSS offers twin benefits of tax savings and opportunity to build wealth by investing in equities for the long term. It comes with a lock-in period of three years.

ELSS = Tax Benefits + Potential Long Term Capital Appreciation

And while you are looking for an ELSS fund to save tax, maybe you should consider adding the Quantum Tax Saving Fund (QTSF) - an open ended Equity Linked Savings Scheme with a 3 year lock-in period to your portfolio. With all the features and advantages of an ELSS fund, it’s time you experience the benefits of investing your money with an aim to achieve risk-adjusted returns through QTSF.

5 Reasons why you should invest in the Quantum Tax Saving Fund:

1. It follows a disciplined research and investment process.

2. Consists of a well balanced portfolio - typically 25 to 40 stocks, across various sectors.

3. It has a lock-in period of 3 years which helps to reduce portfolio churn as the fund manager does not need to re-adjust the portfolio to meet frequent redemptions.

4. Minimizes risk by pursuing a bottom-up stock selection approach.

5. Holds cash when stocks are overvalued - no derivatives and no hedging is included.

So, make the most of the time you have. Do your research & consider investing in the Quantum Tax Saving Fund to save tax under Section 80C and aim to achieve long term capital appreciation. It’s time to not just save but give your money the opportunity to grow.

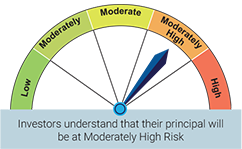

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Tax Saving Fund An Open Ended Equity Linked Saving Scheme with a Statutory Lock in of 3 years and Tax Benefit | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index and to save tax u/s 80 C of the Income Tax Act. Investments in this product are subject to lock in period of 3 years. |  |

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Equity Monthly View for April 2025

Posted On Wednesday, May 07, 2025

April 2025 witnessed a reversal in FPI flows and an ease of global tariff related uncertainties, leading to a rise in broader indices.

Read More -

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

Read More -

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

Read More