Buying Gold at a Lower Rate... For Your Benefit!

Posted On Saturday, May 02, 2020

The pandemic induced global lockdowns have disrupted gold mining and refining operations. In addition, as most gold is transported via commercial flights, India has been unable to import the metal. Remember, India is largely dependent on imports to meet its gold requirement. As a result of supply disruptions, there has been a finite supply of gold bars in the physical market. There is still no shortage as such to meet current requirements, however, as investment demand for gold increases on account of the virus-induced economic deceleration, this finite supply is bid at a premium to the international parity rate for gold in India. This is not unique to India, we have been hearing reports of physical gold being bid at a premium in London and US markets as well.

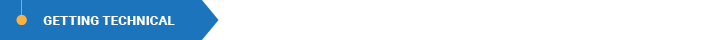

Now, if we look at the trading price of Quantum Gold Fund (QGF) units on 30th April 2020, we realize that even though it is trading at a premium to its NAV, the premium of ~2% is much lesser compared to other ETF's trading at premiums of over 3%. This lower premium means that QGF has been able to source/buy gold for its investors more efficiently at lower prices, in spite of the current supply crunch. It's the same 24 Karat gold from LBMA approved refiners that we could procure by constantly being talking to market participants to ensure that investors don't end up paying prices that reflect the underlying physical gold market prices and don't end up paying high premiums. These lower purchase prices will translate into relatively better returns for the investor when the premiums wane or gold prices increase, which we believe, are around the corner.

Table 1: Gold ETFs trading at a premium to NAV

Moving on to gold savings funds. These funds, in turn, invest in the gold ETFs and are valued at the traded prices of the ETF. They, therefore, reflect the premiums/discounts prevailing in the domestic market.

The Quantum Gold Savings Fund (QGSF) invests in the QGF, and its NAV reflects the traded prices of QGF on the exchange. Thus, in the current scenario, QGSF too will enjoy the benefit of lower premiums paid by QGF to acquire gold. The lower premiums will translate into smaller increases in daily NAV for QGSF compared to other gold savings funds that track the trading prices of their respective Gold ETFs, which as seen in the above table are trading at higher premiums. But investors should keep in mind that this lower NAV change of QGSF is, in fact, reflective of lower purchase prices paid by the underlying QGF, which in turn will generate better returns for the QGSF.

Once the supply constraints ease, it is likely that these premiums will even out over time. Therefore, lower premiums are better for investors. However, given QGSF is trading at lower premiums, its current performance will look temporarily inferior as compared to its peers. However, in reality, it is not underperforming but helping investors invest in gold at lower premiums! Better for you, dear reader!

There will be funds out there who's NAV will be temporarily 'inflated' as a result of this premium, but being the investor focused Fund House that Quantum is, we are happy to reflect lower NAVs as long as the lower premiums for the same quality of Gold ultimately benefits the one person around whom the company is built and for whom we exist - YOU dear investor!

Given the current market scenario we advise you to allocate wisely to gold.

| Name of the Scheme & Primary Benchmark | This product is suitable for investors who are seeking* | Risk-o-meter of Scheme |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns •Investments in units of Quantum Gold Fund - Exchange Traded Fund whose underlying investments are in physical gold. |  Investors understand that their principal will be at Moderately High Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumMF.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More