Indian Bonds Going Global

Posted On Thursday, Sep 22, 2022

Recently, there have been increasing conversations about the potential inclusion of Indian government bonds into the global bond indices. Indian bond market has defied the global trend of rising bond yields over the last two months on an expectation that India will be included in the JP Morgan GBI-EM Global Diversified Index and foreigners will rush to buy Indian bonds.

Government has also joined the inflation fight. Over the last two months, the central government has reduced taxes on petrol and diesel, doubled the fertilizer subsidy, cut the import taxes on edible oils, put a limit on the export of wheat and sugar and imposed an export duty on exports on iron and steel. Various state governments have also reduced the VAT (value added tax) on petrol and diesel.

India has one of the largest local currency government bond markets among emerging-market economies with over Rs. 86 trillion (USD 1.2 trillion) of outstanding debt stock. But long-held restrictions on foreign buying of its bonds have kept it out of the top benchmarks used by global money managers.

In April 2020, the RBI removed all the foreign investment caps for a list of government securities under the fully accessible route (FAR). This opened up the possibility of India’s inclusion in the global bond indices.

Currently, there are 22 bonds in the FAR list with maturities ranging between 1 to 30 years. The total outstanding amount of FAR bonds is Rs. 22.8 trillion (USD 287 billion).

Despite the removal of investment restrictions on Indian debt, global investors held back India’s index inclusion citing problems with capital controls, custody and settlement, taxations, and other operational snags.

In October 2021, JP Morgan put India on the watchlist. It noted - “India (INR) government bonds are on track to be placed on Index Watch (observation period) for eligibility to the GBI-EM Global Diversified Index”. As per the agency “India is the largest ‘off-index’ market with the potential to reach a 10% allocation in the GBI-EM GD”.

The report also highlighted two key hurdles in the index inclusion –

(1) ability to access the market through an international central security depository (e.g. Euroclear)

(2) clarity on taxes.

There has been no progress on these two remaining issues till now.

So, what changed?

JP Morgan removed Russian debt from all its bond indices in March 2022 in response to Russia’s attack on Ukraine.

Russia had a weight of about 8% in the JP Morgan GBI EM Index. Its removal led to an excessive concentration among a few countries within the index. Now, 7 countries in the GBI-EM Index have the maximum allowed weight of 10%, while the remaining 13 countries have a combined weight of only 30%.

This has fuelled an expectation that global investors may overlook some of the remaining concerns and prefer to include India this time.

India’s index inclusion would add diversification to the index, enhance the yield and expand the market opportunities for global debt investors. So, the benefits might outweigh the concerns.

What does it mean for India?

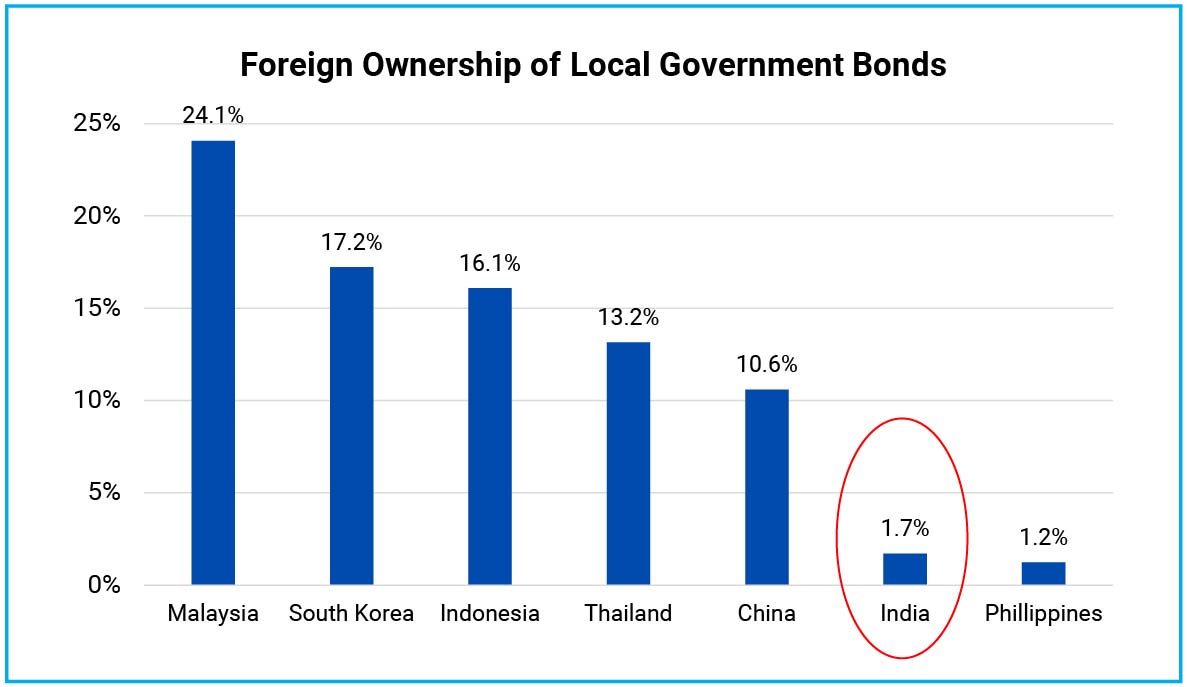

Unlike equities, Indian bond markets have failed to attract any sizeable pool of foreign capital till now. Foreigners hold less than 2% of Indian bonds; while the government is excessively relying on commercial banks and the RBI to fund its large borrowing program.

Chart – I: Indian Bonds are under-owned by foreigners

Source – www.asianbondsonline.adb.org, RBI, Quantum Research.

Data for India as of 16th Sep 2022, Korea as of Mar 31, 2022, China as of Sep 30, 2021, and all others are as of June 30, 2022

Index inclusion will open up a source of durable demand for Indian bonds from investors who track the index, particularly from the exchange-traded funds or ETFs. Even active investors will be more comfortable investing in India when it becomes part of the index.

Apart from the direct impact of additional demand, there are other benefits as well.

• The new demand source for government bonds might also help in deepening the corporate bond market in India.

• Potential foreign inflows into Indian debt will expand the source of foreign capital which in turn will strengthen India’s balance of payment situation and deepen the market for the Indian Rupee.

• Foreign holding of bonds would enforce much stricter discipline on the fiscal and monetary policy.

• Increased participation by foreign investors, would enhance the credibility of the Indian bond market and will make it easier for the government and the corporate sector to raise debt capital from global investors.

Clearly, India has a lot to gain from Index inclusion. However, there are downsides as well. High foreign holding of debt might expose Indian markets to external shocks. Large inflows-outflows linked to developments in the global markets can have an outsized impact on the domestic bond and currency markets.

Thus, additional safeguard measures will have to be deployed to deal with any such external shocks.

What does the bond market expect?

As per estimates by some global investment banks, India’s inclusion in the GBI-EM Index could attract around USD 25-40 billion foreign inflows in the first year. Inclusion into Bloomberg’s Global Aggregate Index could attract another USD 7-10 billion.

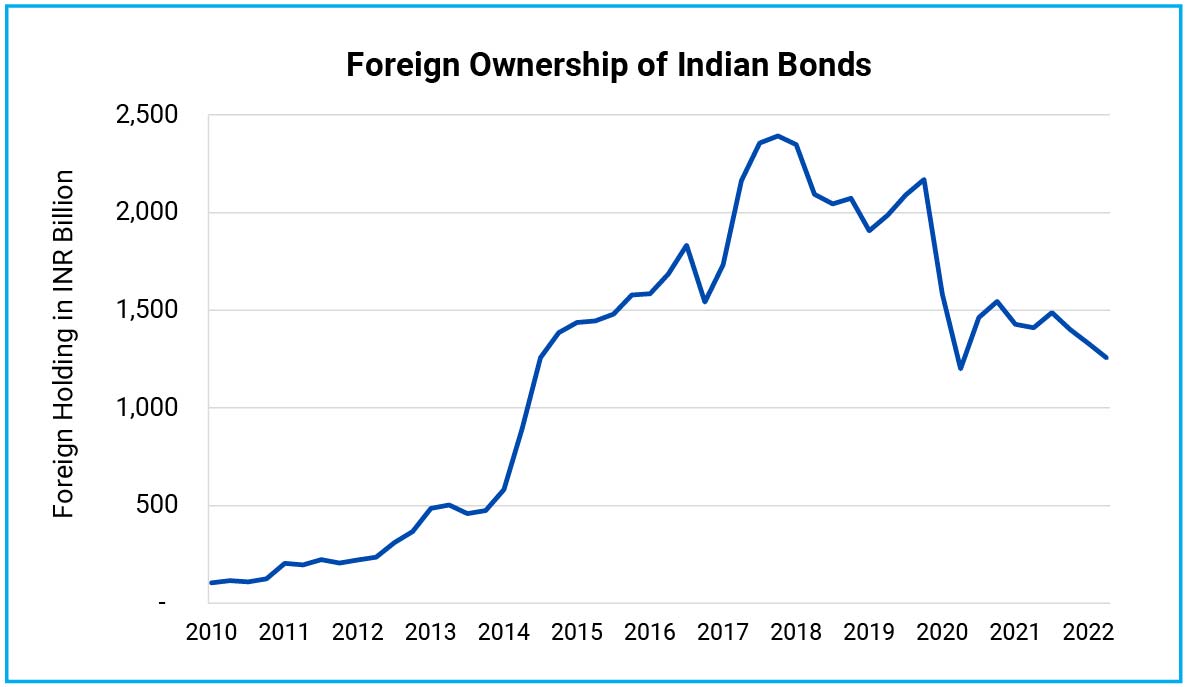

Currently, foreign investors holding Indian government bonds are around USD 18 billion and corporate bonds are around USD 13.8 billion. A sharp jump in foreign demand will be a big boost for the Indian debt market. It should drive bond yields lower and prices higher.

Chart – II: FPI has shied away from Indian Debt Since 2018

However, we expect it to be a story for the next year. Even if JP Morgan announces India’s inclusion into its emerging market bond index, it would take around 6-12 months for actual inclusion to start. The lead time allows investors to set up accounts and make other operational arrangements.

We expect actual inclusion to start sometime between April – September 2023, assuming the announcement comes during this month or the next. Based on the ongoing practise, the inclusion should happen with a starting index weight of 1% which would go up to the final 10% weight in 10 months period with a one percentage point increase in weight every month.

So, passive inflows should come during the second half of 2023. There is a possibility that active global investors will load up the Indian bonds before the actual inclusion. However, we do not expect any significant inflows at this stage given the uncertainty over the future course of monetary policy in the advanced economies.

Almost all the major central banks are hiking interest rates and reducing liquidity to fight inflation. Bond yields across all the major economies have been moving higher sharply. This might not be a conducive environment for investors to take a tactical bet on an emerging market local bond.

Thus, in the near term, the impact of index inclusion would be purely sentimental. There is a possibility of a very short-term 10-20 basis points dip in bond yields following the index inclusion announcement. However, we do not see a sustained fall in yields in the current year. We would prefer to wait for the global central banks to slow down the pace of rate hikes before taking any bet on India’s index inclusion.

Outlook

Indian bond yields have been falling (bond prices rising) since mid-June 2022. The 10-year government bond yield peaked at 7.6% in June 2022. It fell to 7.45% by June end, 7.32% by July end, and 7.24% by August end and dipped to the lows of 7.07% during the second week of September 2022. It gave up some of the gains over the last few days and is currently trading around 7.24% as on September 20, 2022.

The decline in bond yields started with a clamour of global growth slowdown and falling commodity prices. The rally was extended on the expectation of index inclusion chatters.

The domestic monetary policy in India is near its fag end. The market is already pricing for the Repo rate to peak around 6% by this year-end and remain there for some time. However, the RBI might maintain its hawkish tone beyond 2022 if the external monetary environment remains hostile.

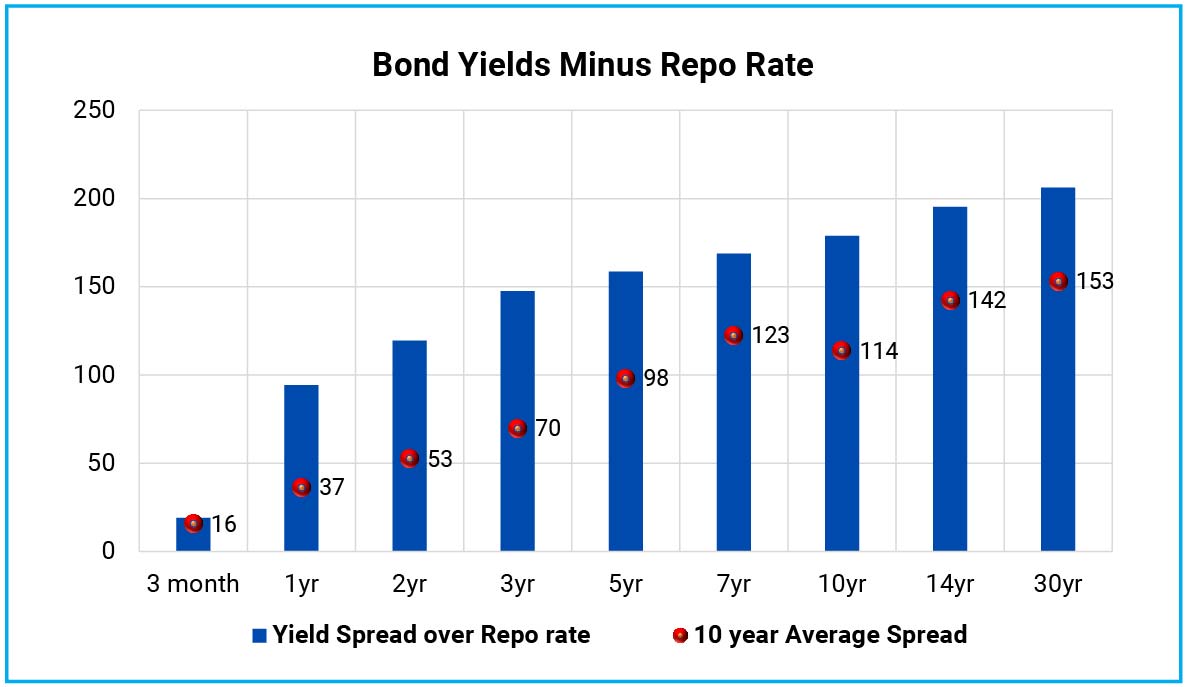

We maintain our view that the worst of the bond market sell-off is now behind us though there we may not see a reversal happening anytime soon. Medium to long-term bond yields should trade in a narrow range for the next 3-6 months.

Chart – III: Yield Spreads over Repo Rate are significantly above their long-term averages – pricing for potential rate hikes, demand-supply imbalance, and other uncertainties

Past Performance may or may not sustained in future.

We expect the 10-year government bond yield to trade in a broader range of 7.1%-7.5%. The short end of the curve will likely move higher with Overnight rates moving closer to 6% by the year-end.

Considering the duration-accrual balance, the 3-5 years segment remains the best play as core portfolio allocation. The long end of the yield curve is vulnerable to an adverse demand supply shock. However, any mispricing in this segment can be exploited through tactical positioning from time to time.

Portfolio Positioning

In the Quantum Dynamic Bond Fund (QDBF), we have been avoiding long-term bonds for some time due to our cautious stance on the markets. The defensive positioning helped the portfolio ride through the market sell-off since the start of the year.

Given the bond yields are currently near the bottom of our expected yield range, we have turned defensive and created some cash-like positions in the portfolio to defend against any sudden jump in the market yields.

We would prefer to move into the 3-5 years maturity government bonds as a core portfolio allocation. We would also remain open and nimble to exploit any market mispricing by making a measured tactical allocation to any part of the bond yield curve as and when the opportunity arises.

We stand vigilant to react and change the portfolio positioning in case our view on the market changes.

What should Investors do?

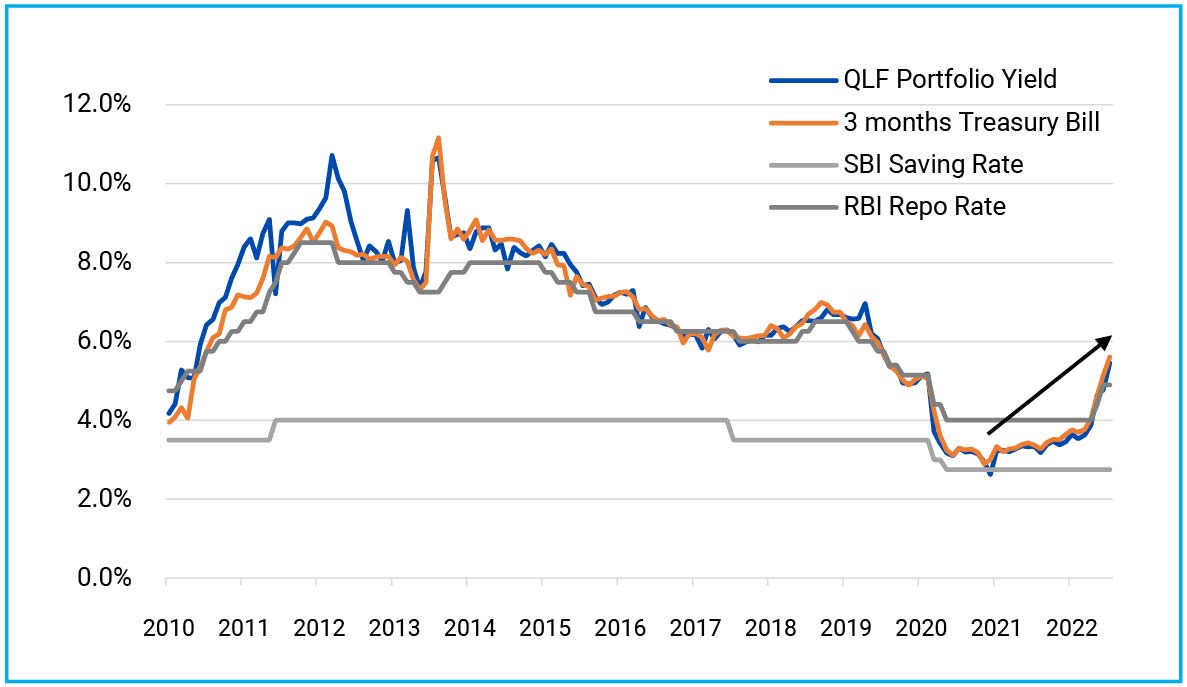

The interest rate on short-term treasury bills has jumped about 190 basis points (1.9%) in the last 6 months. With more rate hikes coming, short-term treasury bill rates are expected to move higher. This suggests higher potential returns from investments in liquid and short-term money market funds going forward.

Chart – IV: Liquid Fund Yields Closely Tracks 2-3 Months Treasury Bill Rate

Past Performance may or may not sustained in future.

Since the interest rate on bank saving accounts are not likely to increase quickly while the returns from the liquid fund are already seeing an increase, investing in liquid funds looks more attractive for your surplus funds.

Investors with a short-term investment horizon and with little desire to take risks should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Investors with more than 2-3 years holding period can consider dynamic bond funds which have the flexibility to change the portfolio positioning as per the evolving market conditions.

Medium to Long term interest rates in the bond markets are already at long-term averages as compared to fixed deposits which remain low. With higher accrual yield (interest income) and relatively lower price risk (compared to the last two years), dynamic bond funds are appropriately positioned to gain over the next 2-3 years.

Investors in dynamic bond funds or any other medium to long-term debt funds should be ready to tolerate some intermittent volatility associated with the movement in the market interest rates.

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Liquid Fund An Open-ended Liquid Scheme. A relatively low interest rate risk and relatively low credit risk. | • Income over the short term • Investments in debt / money market instruments |  Investors understand that their principal will be at Low Risk |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on August 31, 2022.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

| Potential Risk Class Matrix – Quantum Liquid Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | A-I | ||

| Moderate (Class II) | |||

| Relatively High (Class III) | |||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More