Let's Bond with Bonds

Posted On Wednesday, Jul 20, 2022

In the June 2022 edition of the Debt Market Observer - Looking Beyond FED, we made a case that the inflation narrative has peaked. Market developments since then have made us more convinced about the inflation endgame.

Commodity Crack

Commodity prices have been softening for the last 2-3 months due to moderation in the global growth outlook. Lockdown in China and fear of recession in the US and Europe accelerated the pace of decline in last 4-6 weeks. Prices of most of the industrial as well agricultural commodities are down upto 50% from their recent peaks.

Table - I: Commodities off peak on recession fears

| % Price Change from the Peak | % Price Change year till date | |

| Thomson Reuters Core Commodity CRB Index | -13% | 23% |

| S&P GSCI Agriculture Index | -22% | 7% |

| Brent Crude Oil | -17% | 37% |

| Bloomberg Industrial Metals Subindex | -39% | -16% |

Our inflation estimates were not based on the highest level of commodity prices. So this drop in prices may not materially change the inflation numbers immediately. However, the upside risk to the inflation estimate in this year has gone down to a significant extent.

If commodities prices stabilize, India’s CPI inflation should come below the RBI’s upper threshold of 6% by early next year from the current levels of above 7%. Given the synchronized global monetary tightening and slowing global growth, this seems the most plausible outcome.

Monsoon on Track

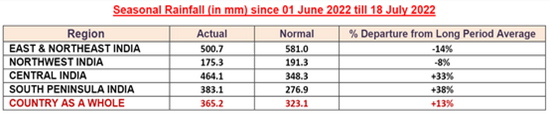

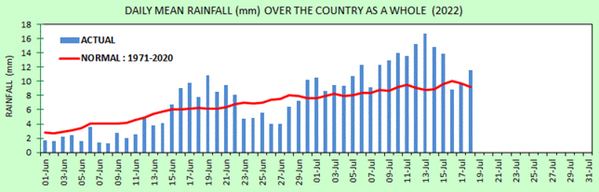

Domestically also things have improved for inflation to cool off. After initial delays, monsoon has now picked up sharply. Total rainfall between June 1, 2022 to July 18, 2022 is 13% above the long term average rainfall during this period. However, spatial distribution of monsoon is bit concerning as the monsoon activity is concentrated in the western and southern region of the country while the north and east parts are still in deficiency.

Table - II: Total rainfall in surplus; but spatial distribution is poor

Source - India Meteorological Department; data as of July 18, 2022

Sowing of kharif crops has also picked up along with the southwest monsoon; though total acreage is still lagging in Rice compared to its last 5 years trend.

Much of the rainfall in the current monsoon season has come in the last two weeks. So, the sowing activity should pick up sharply from here on.

Table - III: Kharif sowing picked up; still lagging in Rice

| Crop | Normal Total Kharif Sowing Area (In Million Hectares) for Kharif Season | Area Sown (In Million Hectares) as of July 15, 2022 | ||

| 2022 | 2021 | % Year-on-Year Change | ||

| Rice | 39.7 | 12.8 | 15.6 | -17.9% |

| Pulses | 14.0 | 7.3 | 6.7 | 9.0% |

| Course-cum-Nutri Cereals | 18.4 | 9.4 | 8.7 | 8.0% |

| Oilseeds | 18.4 | 13.4 | 12.5 | 7.2% |

| Sugarcane | 4.7 | 5.3 | 5.4 | -1.9% |

| Jute & Mesta | 0.7 | 0.7 | 0.7 | 0.0% |

| Cotton | 12.6 | 10.3 | 9.7 | 6.2% |

| Total | 108.5 | 59.2 | 59.3 | -0.2% |

Globally, agricultural commodity prices have started to soften. A healthy monsoon season should help in easing food prices in the domestic market as well.

Government's inflation fight

Government has also joined the inflation fight. Over the last two months, the central government has reduced taxes on petrol and diesel, doubled the fertilizer subsidy, cut the import taxes on edible oils, put a limit on the export of wheat and sugar and imposed an export duty on exports on iron and steel. Various state governments have also reduced the VAT (value added tax) on petrol and diesel.

The government is particularly sensitive about the food and fuel inflation that have been elevated for the last two years. The government may announce more measures to bring down inflation or at least to a put a cap on it.

Indian CPI basket has close to 5% weight in petroleum fuel items and around 46% weight in food items. Thus, reduction in food and fuel prices could sharply bring down the inflation.

Inflation losing Momentum

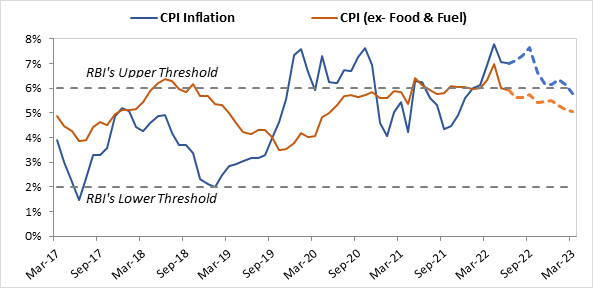

In June 2022, CPI inflation grew at 7.01% yoy, posting third consecutive month of decline in the headline CPI from 7.05% in May 2022 and 7.8% in April 2022. We found some green shoots in the inflation internals.

Sequential momentum across various high weightage items like Cereals, Meat & Fish, Spices, Prepared meals and clothing & footwear have softened in June. Prices of Oil & Fats came down due to drop in global edible oil prices and reduction in import duties by the Government. The transports and communication index came down due to earlier reduction in fuel taxes. Another positive sign was the moderation in the sequential momentum in some of the key services like health care and recreation.

We expect the headline CPI inflation to move up again between July - September 2022 due to lower base effect from the last year and seasonal uptick in the vegetable and fruit prices. However, it should come down sharply in the second half of the year.

RBI’s monetary policy committee, may deliver another 25-50 basis points of rate hike in its August meeting, to take the repo rate above its pre-pandemic level of 5.15%. However, easing of inflation momentum should take off some pressure and allow the RBI to slow down the pace of rate hikes in the second half of the year. The RBI may still take the Repo rate to 6.00% by early next year to take the short-term real interest rates into positive territory.

Chart - I: Inflation Elevated; But Likely to Slide Lower

Source - MOSPI, Quantum Research

@Actual Data upto June 2022. Data between July 2022 to December 2022 is based on

Quantum Fixed Income Team’s Estimates and may or may not turn out the same.

What does this mean for the Bond Market?

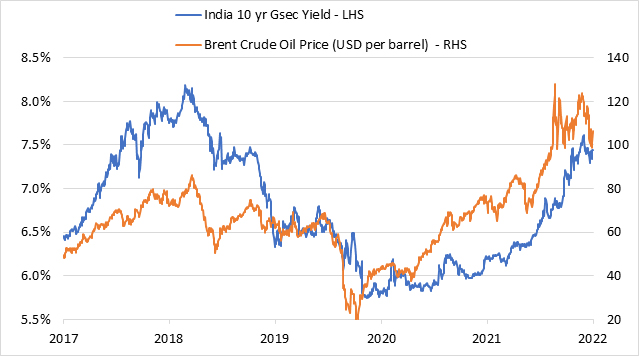

Bond yields have come down sharply in the last 4-5 weeks in response to falling commodity prices and falling US treasury yields. The 10-year Indian government bond yield peaked at 7.60% on June 13, 2022. It fell below 7.30% in the first week of July. Currently, on July 18, 2022, the 10-year Indian government bond is trading at a yield of 7.44%.

Chart - II: Moderating Commodity Prices to Cap Indian Bond Yields

Source - Refinitiv, Quantum Research; Data as of July 18, 2022

Past performance may or may not be sustained in the future

Last month, we wrote to investors that the prevailing valuations at the medium to long maturity bonds had built in a significant uncertainty premium (Looking Beyond FED). The recent drop in the bond yields and the consequent compression of yield spread on medium to long duration bonds over the repo rate, has lowered the uncertainty premium

somewhat.

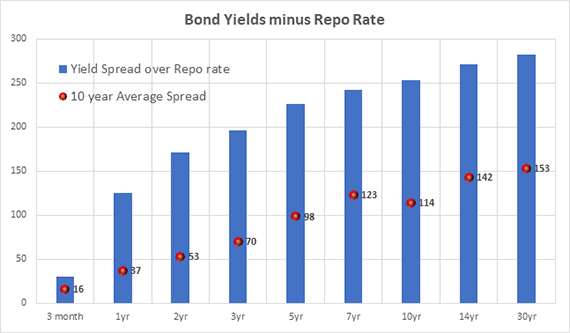

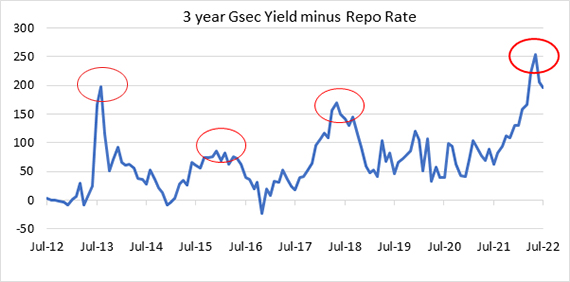

However, term spreads (yields on long term bonds over shorter maturity bonds or the repo rate) are still significantly higher than their long term averages. At 6.88% yield, the 3-year government bond is currently trading at about 200 basis points above the policy repo rate of 4.90%. The long-term average of this spread in a tightening interest rate environment is ~80 basis points.

Chart - III: Yield Spreads over Repo Rate are significantly above their long-term averages -

pricing for potential rate hikes, demand supply imbalance and other uncertainties

Source - Refinitiv, Quantum Research; Data as of July 18, 2022

Past performance may or may not be sustained in the future

Chart - IV: Bond Valuations have built-in significant uncertainty premium

Source - Refinitiv, Quantum Research; Data as of July 18, 2022

Past performance may or may not be sustained in the future

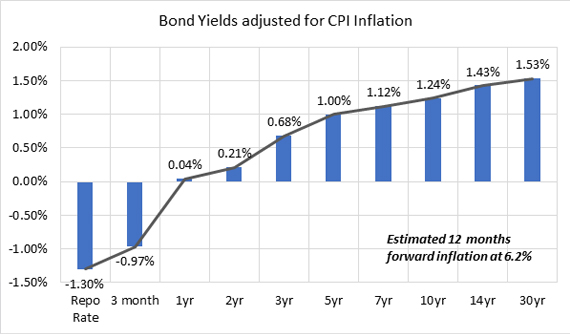

Even in terms of real rates (interest rates/bond yields minus expected inflation rate), yield on government bonds beyond 1 year maturity are now above the average 12 months forward inflation estimate. Our estimate of 12 months average forward inflation (simple average of expected monthly inflation estimates from July 2022 till June 2023) is around 6.2%.

Chart - V: Real rates are now in positive territory beyond 12 months term

Source - Refinitiv, Quantum Research; Data as of July 18, 2022

@ Real rates are calculated based on forward 12 months CPI inflation as per the Quantum Fixed Income Team’s Estimates;

Future estimates may or may not turn out the same. Past performance may or may not be sustained in the future

Outlook

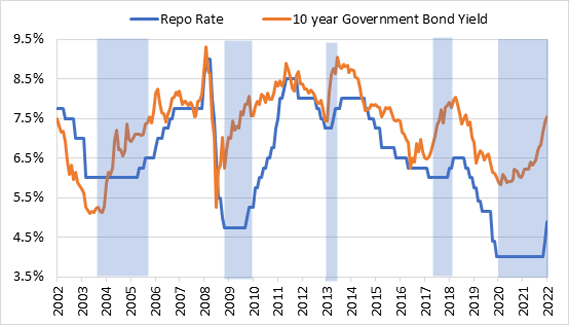

Markets have a tendency to pre-empt policy moves. Yields on medium to long term bonds had moved up over the last 12 months to price for the rising inflationary risks and potential rate hikes by the RBI.

At current valuations, much of the potential rate hikes are already priced in the medium to long duration bonds. Thus, the bond market may not be too sensitive to RBI’s rate hikes going forward.

As the RBI delivers on the expected rate hikes, short term interest rates – yield short term treasury bills etc. should move higher proportionately. However, long term bond yields may remain in a tight range or move up only marginally.

We found a similar trend in past. In all the previous rate hiking cycles, maximum jump in yields had happened up until the first-rate hike. Thereafter, yields moved up only marginally or got stuck in a narrow range.

Chart - VI: Bond Market has run ahead of the Policy rates; Much of the potential Rate Hikes are already Priced

Source - Refinitiv, Quantum Research; Data as of July 18, 2022

Past Performance may or may not sustained in future.

There is still a risk of yields moving up due to unfavorable demand-supply balance. Long term bonds (above 5 years maturity) are more exposed to this risk as their prices are more sensitive to interest rate changes. When market interest rates rise, long term bond prices fall more compared to prices of shorter maturity bonds.

Since we are in a rising interest rate environment, at this stage our strategy should be to have higher accrual with a lower maturity/duration. In our opinion 2-5 year maturity bonds offer this critical balance between accrual (interest income) and duration (price changes).

Portfolio Positioning

In the Quantum Dynamic Bond Fund (QDBF), we have been avoiding long-term bonds for some time due to our cautious stance on the markets. The defensive positioning helped the portfolio ride through the market sell-off over the last 6 months.

Bulk of the QDBF portfolio is currently positioned in the 1-3 years maturity bonds. We continue to like the 2-5 year segment of the bond market and maintain our cautious stance on the above 5 year maturity bonds.

However, we would remain open and nimble to exploit any market mispricing by making a measured tactical allocation to any part of the bond yield curve as and when the opportunity arises.

We stand vigilant to react and change the portfolio positioning in case our view on the market changes.

What should Investors do?

Interest rate on short term treasury bills have jumped about 160 basis points (1.6%) in the last 6 months. With more rate hikes coming, short term treasury bill rates are expected to move higher in coming months. This suggests higher potential returns from investments in liquid and debt funds going forward.

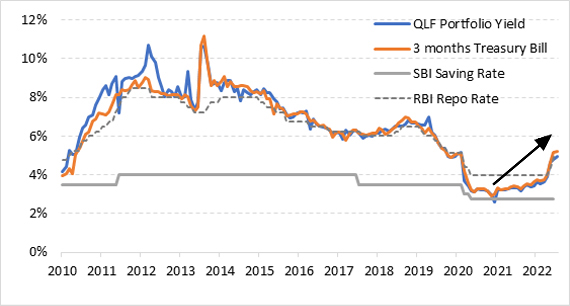

Chart - VII: Liquid Fund Yields Closely Tracks 2-3 Months Treasury Bill Rate

Past performance may or may not be sustained in the future

Since the interest rate on bank saving accounts are not likely to increase quickly while the returns from liquid fund are already seeing an increase, investing in liquid funds looks more attractive for your surplus funds. Investors with a short-term investment horizon and with little desire to take risks, should invest in liquid funds which own government securities and do not invest in private sector companies which carry lower liquidity and higher risk of capital loss in case of default.

Investors with more than 2-3 years holding period can consider dynamic bond funds which have a flexibility to change the portfolio positioning as per the evolving market conditions.

Medium to Long term interest rates in the bond markets are already at long-term averages as compared to fixed deposits which remain low. With higher accrual yield (interest income) and relatively lower price risk (compared to last two years), dynamic bond funds are appropriately positioned to gain.

However, investors in debt fund dynamic bond funds or any other medium to long term debt funds should be ready to tolerate some intermittent volatility associated with the movement in the market interest rates.

For any queries directly linked to the insights and data shared in the newsletter, please reach out to the author – Pankaj Pathak, Fund Manager – Fixed Income at [email protected].

For all other queries, please contact Neeraj Kotian – Area Manager, Quantum AMC at [email protected] / [email protected] or call him on Tel: 9833289034

Read our last few Debt Market Observer write-ups -

- Looking Beyond FED

- RBI Sprint - Market Tremors

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum Dynamic Bond Fund An Open-ended Dynamic Debt Scheme Investing Across Duration. A relatively high interest rate risk and relatively low credit risk. | • Regular income over short to medium term and capital appreciation • Investment in Debt / Money Market Instruments / Government Securities |  Investors understand that their principal will be at Low to Moderate Risk |

* Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on March 31, 2022.

| Potential Risk Class Matrix – Quantum Dynamic Bond Fund | |||

| Credit Risk → | Relatively Low | Moderate (Class B) | Relatively High (Class C) |

| Interest Rate Risk↓ | |||

| Relatively Low (Class I) | |||

| Moderate (Class II) | |||

| Relatively High (Class III) | A-III | ||

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

The Pivot

Posted On Friday, Apr 21, 2023

The fiscal year 2022-23 has come to an end. The defining feature

Read More -

Yield Curve Inversion Ahead

Posted On Thursday, Mar 23, 2023

Indian money markets have tightened meaningfully over the last one and a half month.

Read More -

Past, Present, and Future of Inflation

Posted On Friday, Feb 24, 2023

Inflation has been one of the biggest challenges in the post-pandemic world.

Read More