Are You Navigating Small Caps or Just Following the Herd?

Posted On Monday, Sep 15, 2025

Imagine a small castle surrounded by a deep, wide moat filled with water. The purpose of that moat? To protect the castle from invaders. The wider and deeper the moat, the harder it is for anyone to break in. In life and in investing, a moat works the same way—it's something that gives you an edge, a way to stay ahead and stay protected.

In mutual fund investing—especially in small-cap it is critical how to choose the company for investing. That’s where stock picking becomes your moat—your way of building a solid defence against uncertainties and risky situations.

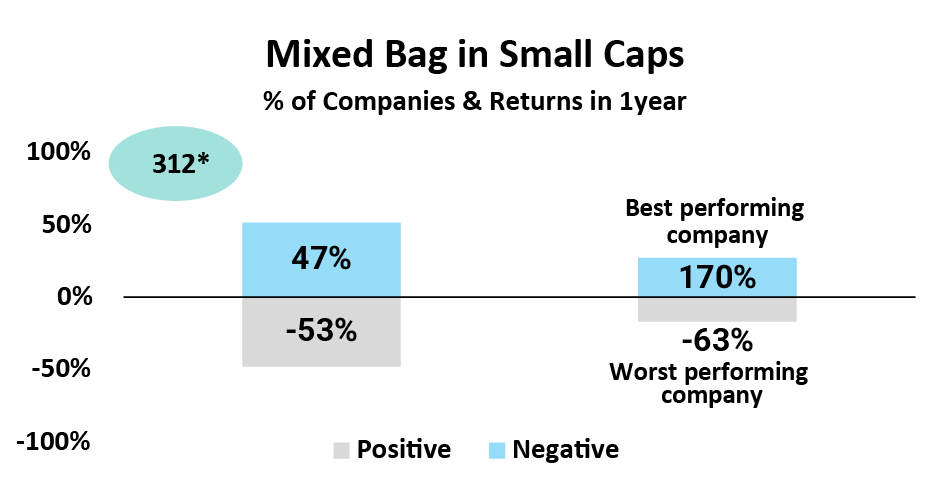

Looking at the BSE 250 SmallCap Index, while 47% of the companies have given positive returns, 53% of the companies have given negative returns during the same time frame.

Source: Bloomberg. Data as on August 2025. *Data analysed for BSE 250 Small Cap Index companies for the last one year ended August 2025. Past performance may or may not be sustained in the future.

That’s almost a 50-50 coin toss! It shows that just randomly investing in small-cap companies—or following the Index—may not take you far. Picking the right small cap stocks makes all the difference.

▎Why is stock picking so important & so powerful, especially in small-cap funds?

Stock picking acts as a moat in small-cap investing primarily because small-cap universe is large and the stocks are generally under-researched, not liquid, more volatile, and sensitive to economic cycles, creating opportunities for fund managers to find undervalued companies with high growth potential that broader Index or passive approaches may miss.

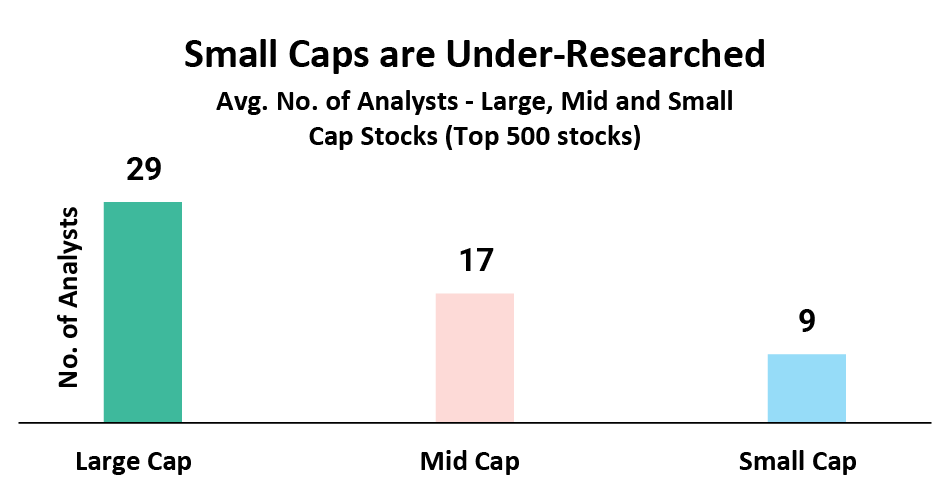

▎Small Cap Companies are not in Focus

Small-cap companies don’t get much focus in media or analyst attention many a times. That means many of them are under the radar. This can create an opportunity to find good businesses that others are missing—like spotting a hidden gem at a flea market.

Source: Bloomberg. Data as on August 2025. The above Analysts refers to the Institutional Sell side brokers in India.

▎More Options = More Chances to get it Right (or Wrong)

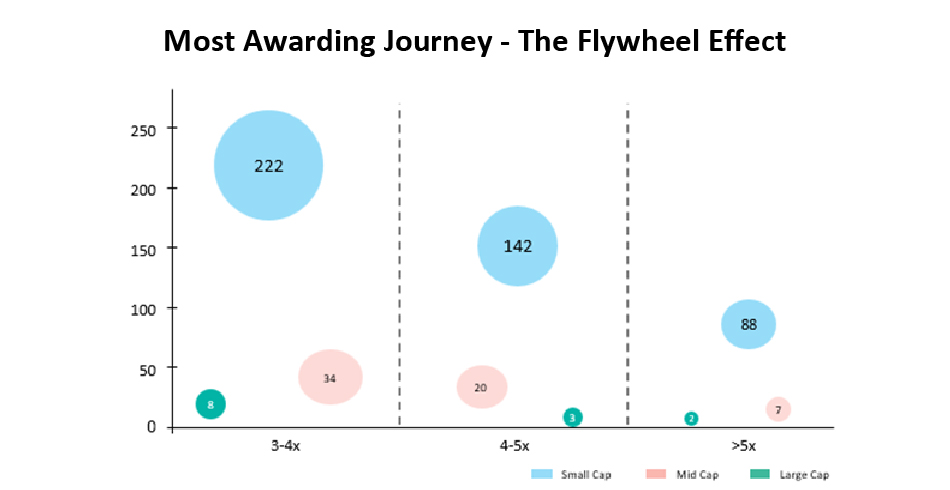

The small-cap universe is vast (over 4000 companies vs 250 in large and mid-caps put together) spanning to diverse sectors and industries, providing a wide platform for selective stock picking to find unique growth stories. Astute fund managers could identify such stories in their early growth phase which may deliver outsized returns over a period of time.

Source: Bloomberg. Data as on FY 24-25. Top 500 stocks based on highest returns in last 10yrs & shorted on Market Cap. Past performance may or may not be sustained in the future.

▎A Smart Filter helps

Using an approach like Sustainable Growth at Reasonable Price (S-GARP)—combined with a check on liquidity and governance— can do wonders in Small Cap investing. It can help find companies that can navigate inefficiencies, capitalize on cycles and themes, avoid pitfalls in this inherently riskier segment and are built on solid foundations. Passive approaches or broad indexes often do not capture these nuanced opportunities well and may underperform despite similar risk exposure, making skillful stock picking essential for better risk-adjusted returns in small caps.

Two important filters—liquidity and corporate governance—along with sustainable earnings growth potential, driven by a strong balance sheet, large opportunity size, and capable management to capitalize on these opportunities, form the modus operandi for creating long-term growth in small-cap investing.

Summary

Just like a moat protects a castle, good stock picking can help protect investments in the high-risk world of Small Cap investing. It gives an edge—avoiding the noise, focusing on quality, and staying ahead of the average.

|

Mr. Chirag Mehta is managing the scheme since November 03, 2023.

Ms. Abhilasha Satale is managing the scheme since November 03, 2023.

| Performance of the Scheme | as on August 29, 2025 | |||||

|---|---|---|---|---|---|---|

| Quantum Small Cap Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (November 03, 2023) | 13.87% | 17.59% | 13.93% | 12,670 | 13,434 | 12,682 |

| 1 year | -1.02% | -9.25% | -1.95% | 9,898 | 9,078 | 9,805 |

#BSE 250 SmallCap TRI; ## BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Performance details of other funds managed by Mr. Chirag Mehta & Mrs. Abhilasha Satale. Click here

Product Labeling

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

|---|---|---|---|

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI |

|  |  |

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More