This Akshay Tritiya, How Best to Invest in Gold?

Posted On Tuesday, May 04, 2021

The festival of summer is here, one of the most auspicious days for buying Gold. For centuries, we have always understood the intrinsic value the yellow metal holds when it comes to wealth creation. Buying Gold during Akshaya Tritiya is considered to be a sign of inviting prosperity into the household.

What is the future of this yellow metal?

As an asset class, Gold has generally seen a negative correlation with other asset classes such as equity, debt, and tends to perform better during risk-off periods. With high inflation rates and low bond yields, gold is likely to benefit and will continue to play a risk-reducing, return-enhancing role in the long run.

What are the 4 Advantages of Investing in Gold ETF?

|

|

|

|

|---|

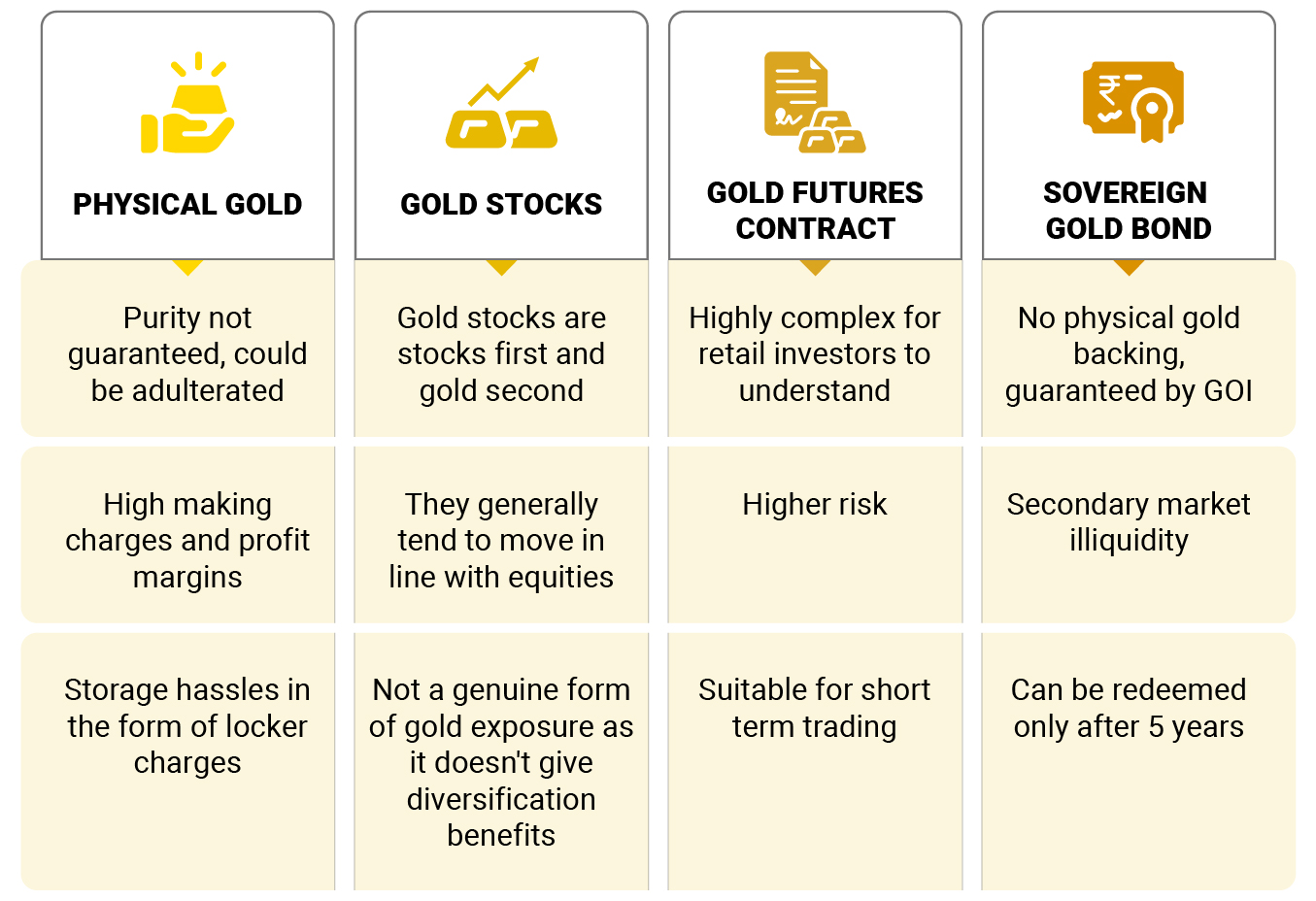

Is purchasing of physical gold your only option?

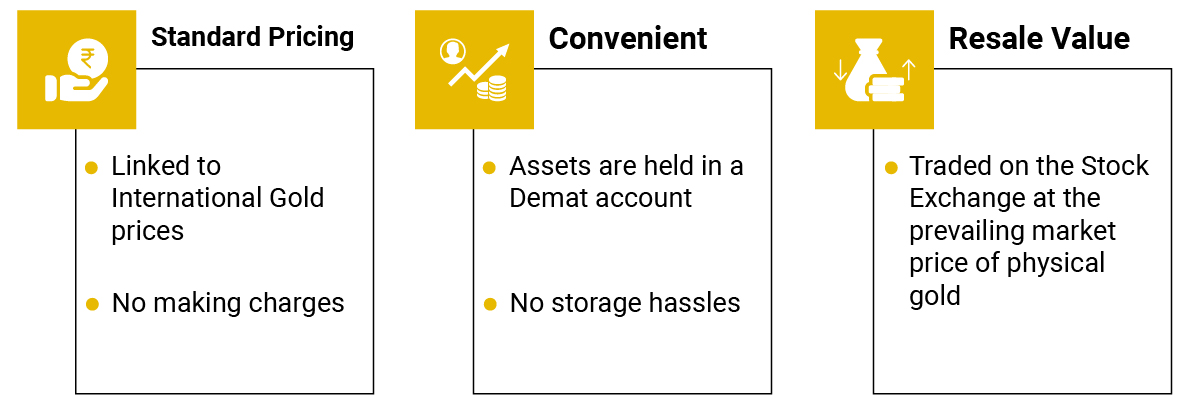

To answer your question, you could explore the mutual fund route through ETFs – Exchange Traded Funds allow you to invest in Gold in a matter of few clicks from the comfort of your home. This year, you don’t have to worry about keeping up with the tradition, thanks to ETFs.

Given the lockdown restrictions and rapidly rising Covid cases in India, it is evident that safety comes first. Buying physical gold from your local jewelry store and putting your life at risk might not be advisable.

Let us look at the benefits of investing in ETF compared to physical Gold and other forms of digital Gold assets.

Benefits of Gold ETF

What are the 5 key reasons to invest in Quantum Gold Fund?

How do we ensure the purity of Gold?

We highly recommend, you watch our webinar video where our Sr. Fund Manager, Chirag Mehta and Compliance Officer Malay Vora have discussed at length about the measures we take to safeguard your gold.

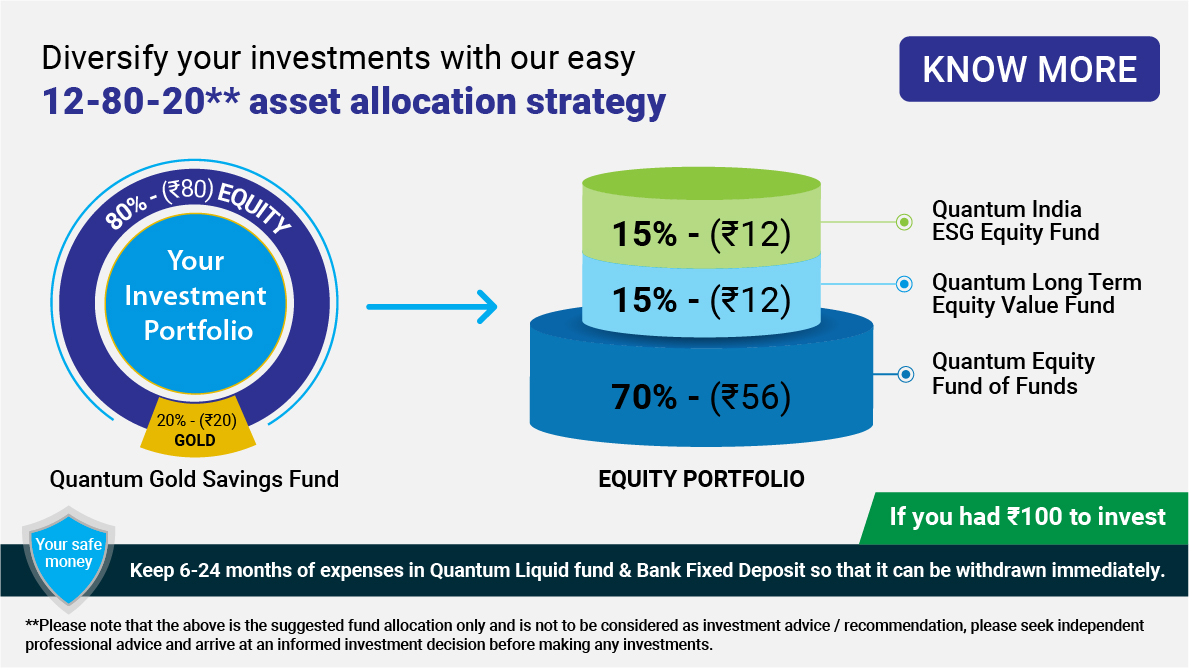

Suggested Asset allocation

As seen in the illustration, it is suggested to follow the age-old advice of allocating 20% of the entire portfolio allocation to Gold.

Considering the uncertainty looming around in the financial market and the restrictions of buying physical gold, it makes sense to follow your traditions with a difference and invest in Quantum Gold Fund.

The auspiciousness of the occasion can never be replaced. However, as a smart investor, you can change the way how you buy Gold.

Wish you a Happy Akshaya Tritiya!

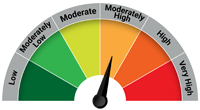

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer |

| Quantum India ESG Equity Fund An Open ended equity scheme investing in companies following Environment, Social and Governance (ESG) theme | • Long term capital appreciation • Invests in shares of companies that meet Quantum's Environment, Social, Governance (ESG) criteria. |  Investors understand that their principal will be at Very High Risk |

| Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |

| Quantum Equity Fund of Funds An Open Ended Fund of Funds scheme Investing in Open Ended Diversified Equity Schemes of Mutual Funds | • Long term capital appreciation • Investments in portfolio of open-ended diversified equity schemes of mutual funds registered with SEBI whose underlying investments are in equity and equity related securities of diversified companies |  Investors understand that their principal will be at Very High Risk |

| Quantum Gold Fund An Open Ended Scheme Replicating / Tracking Gold | • Long term returns • Investments in physical gold |  Investors understand that their principal will be at Moderately High Risk |

| Quantum Gold Savings Fund An Open Ended Fund of Fund Scheme Investing in Quantum Gold Fund | • Long term returns • Investments in units of Quantum Gold Fund – Exchange Traded Fund whose underlying investments are in physical gold |  Investors understand that their principal will be at Moderately High Risk |

The Risk Level of the Scheme in the Risk O Meter is based on the portfolio of the scheme as on March 31, 2021.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Gold Monthly View for April 2025

Posted On Tuesday, May 06, 2025

Gold continued its upward momentum in April 2025 reaching as high as $3,495 an ounce.

Read More -

Waiting for Gold to Correct? Some Moments Are Too Auspicious to Wait!

Posted On Tuesday, Apr 29, 2025

It’s that time of the year again when prosperity is welcomed with open arms—and gold takes centre stage in celebrations across the country.

Read More -

Gold Monthly View for March 2025

Posted On Tuesday, Apr 08, 2025

After experiencing a surge of approximately 9% in 2025 through the end of February, gold prices further increased by an additional 9% in March, bringing year-to-date returns to around 19%.

Read More