NFOs: 5 Key Questions to Ask Yourself Before You Invest

Posted On Friday, Aug 27, 2021

The historic highs in the equity market and the boost in the retail investors have led to a burst of New Fund Offers (NFOs) from the mutual fund industry. As per data from AMFI in the past seven years, mutual funds have launched over 2,200 new schemes in India.

However, while every NFOs might bring with itself dreams of wealth creation, it is important to think a step ahead and first understand how NFOs work. And what are the factors to consider to help you decide if it adds value to your portfolio.

✅ How do NFOs work - Meaning of NFO • A mutual fund scheme is launched by the Asset Management Company on a subscription basis in the market by announcing an NFO (New Fund Offer) which invests in securities as per the scheme investment objective. • The Regulator SEBI mandates that a scheme NFO is open for a maximum period of 15 days. After that, they will reopen for subscriptions/redemptions. • The offer price to subscribe to such a mutual fund scheme is usually fixed at a face value per unit. After the closure of the NFO, investors can purchase or redeem units at a specified Net Asset Value (NAV). |

Following are the questions that you need to ask yourself before you decide to invest:

1. Is It Relevant to My Mutual Fund Objective?

Firstly, you need to revisit your financial objectives. Evaluate your short and mid-term goals with scheme investment objective.

2. Does It Offer Exposure to An Existing Sector or Theme?

Sometimes, NFOs are sector-specific or thematic and might not offer scope for diversification. So, to avoid concentration, check whether an investment in the fund is invested in a diversified scheme or skewed to a particular sector or market cap.

3. Do You Really Need Yet Another Fund in Your Portfolio?

No thumb rule says that more is always better and cheapest is always good. So, if you follow the NFO frenzy, it can get counterproductive.

Ask whether investing in an NFO adds an exposure that does not already exist.

4. Is It Better to Go For an Existing Fund?

It is better to go for a mutual fund that has a proven track record than to go for a completely new fund whose track record is yet to be established.

5. Will It Match My Risk Profile?

Not every Fund could match your risk profile. Assess the risk-return ratio and whether it aligns with your risk profile or are you taking an additional risk with no clear insight of return.

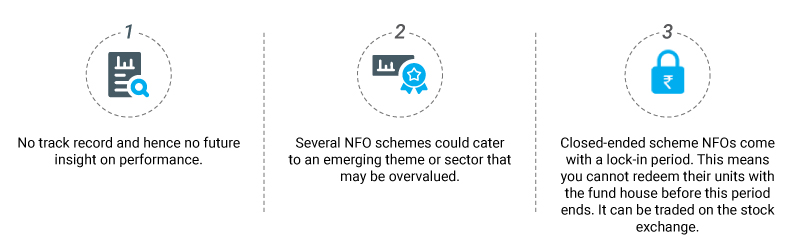

Factors to consider before investing in an NFO

Busting the Myth of A Lower Offer Price For Higher Profits

An NFO might provide an offer price that may or may not be higher than the NAV it declares thereafter. However, do NOT treat this as a discount coupon for getting mutual fund units at a cheaper rate. There is a general misnomer that mutual funds whose NAV is cheaper will be more profitable. However, this is a myth.

Suppose you invest Rs. 5000 in an NFO (let’s call this Fund A) at Rs 10 per unit and Rs. 5000 in an existing mutual fund scheme (and this can be Fund B) at Rs. 50 per unit. Consider both the funds appreciated by 10%. Let’s see this example to see which is more profitable.

| Fund A (NFO) | Fund B (Existing Fund) | |

| NAV Rs. | 10 | 50 |

| Investment Rs. | 5000 | 5000 |

| No of units purchased | 500 | 100 |

| NAV on redemption @10% rise | 11 | 55 |

| Corpus generated Rs. | 500x11 = 5500 | 5500 |

As we see in the example above, the lower NAV of Fund A did not have any difference in the mutual fund units.

To invest or not in NFOs is purely based on your investment objective and risk profile. However, since several key parameters such as the scheme’s past performance and future insight on a scheme portfolio are not known, it is best to exercise caution and not go overboard when it comes to allocation to these funds.

Read related article

If you want to ride the market ups and downs with peace of mind, explore Quantum Mutual Fund that has a track record of 15 years in the industry and mutual funds across equity, debt and gold assets.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments.

Mutual fund investments are subject to market risks read all scheme related documents carefully.

Please visit – www.QuantumAMC.com to read scheme specific risk factors. Investors in the Scheme(s) are not being offered a guaranteed or assured rate of return and there can be no assurance that the schemes objective will be achieved and the NAV of the scheme(s) may go up and down depending upon the factors and forces affecting securities market. Investment in mutual fund units involves investment risk such as trading volumes, settlement risk, liquidity risk, default risk including possible loss of capital. Past performance of the sponsor / AMC / Mutual Fund does not indicate the future performance of the Scheme(s). Statutory Details: Quantum Mutual Fund (the Fund) has been constituted as a Trust under the Indian Trusts Act, 1882. Sponsor: Quantum Advisors Private Limited. (liability of Sponsor limited to Rs. 1,00,000/-) Trustee: Quantum Trustee Company Private Limited. Investment Manager: Quantum Asset Management Company Private Limited. The Sponsor, Trustee and Investment Manager are incorporated under the Companies Act, 1956.

Related Posts

-

Invest without Stress - With Quantum Mutual Fund!

Posted On Monday, May 09, 2022

Since inception, Quantum AMC has stayed true to its Vision and Mission.

Read More -

Active or Passive Investing: Which Style is Right for You?

Posted On Tuesday, Apr 26, 2022

With such a wide variety of investment avenues and styles, you may be confused as to which is the best for you.

Read More -

Stay Ahead of Inflation During These Uncertain Times

Posted On Wednesday, Apr 13, 2022

Inflation has been slowly but steadily eating into the savings of investors.

Read More