- Why Quantum

-

Investment Solutions

- Product Suite

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Active FOF

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Allocation Fund

- Partner Corner

- Learning Lab

- Quantum Ethical Fund

- Quantum Small Cap Fund

- Quantum Value Fund

- Quantum ESG Best In Class Strategy Fund

- Quantum ELSS Tax Saver Fund

- Quantum Diversified Equity All Cap Active FOF

- Quantum Nifty 50 ETF Fund of Fund

- Quantum Nifty 50 ETF

- Quantum Multi Asset Allocation Fund

- Quantum Gold Fund - ETF

- Quantum Gold Savings Fund

- Quantum Dynamic Bond Fund

- Quantum Liquid Fund

- Quantum Multi Asset Active FOF

Notice

Dear Investor,

Pursuant to SEBI circular no. SEBI/HO/IMD/DF2/CIR/P/2020/175 dated September 17, 2020 read with circular no. SEBI/HO/IMD/DF2/CIR/P/2020/253 dated December 31, 2020, effective from February 1, 2021, the applicable NAV in respect of purchase of units of mutual fund scheme shall be subject to realization & availability of the funds in the bank account of mutual fund before the applicable cut off timings, irrespective of the amount of investment, under all mutual fund schemes.

1) To know more about payment modes available :

• Lump Sum Investments and their efficiency in the hierarchy of best to worst Click Here

• SIP Investments and their efficiency in the hierarchy of best to worst Click Here

2) Bank efficiencies in terms of providing credit to mutual funds on the same day before cut-off timings on which investors’ account is debited

i. NPCI (National Payments Corporation of India) Click Here

ii. Payment Aggregators (for e.g. Google Pay, Amazon Pay, PayTM)

We request Investors who have not submitted their PAN details and/or are Non KYC compliant to submit their PAN details & fulfill their KYC at the earliest. You may contact our [email protected] or call our toll free number 1800 - 209 - 3863 / 1800 - 22- 3863 for any queries or assistance.

Liquidity Window - Quantum Gold Fund (ETF): The Liquidity Window under Quantum Gold Fund is Open. Investors of Quantum Gold Fund can submit their redemption request upto Rs.25 Crores at the Official Point of Acceptance of the AMC. You may also redeem by sending the application via email from your registered Email Id to our Transact Id - [email protected].

SEBI’s Important Update on Folios without PAN / PEKRN: Click here for PAN / PEKRN related intimation.

Important Update on PAN & Aadhaar Seeding: As per Section 139AA of the Income Tax Act 1961, every person eligible to obtain an Aadhaar and has PAN must link their Aadhaar with their PAN by 30th June 2023 failing which the unlinked PAN shall become inoperative. Please visit https://www.incometax.gov.in/iec/foportal/ and click on ‘Link Aadhaar option’ under the ‘Quick Links’ section to link your PAN with Aadhaar.

Goal Based Calculator

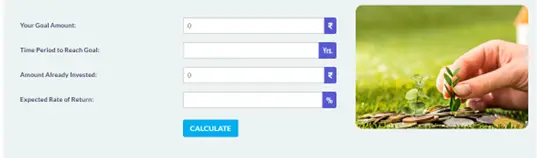

Goal-Based Calculator

In this day and age of consumerism and growing aspirations, we all have some or the other financial goals –– buying a dream home, a car, fancy gadgets, going on a vacation with friends and family, providing the best education to children, getting them married in pomp and style, and then live a blissful retirement (which is also one of the vital financial goals). In short, most of us want to live a good life!

But in the interest of your well-being and bright financial future, it is important to save now and buy later (SNBL), rather than buy now pay later (BNPL) with loans and credit cards at your disposal. In other words, subscribe to the idea of delayed gratification and not give in to instant gratification for fear of missing out (FOMO).

You see, the downside of fulfilling financial goals with excessive credit-backed consumption is that owing to the cost of serving debt, takes a toll on your long-term financial health and limits your ability to save enough. Hence, pay yourself first. In the words of legendary investor, Warren Buffett, “Don’t save what is left after spending but spend what is left after savings.” Such an approach shall enable you to save and engage in financial goal planning (by making prudent investments) to accomplish your envisioned financial goals.

What is financial goal planning?

Financial goal planning is a process of setting your goals, making sure the goals are S.M.A.R.T (Specific, Measurable, Achievable, Realistic and Time-bound), and having an action plan in place to achieve them.

This process provides you with a comprehensive picture of:

- ✔ Your current financial situation

- ✔ The level of risk you can afford to take

- ✔ Your financial objectives

- ✔ What will be the future value of the respective goal (accounting for retail inflation)

- ✔ The time in hand to achieve the goals (short-term, medium-term, and long-term),

- ✔The kind of money you require to save and invest every month for the respective goal,

- ✔ And return you would be required to clock on your investments to fulfil the financial goals

How to invest for your financial goals?

To invest for your envisioned financial goals, you must make regular investments -- it could be lump sum at times and/or taking the SIP (Systematic Investment Plan) route in the best suitable mutual funds (equity-oriented, debt-oriented, hybrid, and gold ETFs) as per your asset allocation.

How does a financial goal-planning calculator serve as a valuable online tool?

The financial goal planning process is rather intricate, requiring you to consider a host of elements and perform complex calculations, and then accordingly make investments in a variety of suitable avenues. But with a goal-planning calculator, the job gets rather simple and straightforward.

All you need to do is, enter your goal amount (in future value terms), the time to achieve the goal, the amount already invested (if any), and your expected rate of return.

What does the financial goal calculator tell you?

On performing complex calculations online at the backend (based on the numbers you punch in), within a few seconds, the calculator reveals the monthly investment you need to make (via SIPs), the additional lump sum investment if required, suggests avenues to invest, and then calculates the future value of your investments.

Say, want to plan for your retirement. Your current age is 35, plan to retire at 65 (which means you have 30 years before you hang your work boots), imagine your life expectancy is 90, the current monthly expenses are Rs 60,000, have already invested Rs 10 lakh for your retirement, and you expect a 12% p.a. rate of return from your investment; here’s what the online goal planning calculator will tell you…

It will indicate the amount required to live a blissful retired life, the future value of your existing investments, the monthly SIP investment you need to make, the additional lump sum investment required, and how you could divide the investment amount into various schemes.

Note: Investments through SIP is subject to market risk and do not assure a profit or returns or protection against a loss in downturn market.

The 5 key benefits of using the financial goal planning calculator are:

- ✔ It is simple

- ✔Convenient to use

- ✔Saves you the trouble of manually performing complex and lengthy calculations

- ✔Helps to align your investment with your financial goals

- ✔And with investment discipline, makes it possible to achieve your financial goals

Here are a few Frequently Asked Questions (FAQs)

Is a financial goal calculator easy to use?

Very much. It is simple and convenient for you to use. It is an online tool that performs all the complex calculations for you at the backend (without storing your data).

How does the financial goal calculator help you?

The financial goal calculator helps you take control of your financial future by planning well. Depending on the inputs for the calculation, it tells you the kind of investment you need to make for the envisioned financial goal/s, suggests investment avenues, and indicates how much would be the future value of the investment you make.

How does the financial goal calculator help you to choose your investments?

Based on your goal, the time in hand to achieve the goal, the amount already invested, and the expected rate of return, the financial goal calculator helps you choose the investments.

Add To Cart

| Total of Lumpsum Amount |

|---|

Broker Details

-

ARN CodeARN -

-

Sub Broker Code

-

EUIN CodeE -

-

I/We hereby confirm that the EUIN box has been intentionally left blank by me/us as this transaction is executed without any interaction or advice by the employee/relationship manager/sales person of the above distributor/sub broker or notwithstanding the advice of in-appropriateness, if any, provided by the employee/relationship manager/sales person of the distributor/sub broker.