heading

Two years ago, did you know what you would have for lunch today?

Well, two years ago we estimated what the value of your portfolio would be today!

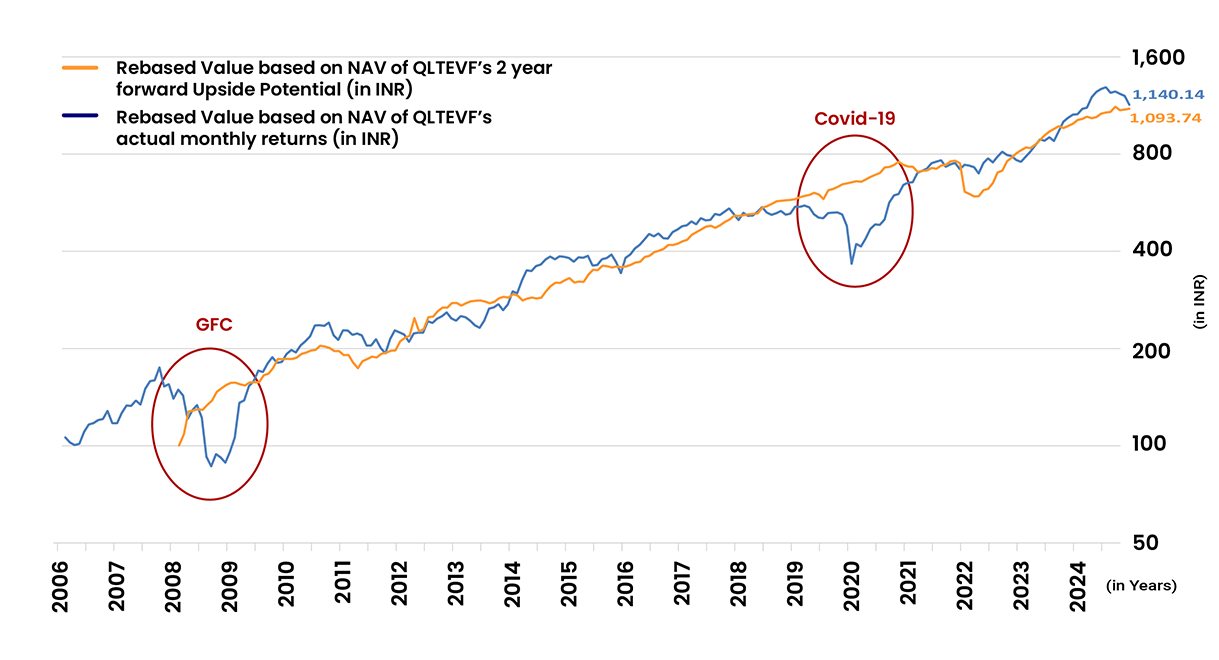

In the dynamic world of finance, where uncertainty often holds sway, Quantum Value Fund carves a niche for itself, presenting certainty born out of a robust research and investment process. While equity investment outcomes can be unpredictable, Quantum's commitment to a disciplined approach emerges as a beacon of stability in the financial landscape. One compelling piece of evidence attesting to Quantum's prowess is the Unique Estimated Upside Potential chart, a visual testament to the alignment of past estimation with present. This chart, diligently estimated every month since April 2006, stands as a testament to Quantum's commitment to transparency and accuracy. Providing estimates of the Portfolio's Gross NAV two years forward, the chart is a unique tool that unveils the potential to deliver in line with the upside in an investment.

The Outcome of our Disciplined Research and Investment Process has a great ‘Fit’:

‘Stirred, Not Shaken’ by two massive Global Macro Events: GFC and Covid

The above graph shows the estimate of rebased GAV of Quantum Value Fund – Direct Plan – Growth Option on the basis of UpsidePotential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams). The performance returns are net of fees andexpenses, and assuming reinvestment of all dividends and other earnings. Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2. Source: Internal Research, Bloomberg Finance L.P., As of December 31st, 2025.

Delving into the chart's revelations, we discover significant consistency. The estimated increase of 12.25 times in 20 years, 13.57% CAGR, mirrors the actual growth of the Portfolio NAV, which increased by 12.92 times at a 13.95% CAGR over the same period. In a world where certainty is rare, Quantum Value Fund has consistently delivered on its estimation and is unshaken by the turbulence of unpredictable markets.

About The Fund

QVF, adopts a value style, that aims for long-term capital appreciation by investing in attractively priced stocks. QVF's robust research driven approach and stringent risk management processes including the Quantum proprietary “Integrity Screen” helps the fund deliver its growth potential over the next two years thereby reducing the uncertainty associated with equity investing. The fund invests across market capitalisation and is sector agnostic. It maintains a focused portfolio of 25-40 stocks. Suited for investors who are looking to preserve wealth in the relatively high-risk equity category, the QVF forms the foundation of your Equity Investing, by offering stability and reliability to your Portfolio. Investors seeking a dependable option for their long-term financial goals can consider this fund.

Data as on December 31st, 2025. Please note the above is a suggested Asset allocation and not to be considered as an investment advice or recommendation. Past Performance may or may not be sustained in the Future. The above performance is of the Direct Plan. To view complete performance for the schemes, click here. Quantum Value Fund- Tier I Benchmark: BSE 500 TRI, Quantum Small Cap Fund - Tier I Benchmark: BSE 250 Small Cap TRI, Quantum ESG Best In Class Strategy Fund - Tier I Benchmark: NIFTY100 ESG TRI, Quantum Gold Savings Fund - Tier I Benchmark: Domestic Price of Physical Gold, Quantum Liquid Fund- Tier I Benchmark: CRISIL Liquid Debt A-I Index.

Reasons to Invest in Quantum Value Fund

-

Unique Upside Potential Chart

to provide predictable outcomes over longer periods -

Value Oriented Equity Diversified Fund

since March 2006 -

Well Diversified Equity Portfolio

typically 25 to 40 stocks, across sectors -

A Disciplined Research and Investment Process

-

Low Portfolio Turnover

Buy after conviction & hold for long -

Holds Shares or Cash

No derivatives, no hedging

Investment Approach

Disciplined Bottom-up Stock Selection Process with a Proprietary Integrity Screen initiated by our Sponsor in 1996

1076 stocks

Addressable

Universe*

- Number of companies trading over US $1 million/day

~200 stocks

Value And

Integrity Screen

- Regular weekly research meetings to review ideas and approve stocks for the database. Consensus required.

- All stocks reviewed within 180 days.

- We must trust the managements/founders

25 to 40 stocks

Portfolio

- Portfolio of stocks with broad exposure to various sectors.

- Approved by a portfolio team

- Reflects three broad themes: domestic consumption, exports and infrastructure

Investors get best of bottom-up ideas with a risk control measurement for each sector. Generally, < 20% of the stocks we cover meet our “Buy” criteria

Data as on December 31st, 2025. Please refer Scheme Information Document of the Scheme for complete Investment Strategy.

Portfolio Construction Process

Fund Managed By

-

Funds Managed:

Qualification

- Post-Graduate Diploma in Management (Finance) from IMT & is a CFA Charter Holder. (Chartered Financial Analyst) (CFA Institute USA)

-

Funds Managed:

Qualification:

- Post-Graduate Diploma in Management (Finance) - IMT

Portfolio

How To Invest

Invest Online in 3 easy steps. Click here to Get Started and plan your Asset Allocation!

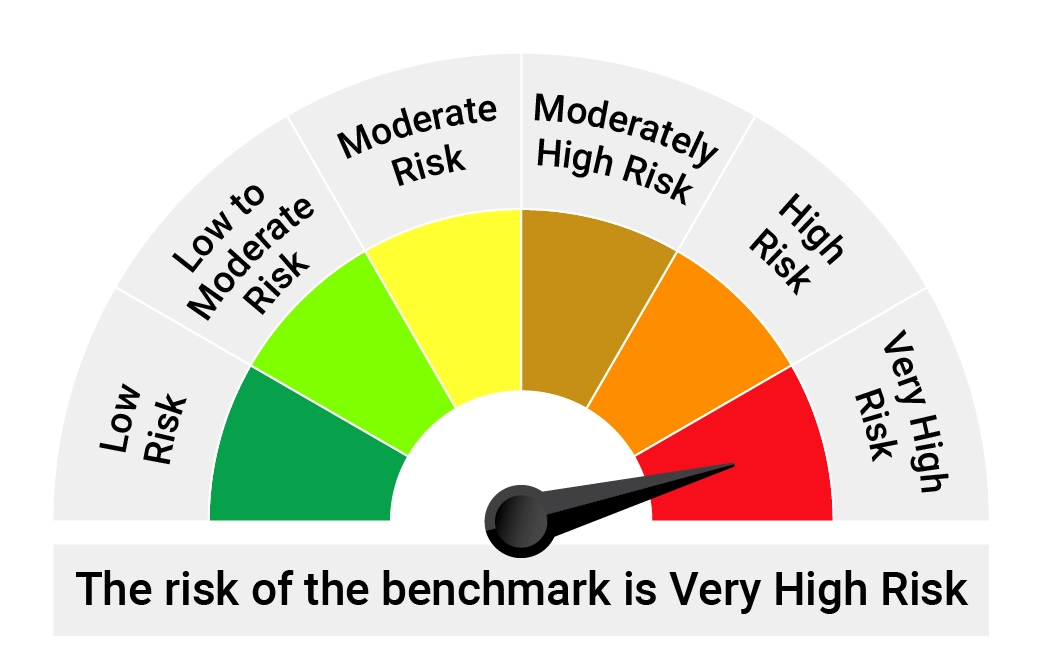

Product Label

-

Name of the Scheme and Benchmarks

Quantum Value Fund

(An Open Ended Equity Scheme following a Value Investment Strategy.)

Tier I Benchmark : BSE 500 TRI | Tier II Benchmark : BSE 200 TRI -

This product is suitable for investors who are seeking*

• Long term capital appreciation

• Invests primarily in equity and equity related securities of companies in BSE 200 index

-

Risk-o-meter of Scheme

-

Risk-o-meter of Tier-I Benchmark and Tier-II Benchmark

*Investors should consult their financial advisors if in doubt about whether the product is suitable for them.

Frequently Asked Questions

The Quantum Value Fund is a true-to-label equity mutual fund that follows a value style approach.

The fund follows a bottom-up stock selection process, focusing on undervalued companies that are trading at a discount to their intrinsic value with strong growth potential.

Imagine having the process to a predictable outcome in an unpredictable market- With Quantum Value Fund you can rely on a fund house that has a track record of delivering on its estimated upside potential based on 2 year forward upside potential.

The fund invests in companies with robust fundamentals across various sectors, with a focus on liquidity, governance, and valuations.

Generally, a Value Fund is likely to thrive in the following situations:

• Normalized interest rate environment and when there is a more broad-based economic growth.

• A combination of comfortable valuations and a potential for an earnings upgrade.

Value Fund Managers are actively trying to identify stocks that are undervalued and traded below their intrinsic value and believes that their future potential is better than the trend it currently reflects. They analyse the stock price of the company based on fundamentals relative to its sector, its historical performance, and overall market trends.

The Quantum Value Fund Portfolio has exposure to stocks in BFSI, technology, consumer discretionary and utilities.

The fund is suitable for investors with a long term view and very high risk appetite. Quantum Value Fund acts as an anchor to your equity portfolio, delivering risk adjusted returns over the long term.

The fund focuses on minimizing risk related to liquidity, governance and valuation. The fund holds shares which have a daily trading volume of $1Million ensuring flexibility to redeem as necessary. It minimizes issues related to Governance by sifting out companies with poor integrity irrespective of their weights in the benchmark index. And lastly, it manages valuation by buying stocks which are at a discount to their intrinsic value and holding them until certain catalysts play out that helps them realize their true value. It also manages valuation by holding cash when stocks are overvalued and avoiding derivatives and hedging.

You can find the fund's historical performance data on the Quantum Mutual Fund website .

Yes, you can set up an SIP with a minimum monthly investment of Rs. 500 or daily investment of Rs. 100.

You can invest in the scheme through direct and regular plans. You can invest in the fund directly through the Quantum Mutual Fund website or through a mutual fund distributor or advisor.

A value fund forms a crucial component of your diversified equity portfolio as part of Quantum’s 12| 20:80 Asset Allocation Strategy. We suggest you explore our Asset Allocation Calculator online to understand how you can build your equity portfolio to position your Value Fund investment.

You can visit the Quantum Mutual Fund website for detailed information about the fund, including its fact sheet and portfolio composition. If you have any further questions, you can contact us directly through our website or by calling our customer service number at 1800 209 3863 / 1800 22 3863.