-

Why India Is the Market to Watch

Posted On Wednesday, Apr 30, 2025

The global economic landscape this year so far has been shaped by a mix of powerful forces that are shifting bond markets.

-

Waiting for Gold to Correct? Some Moments Are Too Auspicious to Wait!

Posted On Tuesday, Apr 29, 2025

It’s that time of the year again when prosperity is welcomed with open arms—and gold takes centre stage in celebrations across the country.

-

Equity Investments and Highways: Navigating Risks with a Seat-belt

Posted On Wednesday, Apr 16, 2025

Navigating the fast-paced investing world is like driving on a bustling highway—without risk mitigation strategies, you're as vulnerable as a driver speeding on a highway without a seat belt.

-

A Strong Year Starts with a Strong Portfolio—Time for a Financial Health Check!

Posted On Tuesday, Apr 08, 2025

A new financial year is here—a clean slate, a fresh start, and a chance to get your investments in shape.

-

Indian Bonds Charting a Steady Course Through Volatility

Posted On Friday, Mar 28, 2025

In our previous edition of the Debt Market Observer (DMO) titled “The Road Ahead for Indian Bonds”

-

QLTEVF – Your Partner in Both Good Times and Bad

Posted On Friday, Mar 28, 2025

A good life partner is one who not only is with us to celebrate the good times but who also has our back during the bad times.

-

Wealth Creation + Tax Saving + Value Investing with Downside Protection – Who Said You Can't Have It All?

Posted On Friday, Mar 21, 2025

As the financial year draws to a close, many investors are focused on optimizing their tax liabilities.

-

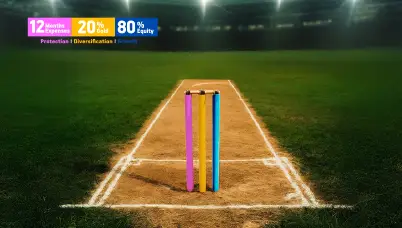

Markets Are Like A Cricket Pitch—Conditions Change, Approach Matters!

Posted On Wednesday, Mar 12, 2025

Cricket is a game of uncertainties. Some pitches allow for free-flowing stroke play, while others test a batter’s patience.

-

The Road Ahead for Indian Bonds

Posted On Monday, Feb 24, 2025

With Donald Trump back in the White House, trade tariffs and anti-immigration policies are back in focus.

Go to page