Click here to view the entire list of who cannot invest?

The unit holders are given an option to hold the units in physical mode or in dematerialized mode.

The Investor intending to hold the units in dematerialized mode will be required to have a beneficiary account with a Depository Participant and will be required to mention the DP’s Name, DP ID No. and Beneficiary Account No. with the DP in the application form at the time of subscription / additional purchase of the units of the Scheme.

It may be noted that in case of option to hold units in dematerialized mode under Systematic Investment Plan (SIP), the units will be credited to Investor’s demat account on weekly basis on every Monday subject to realization of funds in the last week. For e.g. Units will be credited to investor’s demat account on following Monday for realization status of funds received in the last week from Monday to Friday.

It may be noted that the facilities viz. Switch in and out/ Systematic Withdrawal Plan (SWP) / Systematic Transfer Plan (STP) are currently not available in the dematerialized mode.

Irrespective of the time of receipt of application at the official point(s) of acceptance, where the funds for the entire amount of subscription / purchase (including switch-in) as per the application are credited to the bank account of the respective Schemes on or before the cut - off time of the subsequent Business Day i.e. funds are available for utilization before the cut-off time of subsequent Business Day - the closing NAV of such subsequent Business Day shall be applicable.

For Systematic Investment Plan (SIP), Systematic Transfer Plan (STP), Dividend Transfer Facility:

The units will be allotted based on which the funds are available for utilization by the respective schemes / target schemes irrespective of the installment date of the SIP, STP or record date of dividend declarations. It may also be noted that allotment of units in the normal course will be based on realization of amount of subscription or the date of receipt of application or the date of instalment (in case of SIP) whichever is later if both realization and application dates are different.

Further, if the time of realization of funds can’t be ascertained then the allotment of units will be as per the day and date of realization of amount of subscription.

The following features are available in the scheme during ongoing period:

Systematic Investment Plan (SIP): This feature enables investors to save and invest periodically over a long period of time.Click here to know more about SIP in detail.

Systematic Withdrawal Plan (SWP): This feature enables an investor to withdraw amount/units from their holdings in the Scheme at periodic intervals through a one-time request. Click here to know more about SWP in detail

Systematic Transfer Plan (STP): This feature enables an investor to transfer fixed amounts from their accounts in the Scheme to another scheme within a folio from time to time.Click here to know more about STP in detail.

Switch options: Click here to view switch matrix for the applicable NAV.

Triggers:

A trigger is facility that allows you to specify an exit target (linked to value or time) or to receive an update when the desired levels are reached. The moment this target is achieved, the trigger gets activated. There can be Alert triggers or Action trigger. Click here to view the FAQ on Trigger Facility

The Scheme will invest in the units of Quantum Nifty 50 ETF (Q Nifty), a mutual fund scheme Replicating / Tracking Nifty 50 Index - in the form of an Exchange Traded Fund.View the current portfolio,select the scheme name along with the year and month that you wish to view.

Minimum Amount | Amount in Rs. |

Initial Investment | Rs. 500/- and multiples of Re. 1/- thereafter |

Additional Investment | Rs. 500/- and multiples of Re. 1/- thereafter / 50 units |

Redemption/ Switch Out | Rs. 500/- and multiples of Re. 1 thereafter OR account balance whichever is less / 50 units |

The provision for Minimum Application amount for Systematic Investment Plan (SIP) / Systematic Transfer Plan (STP):

SYSTEMATIC INVESTMENT PLAN (SIP)

Frequencies Available Under SIP |

Daily |

Weekly |

Fortnightly |

Monthly |

Quarterly |

Minimum Amount | ₹100/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter |

Minimum No. of Installments / Instructions |

132 |

25 |

13 |

6 |

4 |

Frequency of dates | Daily-All Business Days Weekly - 7, 15, 21, 28 Fortnightly- 5 & 21 OR 7 & 25 Monthly/Quarterly-5,7,15,21,25,28 | ||||

The unit holders will be able to Initiate request for Systematic Investment Plan (SIP) at the time of NFO along with the first investment during the NFO period. The SIP registration request given during the NFO period will be processed after scheme reopens for continuous sale and repurchase after NFO.

SYSTEMATIC TRANSFER PLAN (STP) (Available during continuous offer)

Frequencies Available Under STP |

Daily |

Weekly |

Fortnightly |

Monthly |

Quarterly |

Minimum Amount | ₹100/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter |

Minimum No. of Installments / Instructions |

132 |

25 |

13 |

6 |

4 |

Frequency of dates | Daily-All Business Days Weekly - 7, 15, 21, 28 Fortnightly- 5 & 21 OR 7 & 25 Monthly/Quarterly-5,7,15,21,25,28 | ||||

Minimum Balance to Start STP |

₹5000/- | ||||

SYSTEMATIC WITHDRAWAL PLAN (SWP) (Available during continuous offer)

Frequencies Available Under SWP |

Weekly |

Fortnightly |

Monthly |

Quarterly |

Minimum Amount | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter | ₹500/- and in multiples of ₹1/- thereafter |

Minimum No. of Installments / Instructions |

25 |

13 |

6 |

4 |

Frequency of dates | Weekly-7,15,21,28 Fortnightly- 5 & 21 OR 7 & 25 Monthly/Quarterly-5,7,15,21,25,28 | |||

Minimum Balance to Start SWP |

₹5000/- | |||

Click here to know more about KYC

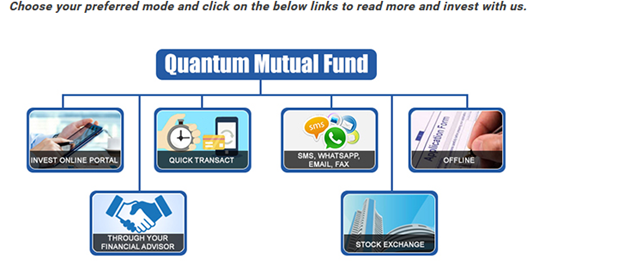

You can invest in our Schemes through the following modes:

| 1 | Through our Login portal |

| 2 | By submitting physical transaction requests offline |

| 3 | Through your mobile phone/computer using Mobile App, SMS, WhatsApp, Email |

| 4 | Through the stock exchange platform |

| 5 | Through your financial advisor |

Kindly note new purchase on SMS, WhatsApp, email and fax is not available during NFO. Only when the scheme is open for daily investment, these options can be used for transacting or making additional investment in the existing folio.

Please note that for ETF schemes i.e. Quantum Gold Fund ETF and Quantum NIFTY 50 ETF you will have to read the respective SID of the schemes.

The Scheme offers two plans:

1) Direct Plan

2) Regular Plan

Each Plan offers Growth Option.

The income attributable to Units under Growth Option will continue to remain invested and will be reflected in the Net Asset Value of Units under Growth Option.

Investor should indicate the Direct / Regular Plan for which the subscription is made by indicating the choice in the application form. In case of valid application received without indicating any choice of plan then the application will be processed for plan as under:

Scenario | Broker Code mentioned by the investor | Plan mentioned by the investor | Default Plan to be captured |

1 | Not mentioned | Not mentioned | Direct Plan |

2 | Not mentioned | Direct | Direct Plan |

3 | Not mentioned | Regular | Direct Plan |

4 | Mentioned | Direct | Direct Plan |

5 | Direct | Not Mentioned | Direct Plan |

6 | Direct | Regular | Direct Plan |

7 | Mentioned | Regular | Regular Plan |

8 | Mentioned | Not Mentioned | Regular Plan |

In cases of wrong/invalid/incomplete ARN codes mentioned on the application form, the application shall be processed under Regular Plan. The AMC shall contact and obtain the correct ARN code within 30 calendar days of the receipt of the application form from the investor/ distributor. In case, the correct code is not received within 30 calendar days, the AMC shall reprocess the transaction under Direct Plan from the date of application.

The Trustees reserves the right to introduce a new Option/ Plan at a later date, subject to the SEBI Regulations.