Valentine’s Day Special: A Perfect Match for Certainty in an Uncertain world

Posted On Wednesday, Feb 14, 2024

As Valentine's Day approaches, it is a great time for creating and nurturing relationships. In a world where uncertainty looms large, we often seek stability and certainty in relationships. Similar is the case when it comes to our relationship with investments - where we constantly look out for permanence and confidence.

While some relationships last long, some may break before they flourish. Often the reason for break ups is that expectations do not match with reality leading to disappointments. Likewise, when it comes to investing, it is important to trust your hard-earned money with a fund house that endures through ups and downs in the market and matches expectations. Let’s look at the parallels between relationships and investments to learn how they can lead to enduring predictability.

Relationships vs. Investments - How are they similar?

- Selecting the right qualities: When choosing a partner, you look for certain qualities beyond first impressions as compatibility is crucial for long-term success. Similarly, investing requires you to look beyond ranking on rating websites. A useful approach for assessing the fund’s compatibility with your portfolio is to look at the 4 Ps - People, Philosophy, Processes and Predictability.

Quantum Mutual Fund upholds the 4 Ps through its people – a strong fund management team that exhibits a track record of navigating through the market cycles. The fund house has a stringent stock selection process backed by a robust research-driven approach, discipline, and effective risk management processes to deliver predictable outcomes.

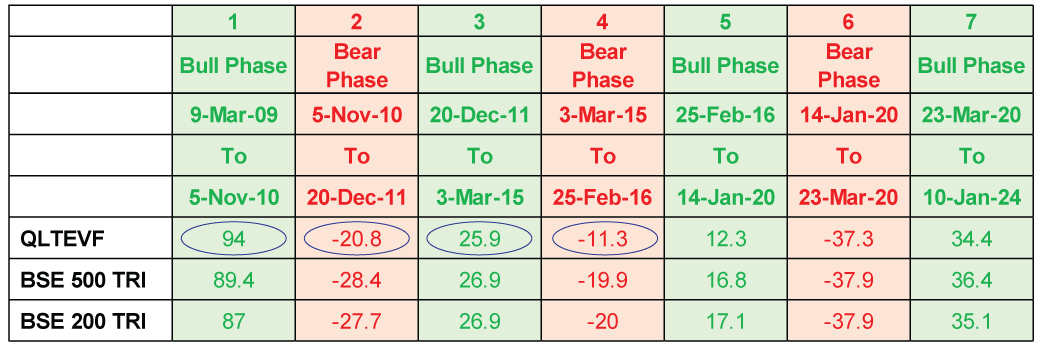

- Patience during testing times: Successful relationships thrive on patience and understanding despite testing times. Similarly, investing requires patience, especially when the markets correct, one has to resist the temptation to book profits unless financial goals are achieved. You need to stick for the long term in both relationships or investments to weather the ups and downs with resilience for the true value to emerge. Fortunately, when it comes to Quantum Long Term Equity Value Fund, the fund has weathered market cycles and showcased better resilience during bear markets as compared to its benchmark.

QLTEVF Performance during Bear and Bull Phases

Returns over 1 year are compounded annualised. Past performance may or may not be sustained in the future and is not indicative of future returns. Data as of Jan 31, 2024(Source: ACE MF) This should be read in conjunction with the complete fund performance given below. Bear market is when markets have corrected over 20% from the highs and remain so for a while, Bull markets are new market high. The phases are selected to depict market cycles.

- Certainty in an Uncertain World: In an increasingly uncertain world, what one must remember is that both investments and relationships have their ups and downs. Aligning expectations with reality is key to maintaining stability and contentment in both spheres. It ensures stability and predictability.

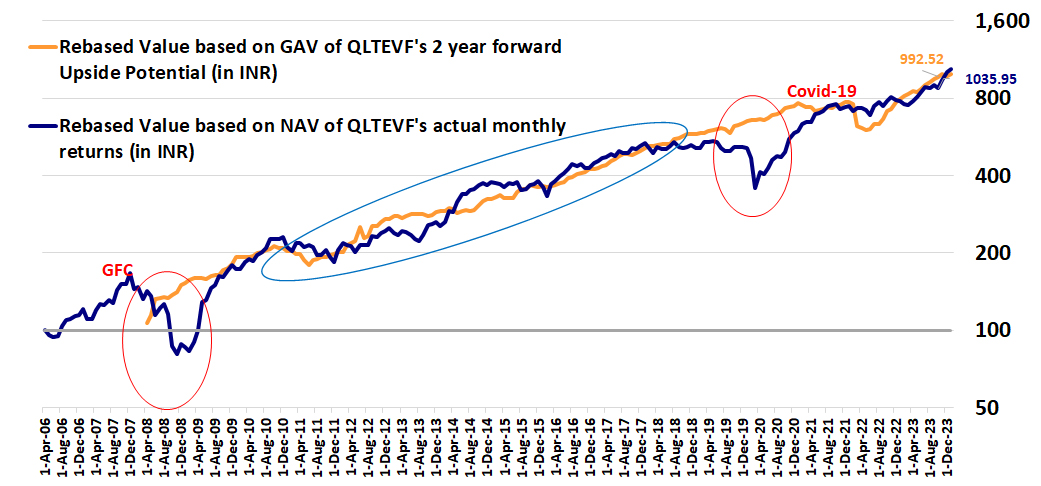

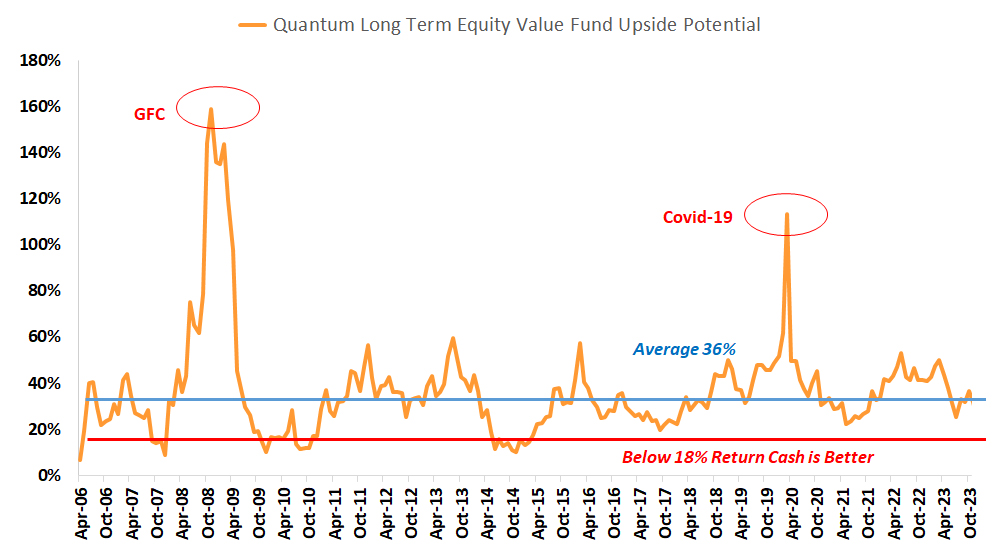

Graph: Estimated Upside Potential of QLTEVF

The above graph shows the estimate of rebased GAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of the Upside Potential of the portfolio (equal to the sum total of weight of each stock multiplied by the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams).

The performance returns are net of fees and expenses, and assuming reinvestment of all dividends and other earnings. The value axis for graph 2 has been plotted based on a logarithmic scale of 2.

Past performance may or may not be sustained in the future.

Source: Internal Research, Bloomberg Finance L.P., As of Jan 31, 2023.

The chart above illustrates Quantum Long Term Equity Fund’s predictable outcomes, showcasing alignment of actual performance with estimates. It is including the Quantum proprietary ‘Integrity Screen’, that has helped Quantum Long Term Equity Value Fund deliver predicted and consistent risk adjusted returns.

Quantum Mutual Fund has a proven track record of delivering consistent risk adjusted returns for your investments over the long term, offering more stability & steady growth.

Despite the two massive events: the Global Financial Crisis of 2008-09 and COVID-19 pandemic, Quantum Long Term Equity Value Fund’s NAV has displayed consistency. The fund has delivered on its estimation and is unshaken by the turbulence of unpredictable equity markets. Our estimated upside potential has closely matched actual performance over the years.

The above graph shows the estimate of rebased GAV of Quantum Long Term Equity Value Fund – Direct Plan – Growth Option on the basis of Upside Potential of the portfolio (equal to the sum total of weight of each stock (multiplied by) the percentage difference between the current market price and the sell limits assigned to each stock in the portfolio by the in-house research teams).

Past performance may or may not be sustained in the future. The value axis for graph 2 has been plotted based on logarithmic scale of 2

Source: Quantum AMC, April 06 - Jan 31st, 2024

- Building a strong foundation: Trust is the foundation of any relationship - and is even applicable to the world of investments. Trust is purely based on integrity and brings with it predictability, consistency, and dependability. What is required is following a value system and ethics.

Earning trust requires doing the right things. Quantum Mutual Fund selects companies after a rigorous research process and those with strong integrity. We would rather skip a short-term opportunity than put an investor’s money at risk with a company with poor integrity, irrespective of their weight in the benchmark index. In a world where uncertainty often holds sway, you require a true Value Fund that serves the foundation of your core equity mutual fund portfolio. The Quantum Long Term Equity Value Fund (QLTEVF) can create value for your investors, and potentially accomplish your envisioned financial goals.

In conclusion, while both relationships and investments entail uncertainties, navigating them with prudence and foresight can lead to fruitful outcomes. Whether it's fostering strong relationships or making prudent investment decisions, choosing the right qualities, exercising patience & building a strong foundation by prioritizing integrity can pave the way for stability and certainty in an otherwise uncertain world. With the reliability and integrity offered by Quantum Mutual Fund, you can be rest assured that your investments is in safe hands.

|

|

| Performance of the Scheme | Direct Plan | |||||||

| Quantum Long Term Equity Value Fund - Growth Option | ||||||||

| Current Value ₹10,000 Invested at the beginning of a given period | ||||||||

| Period | Scheme Returns (%) | Tier 1 - Benchmark# Returns (%) | Tier 2 - Benchmark## Returns (%) | Additional Benchmark Returns (%)## | Scheme (₹) | Tier 1 - Benchmark# Returns (₹) | Tier 2 - Benchmark## Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (13th Mar 2006) | 14.18% | 13.14% | 13.13% | 12.67% | 107,360 | 91,207 | 91,047 | 84,588 |

| January 31, 2014 to January 31, 2024 (10 years) | 15.12% | 16.84% | 16.46% | 14.79% | 40,899 | 47,461 | 45,942 | 39,767 |

| January 31, 2017 to January 31, 2024 (7 years) | 12.71% | 16.62% | 16.37% | 15.98% | 23,118 | 29,347 | 28,917 | 28,245 |

| January 31, 2019 to January 31, 2024 (5 years) | 15.25% | 18.48% | 17.83% | 16.00% | 20,345 | 23,359 | 22,726 | 21,008 |

| January 29, 2021 to January 31, 2024 (3 years) | 20.39% | 21.83% | 20.60% | 17.11% | 17,465 | 18,102 | 17,557 | 16,076 |

| January 31, 2023 to January 31, 2024 (1 year) | 32.41% | 33.42% | 30.76% | 22.10% | 13,241 | 13,342 | 13,076 | 12,210 |

Data as of Jan 31, 2024. #S&P BSE 500 TRI, ##S&P BSE 200 TRI, ###S&P BSE Sensex.

Past performance may or may not be sustained in the future.

Load is not taken into consideration in scheme returns calculation.

Different Plans shall have a different expense structure.

Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR).

#with effect from December 01, 2021 Tier I benchmark has been updated as S&P BSE 500 TRI. As TRI data is not available since inception of the scheme, benchmark performance is calculated using composite CAGR S&P BSE 500 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

##TRI data is not available since inception of the scheme, Tier II benchmark performance is calculated using composite CAGR S&P BSE 200 index PRI Value from March 13, 2006 to July 31, 2006 and TRI Value since August 1, 2006.

The Scheme is co-managed by Mr. George Thomas & Mr. Christy Mathai. Mr. George Thomas is the Fund Manager managing the scheme since April 1, 2022. Mr. Christy Mathai is the Fund Manager managing the scheme since November 23, 2022.

For other Schemes Managed by Mr. George Thomas & Mr. Christy Mathai, please Click here.

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Riskometer of Tier I Benchmark and Tier II Benchmark |

Quantum Long Term Equity Value Fund An Open Ended Equity Scheme following a Value Investment Strategy Tier I Benchmark : S&P BSE 500 TRI Tier II Benchmark : S&P BSE 200 TRI | • Long term capital appreciation • Invests primarily in equity and equity related securities of companies in S&P BSE 200 index |  Investors understand that their principal will be at Very High Risk |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

For latest riskometer, investors may refer to the Monthly Portfolios disclosed on the website of the Fund www.QuantumAMC.com.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More