Small Isn’t a Size—It’s an Advantage

Posted On Tuesday, Aug 26, 2025

When market sentiment turns positive and liquidity flows in, small caps are often the first to take off. Why? Because they’re lean, agile, and often overlooked — giving them the ability to respond swiftly to economic tailwinds and having the potential to generate better returns.

With their smaller size and lower base, even modest improvements in earnings can trigger outsized gains. In bullish phases, this gives them the potential to outpace large-cap peers and deliver better risk adjusted returns.

But tapping into this potential isn’t about chasing trends — it’s about understanding the dynamics and choosing wisely keeping in mind that these come with their own set of challenges like clear book, balance sheet strength, corporate governance, etc., as they are less researched.

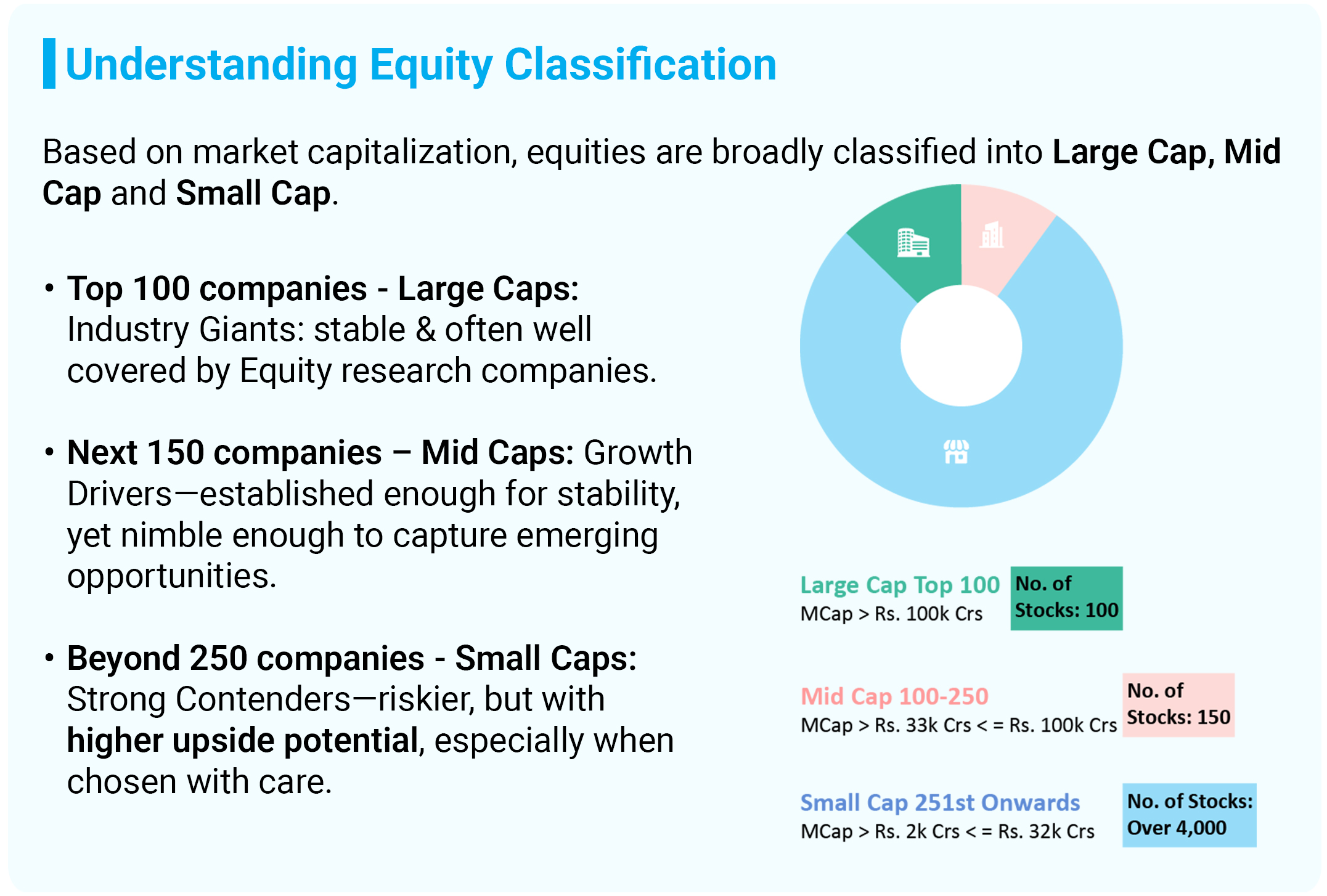

The Nifty SmallCap 250 Index includes 250 companies, while the actual small cap universe in India spans over 4,000 listed companies. That means the Index covers a small slice of a vast and diverse pool. This flexibility gives small cap fund managers a wider canvas to work with—especially valuable in dynamic markets.

Large cap portfolios generally mirror their Index, with limited room for deviation. Small caps, however, remain a fertile ground for discovery — if approached with discipline, patience, and deep research.

This is where active management becomes crucial, and Fund Manager skill becomes key.

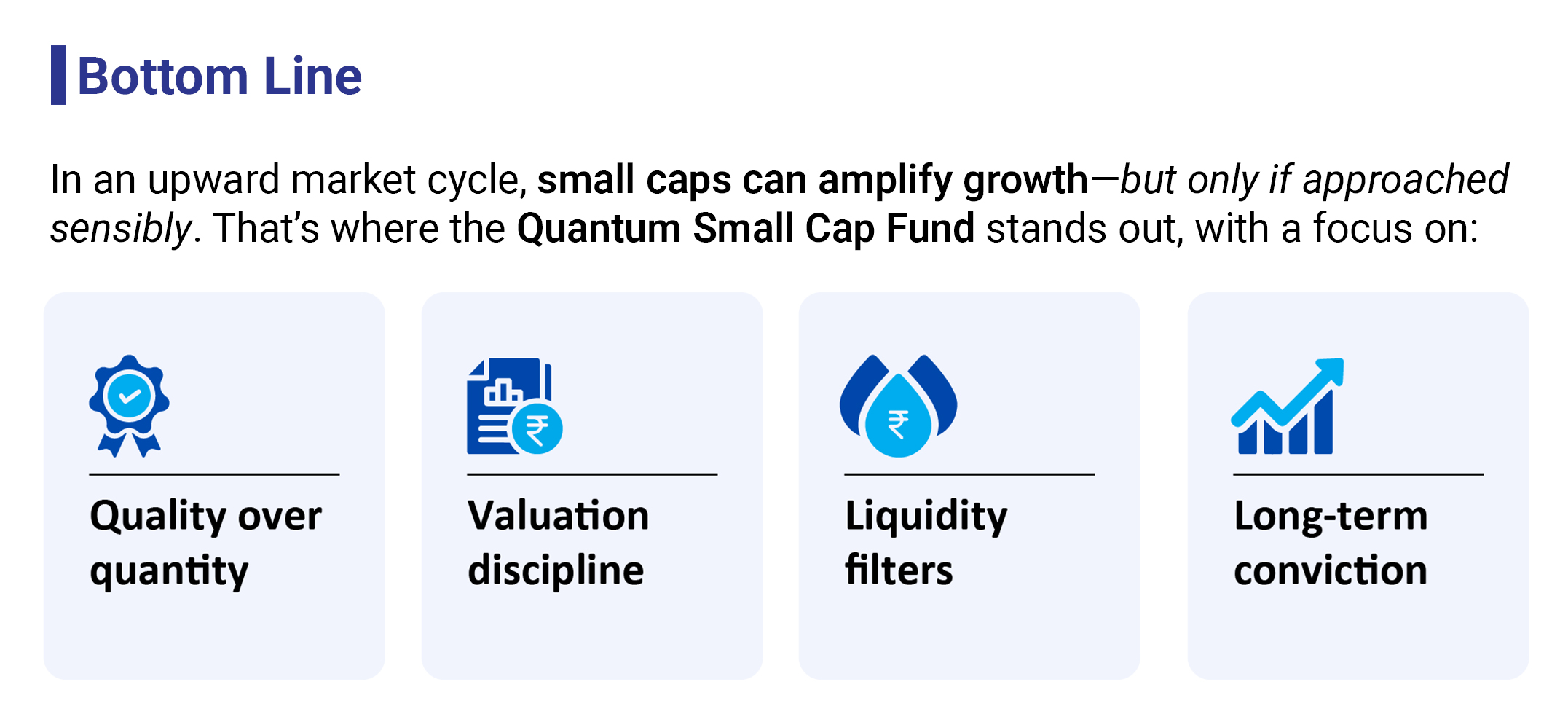

The Fund is designed to capture the best of what small caps have to offer — while staying grounded in fundamentals.

Ready to explore what lies beyond the Index?

|

Mr. Chirag Mehta is managing the scheme since November 03, 2023.

Ms. Abhilasha Satale is managing the scheme since November 03, 2023.

| Performance of the Scheme | as on July 31, 2025 | |||||

| Quantum Small Cap Fund - Direct Plan - Growth Option | Current Value ₹10,000 Invested at the beginning of a given period | |||||

| Period | Scheme Returns (%) | Tier I - Benchmark# Returns (%) | Additional Benchmark Returns (%)## | Scheme Returns (₹) | Tier I - Benchmark# Returns (₹) | Additional Benchmark Returns (₹)## |

| Since Inception (November 03, 2023) | 15.99% | 20.92% | 15.64% | 12,950 | 13,924 | 12,881 |

| 1 year | 5.03% | -4.54% | 0.54% | 10,503 | 9,546 | 10,054 |

#BSE 250 SmallCap TRI; ## BSE Sensex TRI. Past performance may or may not be sustained in the future. Load is not taken into consideration in scheme returns calculation. Different Plans shall have a different expense structure. Returns are net of total expenses and are calculated on the basis of Compounded Annualized Growth Rate (CAGR). Performance details of other funds managed by Mr. Chirag Mehta & Mrs. Abhilasha Satale. Click here

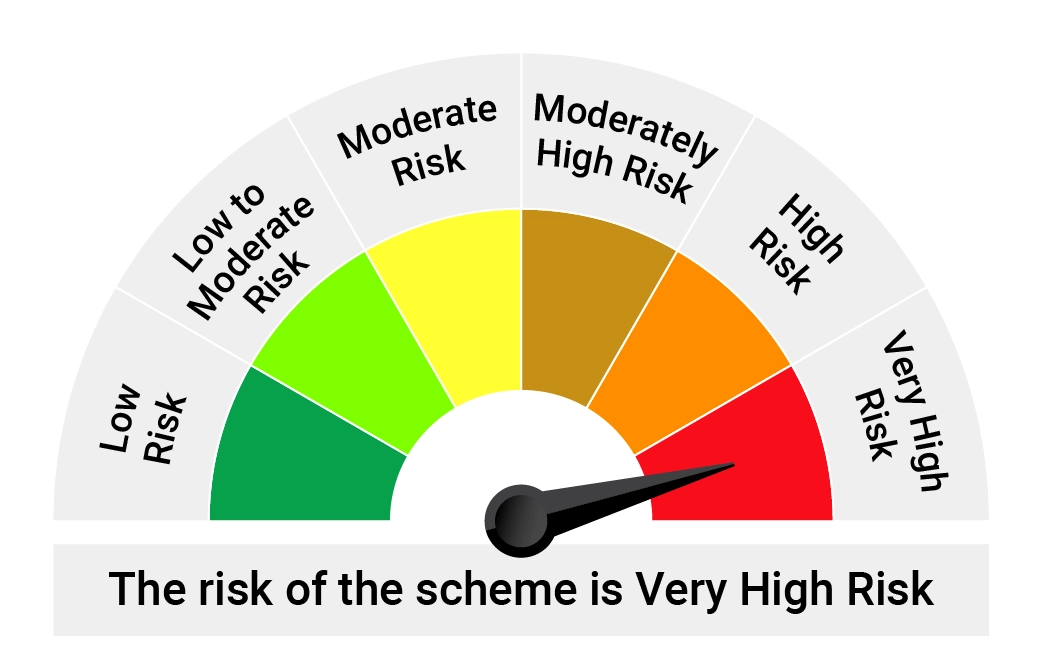

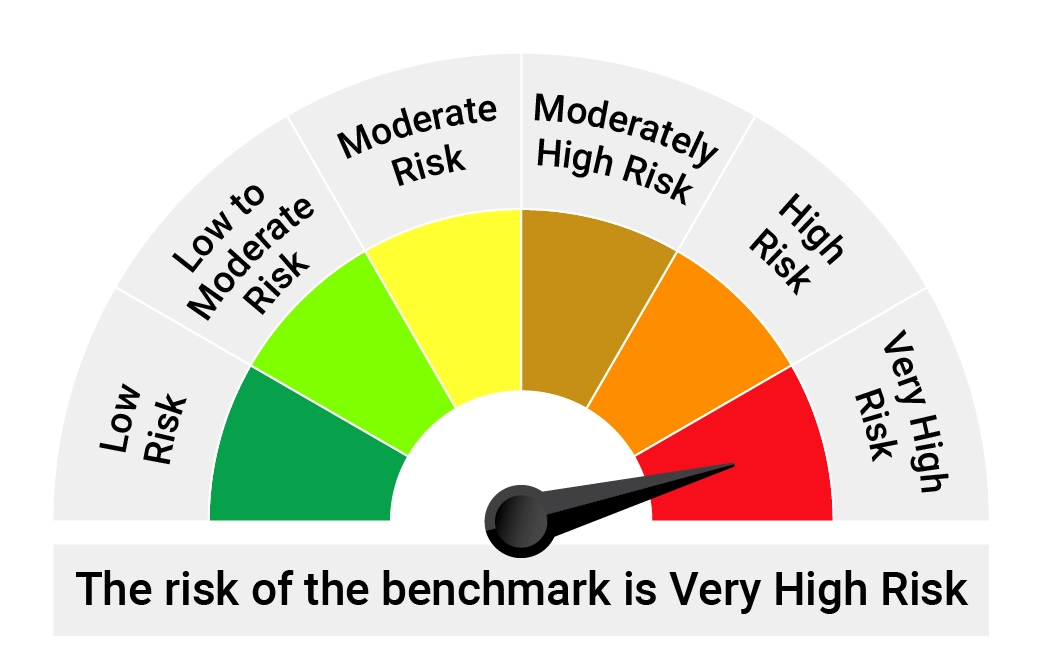

| Name of the Scheme | This product is suitable for investors who are seeking* | Riskometer of scheme | Risk-o-meter of Tier-I Benchmark |

Quantum Small Cap Fund An Open Ended-Equity Scheme Predominantly Investing in Small Cap Stocks Tier I Benchmark: BSE 250 SmallCap TRI | • Long term capital appreciation • Investment in Small Cap Stock |  |  |

*Investors should consult their financial advisers if in doubt about whether the product is suitable for them.

Disclaimer, Statutory Details & Risk Factors:The views expressed here in this article / video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The article has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of this article should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. Mutual Fund investments are subject to market risks, read all scheme related documents carefully. |

Related Posts

-

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Equity Monthly for January 2026

Posted On Friday, Jan 02, 2026

Indian markets remained range-bound in 2025

Read More -

Equity Monthly for September 2025

Posted On Wednesday, Sep 03, 2025

Markets declined in the month of August 2025 amid global trade tensions.

Read More