India’s central bank adds gold, have you?

Posted On Friday, Oct 11, 2019

FY 2018-19 was a busy year for the Reserve Bank of India. It dabbled with everything from an increased questioning of its autonomy, a premature exit by Governor Urijit Patel, the NBFC liquidity crisis, the NPA problem in PSB’s, a slowing economy, sticky rate cut transmissions to a declining rupee!

And news is that in the midst of this mess the RBI has been doing some gold shopping!

As per the World Gold Council, RBI raised its holdings by 52.3 tonnes in the year ended March 2019, its biggest purchase in nearly a decade since it bought 200 tons from the International Monetary Fund in 2009-10.

Quarterly official gold reserves of RBI

Source: World Gold Council

This data should make you stop and think. Why gold, and why now?

Firstly, why the massive gold purchase in 2009?

Obviously the Global Financial Crisis of 2007-08 prompted the reappraisal of gold’s role as a portfolio diversifier and liquidity tool for the central bank.

And what could have prompted this change in RBI’s attitude towards gold now?

Possibly the need to diversify its reserves away from the dollar. There are many who predict “Peak dollar” but there are more citical reasons leading to this urgency to diverisfy reserves into an asset like gold:

But why now?

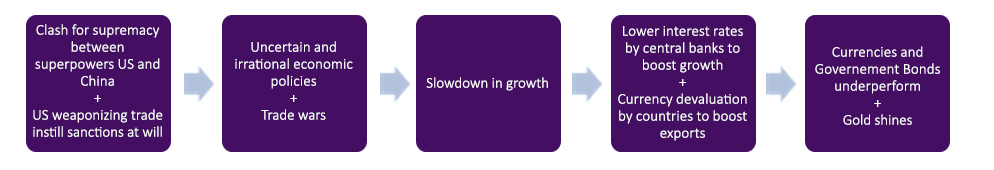

• It seems like a clash for supremacy is at the core of the US-China trade wars, which can be expected to continue, taking a toll on economic growth

• Weaponizing trade and instilling sanctions seems to be a tendency of the country whose currency is the world’s reserve currency and a norm of trade , giving the central bank more reason to diversify reserves

• This irrational behavior from the world’s leadership creates an uncertain economic policy environment, which will add to the economic deceleration

• Countries in an effort to negate the slowdown effects of the trade war and boost exports could enter into a currency devaluation race

• Central banks with the agenda of supporting growth will cut rates which will mean that real interest rates will be on a decline

• In a world where competing assets like currencies and government bonds are expected to underperform, gold seems like a good investment. Going forward, the overriding theme seems to be that with sluggish growth a continuing reality, a weaker currency will help, a stronger one will not. In a nutshell “competitive devaluation”. Devaluation is “beggar-thy-neighbour” policy that can aggregate uncertainties in global financial markets. The biggest beneficiary of the onset of currency trade wars will be gold, basking in the growing supply of freshly printed paper currency worldwide.

Is RBI the only one doing this?

Nope. Central banks around the world have been stocking up on gold, with Russia, China, Turkey, Kazakhstan, Poland, Hungary taking the lead. India seems to be a late entrant in the camp of gold buyers. Countries like Russia, China have been accumulating gold over few years given that they are much more impacted due to trade uncertainty as compared to India due to our lesser external linkages. The RBI like other central banks seems to think that it’s prudent to diversify some its dollar reserves to gold given the uncertainty surrounding policy making and therefore be in an asset that cannot be controlled by whims and fancies of any policy maker. We expect that central bank diversification of reserves will continue given the uncertainty surrounding policy making mainly from the U.S and therefore an exigency to reduce reliance on the dollar.

And what could you as an investor learn from RBI’ gold acquisition? When the central bank buys gold, you may also buy gold. To put it another way, just like the RBI, you need to gauge the direction in which world markets and economics are headed, relook at your risk management practices and diversify your investments by parking 10-15% of your money in gold. Like it has helped central banks during times of stress, it has also helped common citizens during times of financial distress. Importantly, Gold aids in stability of returns of an overall portfolio and brings respite during bad times. The other ability of gold is to maintain value over long time periods.

So how should you go about it?

Well if you have bought enough gold – good, stay with it. If not, use any corrections as an opportunity to add gold to your portfolio, or ideally keep allocating to gold in a systematic manner and build you allocation over the next 6 to 12 months.

Disclaimer, Statutory Details & Risk Factors:

The views expressed here in this Article / Video are for general information and reading purpose only and do not constitute any guidelines and recommendations on any course of action to be followed by the reader. Quantum AMC / Quantum Mutual Fund is not guaranteeing / offering / communicating any indicative yield on investments made in the scheme(s). The views are not meant to serve as a professional guide / investment advice / intended to be an offer or solicitation for the purchase or sale of any financial product or instrument or mutual fund units for the reader. The Article / Video has been prepared on the basis of publicly available information, internally developed data and other sources believed to be reliable. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and views given are fair and reasonable as on date. Readers of the Article / Video should rely on information/data arising out of their own investigations and advised to seek independent professional advice and arrive at an informed decision before making any investments. None of the Quantum Advisors, Quantum AMC, Quantum Trustee or Quantum Mutual Fund, their Affiliates or Representative shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary losses or damages including lost profits arising in any way on account of any action taken basis the data / information / views provided in the Article / video. Please visit – www.quantumamc.com/disclaimer to read scheme specific risk factors.

Related Posts

-

Gold Monthly for February 2026

Posted On Tuesday, Feb 03, 2026

Gold began the new year on a strong footing, carrying forward the momentum from the previous year and extending its upward rally.

Read More -

Equity Monthly for February 2026

Posted On Monday, Feb 02, 2026

Markets continued to be under pressure with Sensex declining by 3.4%.

Read More -

Debt Monthly for February 2026

Posted On Monday, Feb 02, 2026

In FYTD26, Indian bond yields defied expectations, firming up even as monetary policy turned supportive.

Read More